Maine Irrevocable Life Insurance Trusts (Slits) with Crummy withdrawal rights are estate planning tools that allow individuals to benefit from life insurance proceeds while minimizing estate taxes. This article provides a detailed description of these trusts, showcasing their key features and advantages. Maine Slits are designed to hold life insurance policies as assets, ensuring that policy proceeds are excluded from the insured individual's taxable estate upon their demise. These trusts offer an added benefit by allowing beneficiaries to exercise the Crummy withdrawal right — a mechanism that enables them to withdraw a limited portion of contributed funds for a specified period. The Crummy withdrawal right is named after the famous legal case Crummy v. Commissioner in 1968. It allows beneficiaries to experience the benefits of life insurance proceeds while still preserving the trust's nature as an irrevocable trust. This withdrawal right is essential to maintain tax advantages under existing laws. Types of Maine Irrevocable Life Insurance Trusts — Beneficiaries HavCrummyey Right of Withdrawal: 1. Traditional Maine IIT: This type of trust typically grants beneficiaries a right of withdrawal for a specific duration after each contribution. The Crummy withdrawal right limits annual gifts by ensuring the contribution is considered a gift rather than a direct payment to the trust. This mechanism allows the trust to shelter the assets from estate taxes. Contributions can then be used to fund insurance policy premiums, which ultimately benefits the beneficiaries. 2. Generation-Skipping Maine IIT: This trust provides an opportunity to skip a generation when distributing assets. For families seeking to pass wealth to grandchildren while avoiding estate and gift taxes, a generation-skipping IIT with Crummy withdrawal rights can be beneficial. Beneficiaries exercise their withdrawal rights, allowing contributions to the trust to be distributed to future generations (such as grandchild beneficiaries) without additional tax consequences. 3. Dynasty Maine IIT: A dynasty IIT is designed to create a lasting legacy for multiple generations. By utilizing the Crummy withdrawal right, assets held in the trust can be transferred to subsequent generations without incurring estate taxes. This type of trust provides an ideal solution for those aiming to ensure long-term financial security for their descendants. 4. Charitable Maine IIT: This trust incorporates a charitable element by allocating a portion of the policy proceeds to a chosen charity or foundation. Beneficiaries, while enjoying the Crummy withdrawal right, also contribute to philanthropy. This mechanism allows individuals to support causes close to their hearts while optimizing estate planning strategies. In conclusion, Maine Irrevocable Life Insurance Trusts with Crummy withdrawal rights offer individuals an effective strategy to reduce estate taxes while still benefiting from life insurance policies. Whether it's a traditional, generation-skipping, dynasty, or charitable IIT, these trusts can be tailored to meet various estate planning goals. Consulting a financial advisor or estate planning attorney is crucial to determine the trust type that best aligns with individual circumstances and goals.

Maine Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

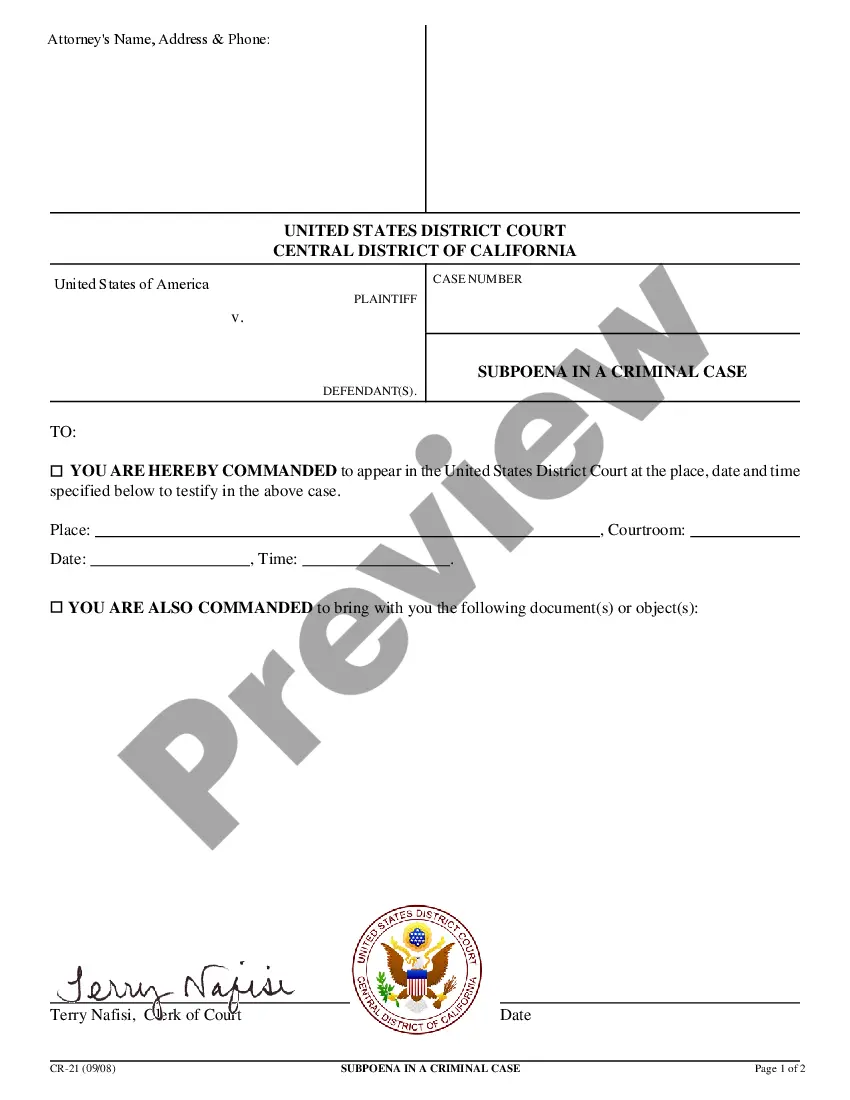

How to fill out Maine Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

Choosing the best legitimate file format could be a struggle. Obviously, there are tons of layouts available online, but how do you find the legitimate form you will need? Use the US Legal Forms website. The services offers a large number of layouts, for example the Maine Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal, which can be used for business and private demands. Each of the kinds are checked out by pros and fulfill state and federal specifications.

If you are already signed up, log in in your accounts and then click the Acquire key to get the Maine Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal. Make use of your accounts to check with the legitimate kinds you may have ordered previously. Visit the My Forms tab of your respective accounts and obtain one more backup from the file you will need.

If you are a whole new user of US Legal Forms, listed below are easy instructions for you to adhere to:

- Initial, be sure you have chosen the right form for your town/region. It is possible to look over the form making use of the Review key and look at the form explanation to ensure this is the right one for you.

- When the form will not fulfill your expectations, use the Seach field to obtain the proper form.

- When you are certain the form is suitable, go through the Acquire now key to get the form.

- Pick the pricing prepare you would like and enter the required information. Make your accounts and pay money for the order using your PayPal accounts or bank card.

- Choose the data file file format and acquire the legitimate file format in your device.

- Comprehensive, change and produce and signal the received Maine Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal.

US Legal Forms is the greatest local library of legitimate kinds where you can see different file layouts. Use the company to acquire skillfully-created files that adhere to state specifications.