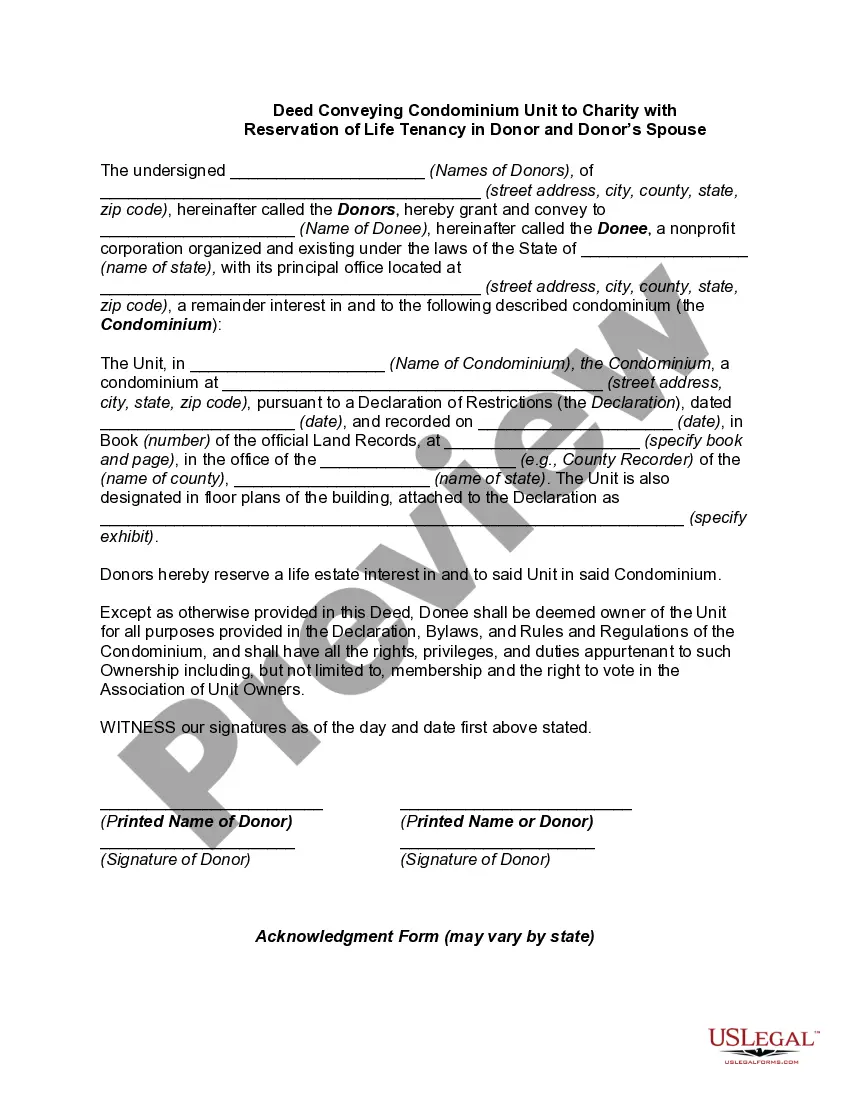

Maine Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

How to fill out Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

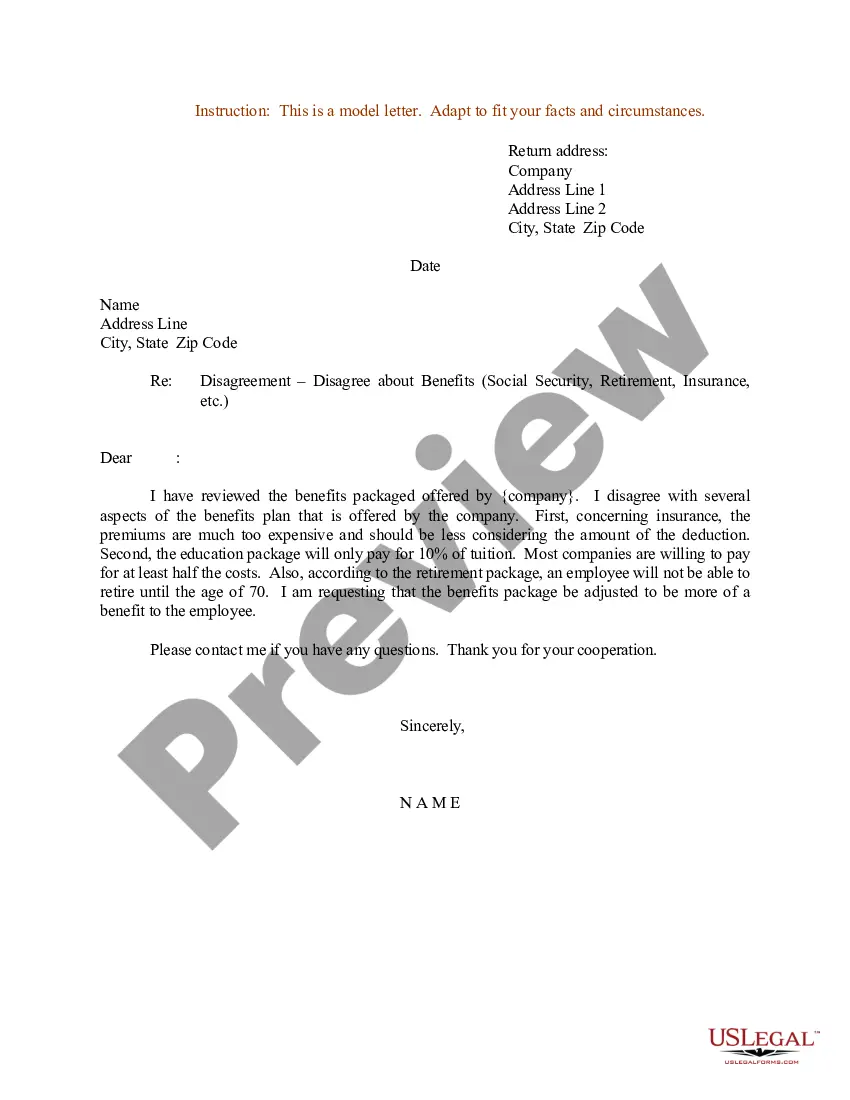

Have you been in the situation in which you will need papers for sometimes company or specific functions virtually every day? There are tons of legitimate papers layouts available on the Internet, but locating kinds you can rely is not simple. US Legal Forms gives 1000s of kind layouts, such as the Maine Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, which are created in order to meet federal and state specifications.

If you are currently familiar with US Legal Forms web site and have your account, just log in. Afterward, it is possible to acquire the Maine Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse web template.

Should you not have an profile and wish to begin to use US Legal Forms, adopt these measures:

- Find the kind you require and make sure it is to the appropriate town/region.

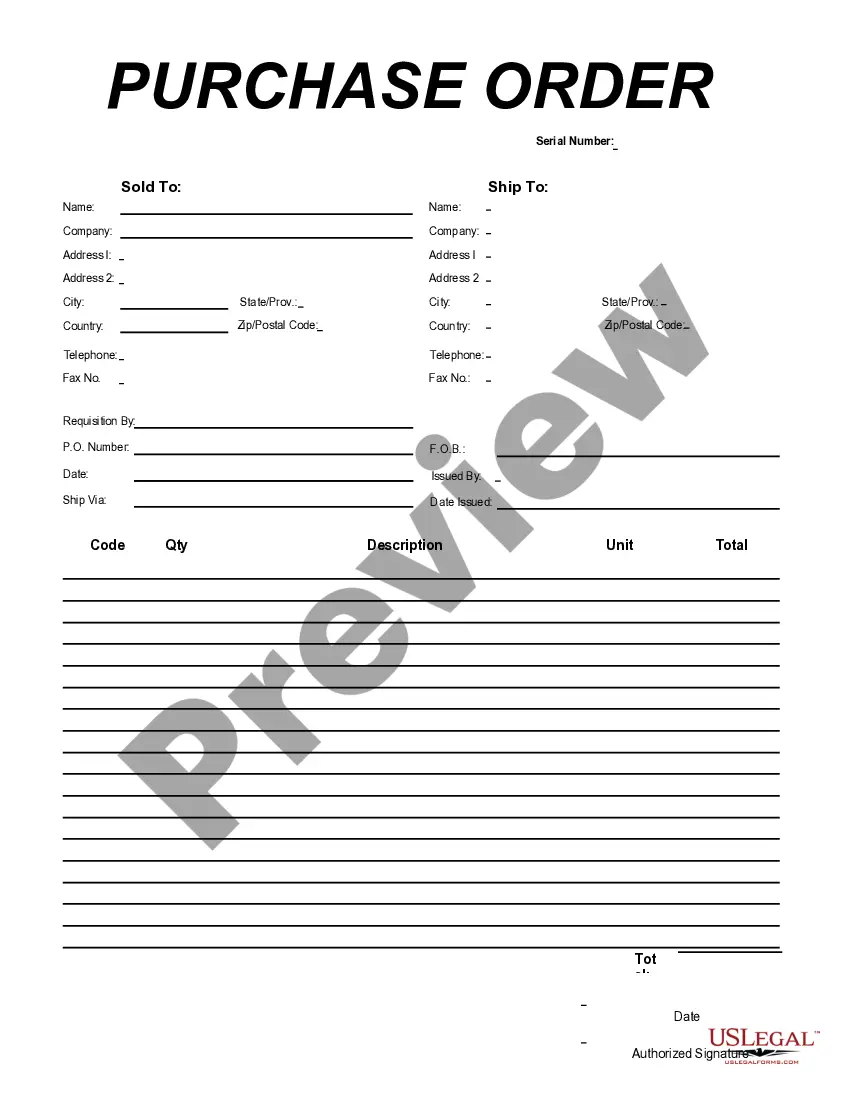

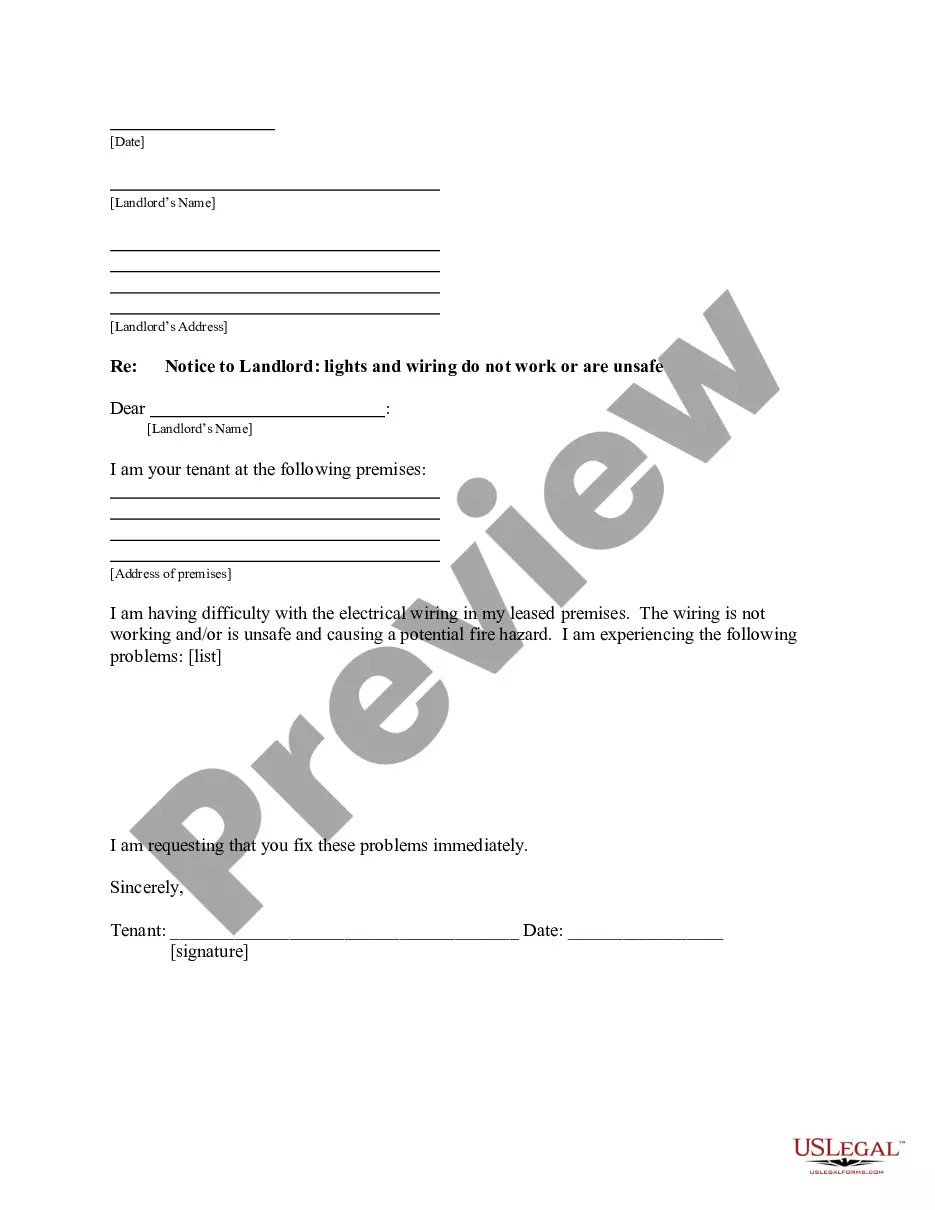

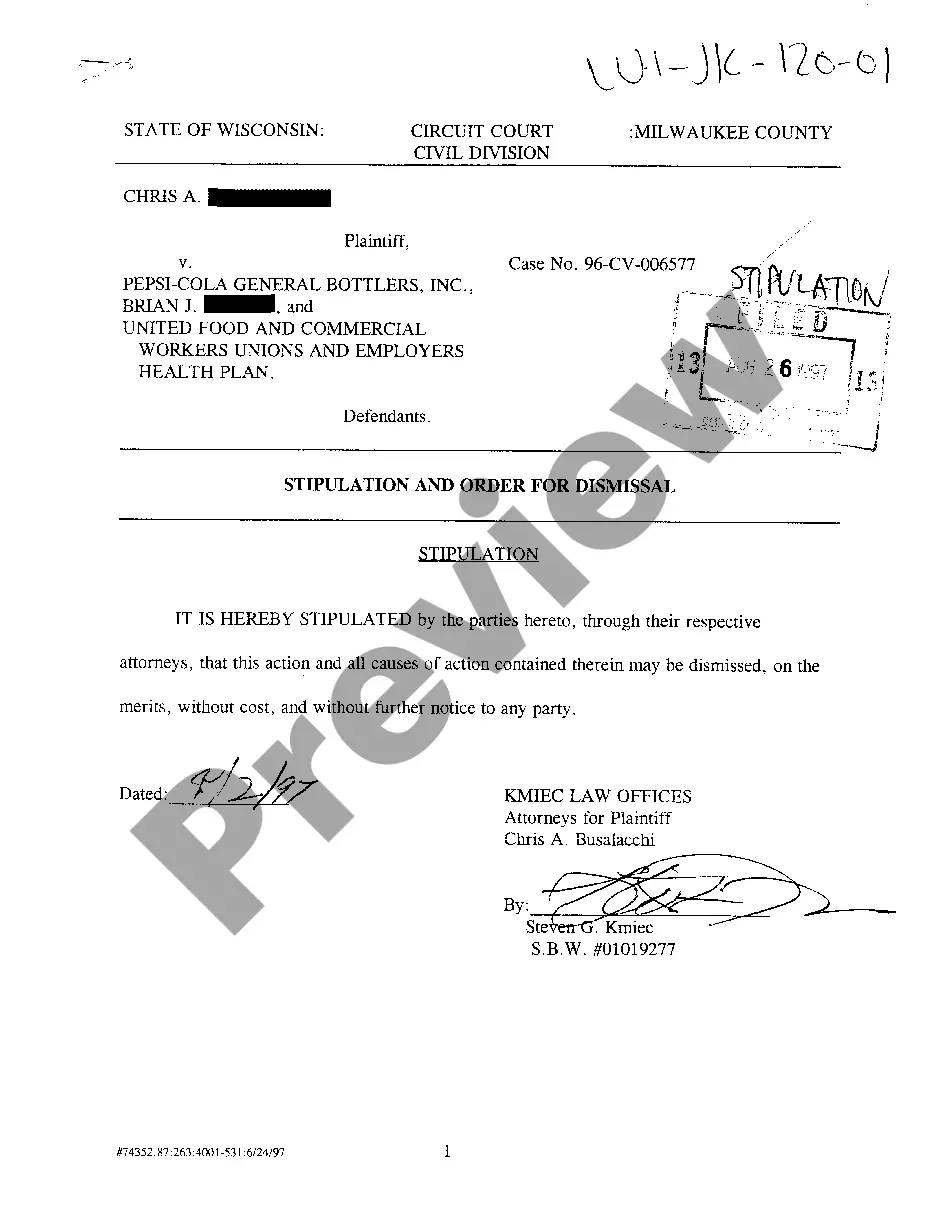

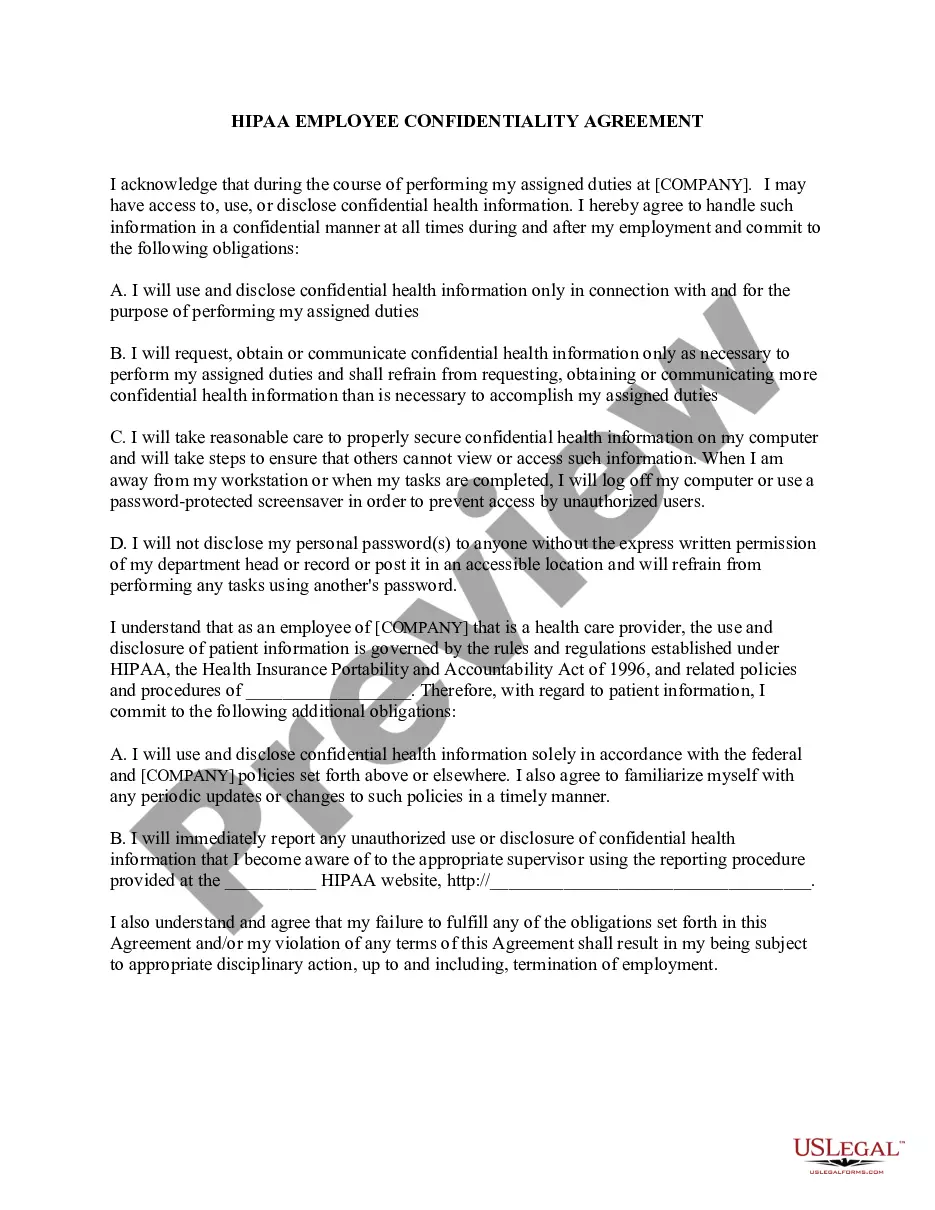

- Utilize the Preview option to review the form.

- See the explanation to actually have selected the right kind.

- In the event the kind is not what you`re searching for, use the Search area to find the kind that suits you and specifications.

- Once you get the appropriate kind, click on Get now.

- Opt for the costs plan you need, fill out the desired information to generate your bank account, and purchase an order using your PayPal or Visa or Mastercard.

- Decide on a handy file file format and acquire your duplicate.

Discover every one of the papers layouts you possess purchased in the My Forms food list. You may get a additional duplicate of Maine Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse whenever, if necessary. Just click the required kind to acquire or produce the papers web template.

Use US Legal Forms, one of the most substantial selection of legitimate varieties, in order to save efforts and prevent faults. The services gives skillfully made legitimate papers layouts that you can use for a range of functions. Make your account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

When the life tenant dies, the remainderman typically receives a step-up tax basis in the property. This means the remainderman takes ownership of the home at its fair market value at the time of the life tenant's death. This can save the remainderman capital gains tax when the property is sold.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

Each joint owner has an undivided right to possess the whole property and a proportionate right of equal ownership interest. When one joint tenant dies, his/her interest automatically passes on to the surviving joint tenant(s).

Dower & Curtesy Defined At common law, the estate of dower is held by a widow upon her husband's death and consists of a life estate of one-third to one-half of the land owned by her husband if he held a freehold interest in the land (e.g., a fee simple) and the land is inheritable by the issue of the marriage.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

Defining a California Life Estate A life estate is a form of ownership that allows one person to live in or on a piece of real property until they pass away. At their death, the real property passes to the intended beneficiary of the original owner.

The owner of a life estate cannot leave the property to anyone in their will as their interest in the property will terminate at their death. The holder has full rights to possess and use the property, and may also transfer their interest during their lifetime.