Maine Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

US Legal Forms - one of the premier repositories of legal templates in the United States - offers an extensive selection of legal document formats you can download or create.

By utilizing the website, you can access thousands of templates for business and personal purposes, categorized by types, states, or keywords.

You can obtain the most recent versions of documents such as the Maine Sample of a Collection Letter to Small Business in Quick order.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select your preferred pricing plan and provide your credentials to register for the account.

- If you already have a monthly subscription, Log In and retrieve the Maine Sample of a Collection Letter to Small Business in the US Legal Forms library.

- The Download button will appear on every template you explore.

- You can access all previously downloaded forms from the My documents section of your account.

- If you’re utilizing US Legal Forms for the first time, here are simple instructions to get started.

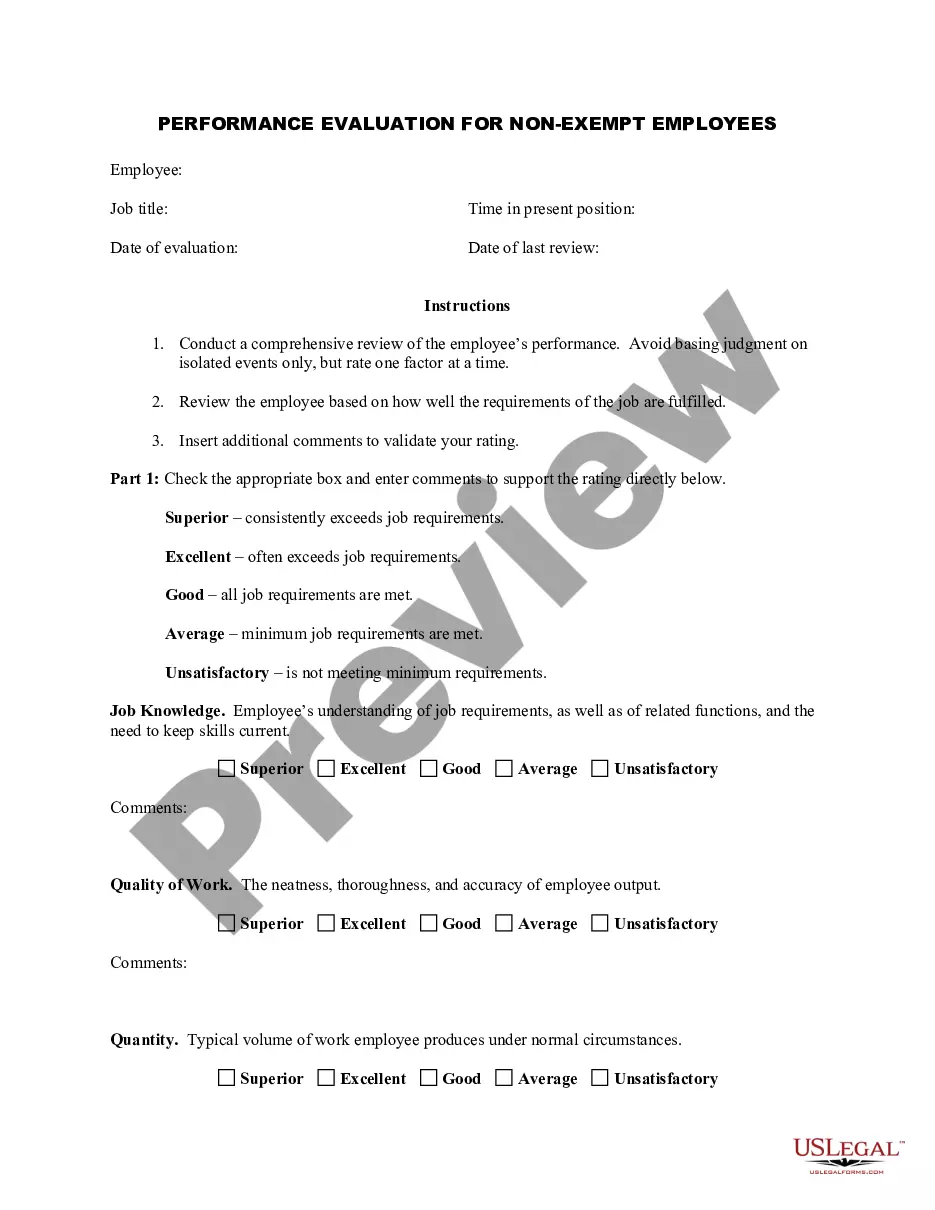

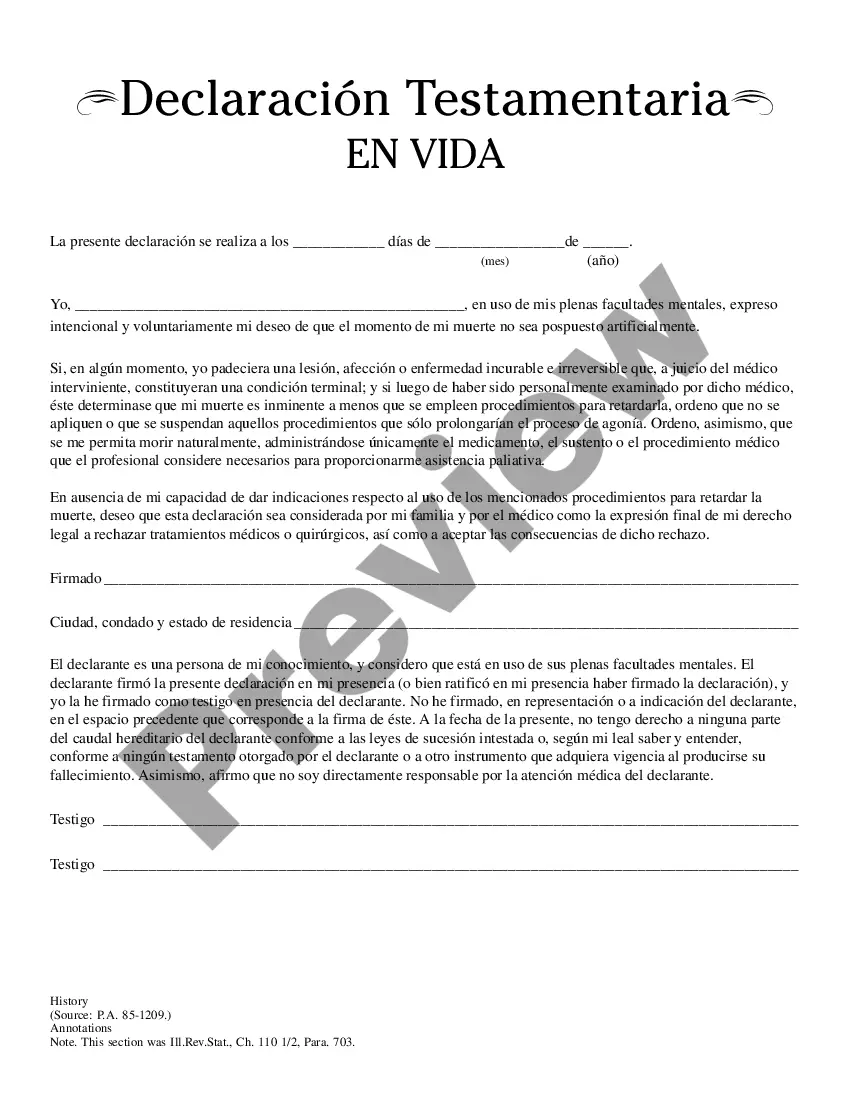

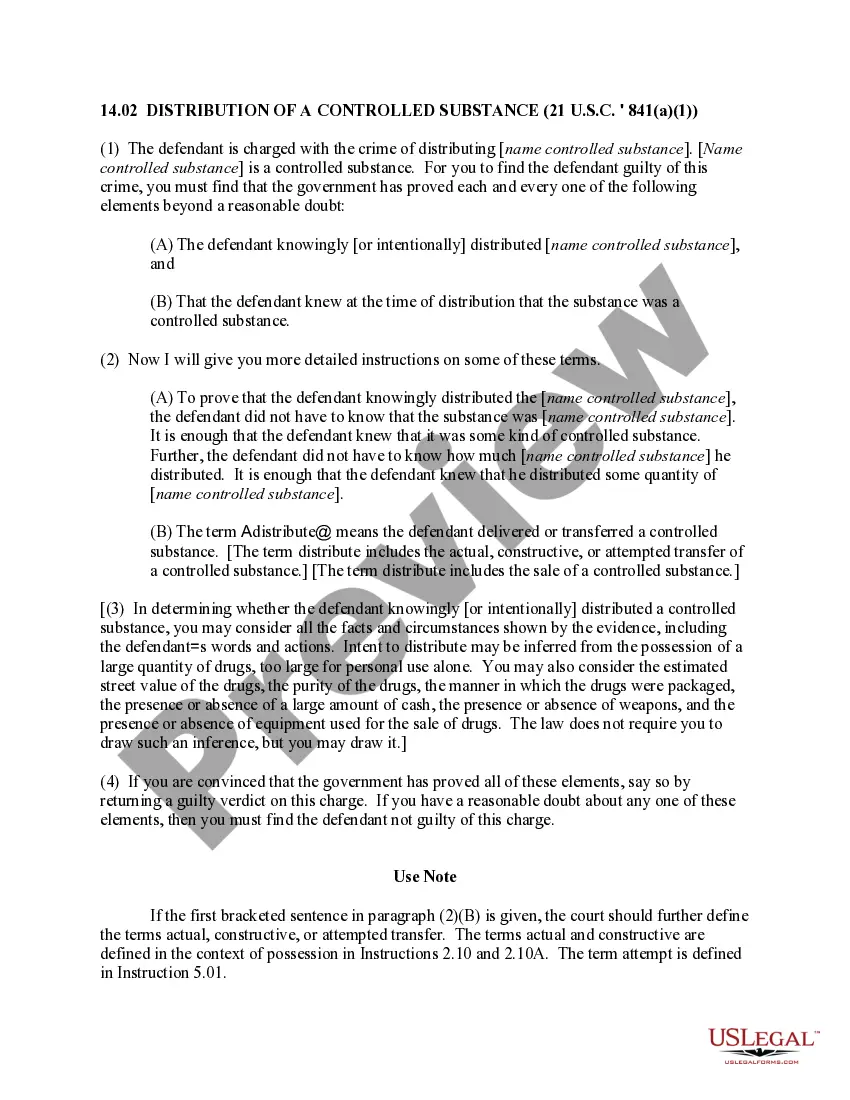

- Ensure you have selected the correct form for your location. Click the Review button to assess the content of the form.

- Examine the form summary to confirm that you have selected the appropriate form.

Form popularity

FAQ

To send a bill to a collection agency, gather all evidence of the debt and complete any necessary forms required by the agency. Reach out to the agency to understand their specific submission process. A Maine Sample of a Collection Letter to Small Business in Advance can provide a template to ensure that your communication is direct and comprehensible.

A debt collection letter should clearly state the amount owed, the due date, and any actions that will follow if the debt remains unpaid. It must also include your company's contact information and should be polite yet firm. For clarity and effectiveness, consider a Maine Sample of a Collection Letter to Small Business in Advance to structure your message correctly.

A collection letter is a formal document sent to request payment of an overdue debt. It should outline the amount owed, the due date, and the potential consequences of not paying. For businesses in Maine, a Maine Sample of a Collection Letter to Small Business in Advance can serve as a helpful template to ensure all necessary information is included.

To write an effective collection letter, begin with a clear subject line that reflects the purpose of your message. State the debt amount, payment options, and next steps, while ensuring the tone remains professional and understanding. Consider using a Maine Sample of a Collection Letter to Small Business in Advance as a reference to enhance your effectiveness.

To write a letter of debt collection, include the debtor's details, the outstanding amount, and the due date. Clearly state the consequences of not paying the debt, while maintaining a respectful tone. A Maine Sample of a Collection Letter to Small Business in Advance is an excellent resource for formatting your letter effectively.

Begin your collection email with a polite greeting, followed by a concise explanation of the outstanding debt. Be straightforward but courteous, and provide clear instructions on how to make the payment. Including a Maine Sample of a Collection Letter to Small Business in Advance can help you craft an impactful email.

To write a good collection letter, start by clearly stating the purpose of your communication. Use a professional tone, and ensure you include all necessary account details, such as the amount owed and payment due date. A Maine Sample of a Collection Letter to Small Business in Advance can guide you in structuring your message effectively.

A collection notice typically outlines the amount owed, the due date, and potential late fees. It should provide clear instructions for payment and explain the next steps if the debt remains unpaid. Examples can vary but having a Maine Sample of a Collection Letter to Small Business in Advance can serve as a helpful reference for crafting your own.

Drafting an effective collection letter involves being clear, concise, and respectful. Always state the purpose of the letter upfront and include all necessary details, such as payment options and deadlines. Be firm yet courteous to encourage a positive response. Utilizing a Maine Sample of a Collection Letter to Small Business in Advance can help you follow these essential guidelines.

Your collection letter should start with a formal introduction, followed by the specifics of the outstanding amount. Use a straightforward format and maintain a professional tone throughout, expressing urgency without sounding aggressive. Include a clear call to action, inviting the recipient to address the matter promptly. Consider using a Maine Sample of a Collection Letter to Small Business in Advance for effective communication.