Maine Receipt and Release Personal Representative of Estate Regarding Legacy of a Will is a legal document that plays a crucial role in the administration of a deceased person's estate in the state of Maine. This document serves as proof that the personal representative (also referred to as an executor or administrator) has received the assets outlined in a will and releases the estate from any further claims or liabilities. The Maine Receipt and Release Personal Representative of Estate Regarding Legacy of a Will contains various important elements. It starts with identifying information, including the name of the deceased individual (referred to as the decedent), the date of death, and the county where the probate proceedings are taking place. It also includes the name and contact details of the personal representative. The document then outlines the specific provisions of the will, including details of the specific assets or legacies assigned to beneficiaries. This may include real estate properties, vehicles, bank accounts, investments, personal belongings, or other valuable possessions. Each asset should be clearly identified and described to avoid any confusion or disputes. Furthermore, the Receipt and Release states that the personal representative acknowledges receipt of these assets and confirms that they have been delivered to the designated beneficiaries according to the terms and provisions of the will. The personal representative also agrees that they have not withheld any assets or acted against the wishes specified in the will. Moreover, the document contains a release clause, stating that the personal representative and the estate are released from any further claims, demands, or liabilities arising from the administration of the estate. This provision is essential in safeguarding the personal representative from future disputes or legal actions related to the distribution of the estate. In Maine, there might be different variations or types of Receipt and Release forms specific to different circumstances. These may include: 1. Receipt and Release for a Specific Legacy: This document is used when the personal representative is distributing a specific asset or legacy to the rightful beneficiary, and it requires the beneficiary's acknowledgement of receipt and release of the estate. 2. Receipt and Release for Residual Distribution: This type of form is used when the personal representative has already distributed all specific legacies and is now distributing the residual estate, which is the remaining assets after satisfying any debts, expenses, or taxes. It ensures that the residual beneficiaries acknowledge receipt and release the estate from any further claims. It is important to consult with an attorney or legal professional to ensure compliance with Maine state laws and to use the appropriate form for the specific circumstances of the estate administration.

Maine Receipt and Release Personal Representative of Estate Regarding Legacy of a Will

Description

How to fill out Maine Receipt And Release Personal Representative Of Estate Regarding Legacy Of A Will?

Are you in a situation the place you need documents for sometimes company or person functions just about every time? There are a lot of authorized file web templates accessible on the Internet, but discovering types you can depend on isn`t effortless. US Legal Forms provides 1000s of type web templates, such as the Maine Receipt and Release Personal Representative of Estate Regarding Legacy of a Will, that happen to be composed in order to meet federal and state specifications.

If you are presently acquainted with US Legal Forms site and have a merchant account, simply log in. Afterward, it is possible to download the Maine Receipt and Release Personal Representative of Estate Regarding Legacy of a Will web template.

Should you not provide an bank account and wish to begin using US Legal Forms, adopt these measures:

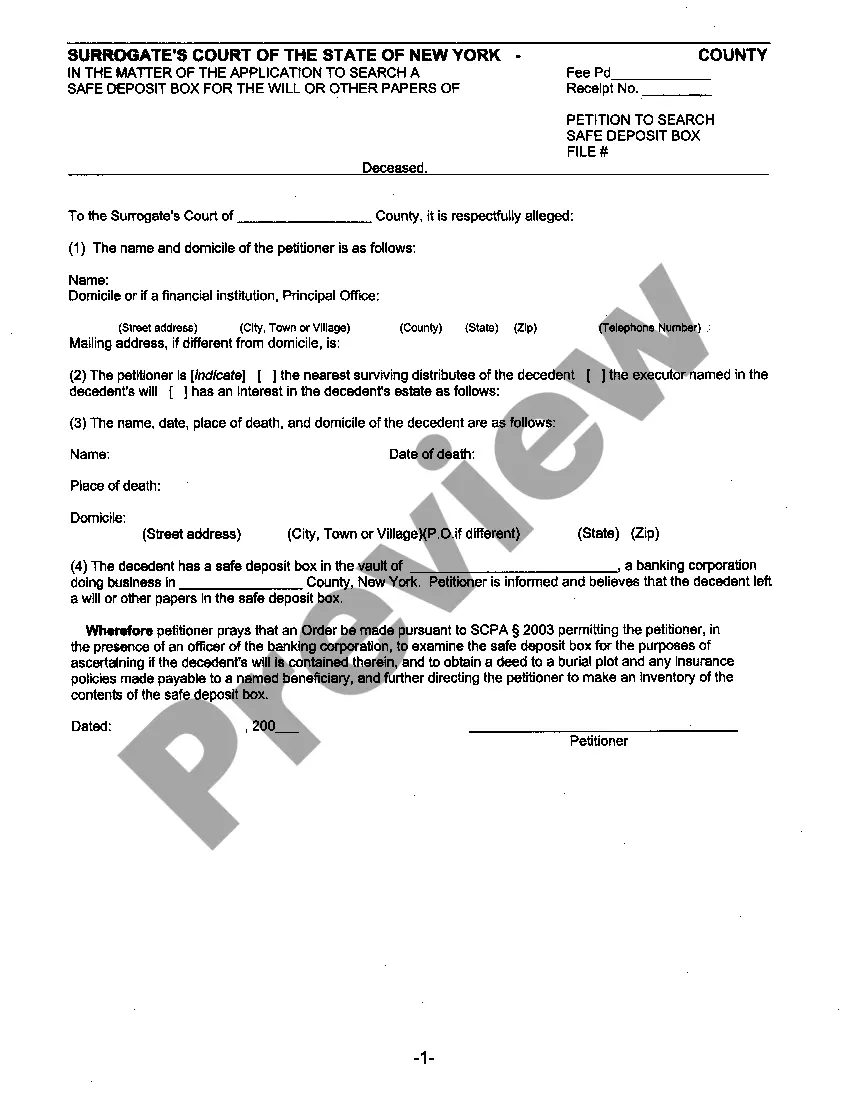

- Discover the type you want and make sure it is for the right city/state.

- Utilize the Review option to analyze the form.

- Read the information to actually have chosen the right type.

- In case the type isn`t what you are trying to find, use the Search discipline to find the type that meets your requirements and specifications.

- If you obtain the right type, simply click Acquire now.

- Opt for the prices plan you want, submit the necessary details to generate your money, and purchase an order with your PayPal or bank card.

- Choose a handy file format and download your version.

Get every one of the file web templates you possess purchased in the My Forms menu. You may get a further version of Maine Receipt and Release Personal Representative of Estate Regarding Legacy of a Will anytime, if possible. Just click on the required type to download or print out the file web template.

Use US Legal Forms, the most substantial variety of authorized varieties, to conserve efforts and avoid blunders. The service provides appropriately created authorized file web templates that can be used for a selection of functions. Create a merchant account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Criminal statutes of limitations in Maine are generally three years for misdemeanors and six years for felonies, although the time limit is eight years for sexual assault charges and no limit for murder or sexual assault against a victim under the age of 16.

Appropriate probate, appointment or testacy proceedings may be commenced in relation to a claim for personal injury made against the decedent by a person without actual notice of the death of the decedent at any time within 6 years after the cause of action accrues.

Probate Basics In Maine, if the deceased dies testate (or with a valid will) then the estate will be distributed ing to the terms of the will. However, if the deceased dies intestate (without a valid will) then the estate will pass to the deceased's heirs ing to Maine's intestate succession laws.

A personal representative appointed by a court of the decedent's domicile has priority over all other persons except when the decedent's will nominates different persons to be personal representative in this State and in the state of domicile.

How Long Do You Have to File Probate After a Death in Maine? Probate must be filed within three years of the person's death as listed in the Maine Code Title 18-C Section 3-108. There are a few exceptions where probate would be accepted after this deadline.

Under current Maine law, creditors have a maximum time limit of 9 months from the date of death to present their claims to the Personal Representative. The 9-month period can be shortened if you provide a written notice to the creditor and request that the creditor promptly file the claim.

If the deceased person left a Will, then the Personal Representative named in the Will is appointed. If there is no Will, then the next of kin has "priority of appointment." This step usually takes a few weeks to a month, depending on the Maine county in which the application is filed.

Under current Maine law, creditors have a maximum time limit of 9 months from the date of death to present their claims to the Personal Representative. The 9-month period can be shortened if you provide a written notice to the creditor and request that the creditor promptly file the claim.