Maine Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose is a legal provision that allows individuals to include specific instructions and requirements in their wills regarding the establishment of a charitable trust for a stated charitable purpose. This provision ensures that the individual's charitable goals and intentions are carried out after their passing. In Maine, there are different types of provisions that can be included in a testamentary trust with a bequest to charity for a stated charitable purpose. These include: 1. Charitable Remainder Trust: Under this provision, a portion of the estate or assets is set aside in a trust that pays income to designated beneficiaries for a specified period, typically their lifetime or a fixed term. After this period, the remaining assets are transferred to the named charity or charities to fulfill the stated charitable purpose. 2. Charitable Lead Trust: This provision allows individuals to allocate a portion of their estate to generate income for a specified charitable purpose for a set period. After this period, the remaining estate assets are distributed to the designated beneficiaries. 3. Pooled Income Fund: Individuals can choose to establish a provision that allows their assets to be combined with other donors' assets into a larger investment pool. The income generated from this fund is then distributed periodically to the charity for the stated charitable purpose. 4. Charitable Gift Annuity: This provision allows individuals to make a charitable gift during their lifetime in exchange for a fixed income stream for themselves or their designated beneficiaries. After the individual's passing, the remaining assets are directed to the charity for the stated charitable purpose. It is essential to ensure that these provisions comply with Maine state laws and regulations pertaining to testamentary trusts and charitable organizations. Seeking legal advice from an experienced attorney specializing in estate planning and charitable giving is highly recommended when incorporating a Maine Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose. By considering these various provisions, individuals in Maine can leave a lasting legacy through philanthropy while ensuring that their assets are utilized for their intended charitable purpose.

Maine Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

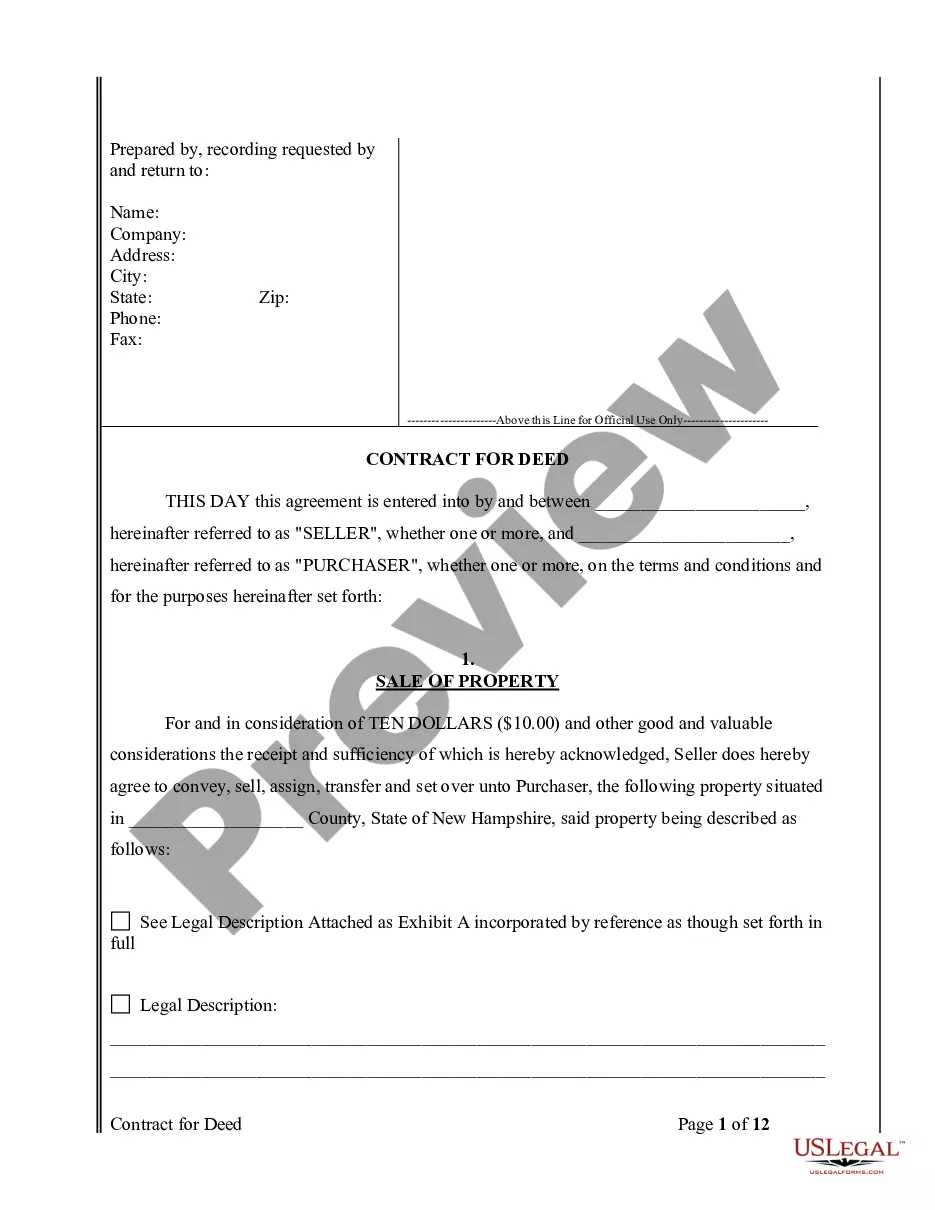

How to fill out Maine Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

US Legal Forms - one of many greatest libraries of authorized kinds in the States - offers a wide array of authorized document web templates it is possible to down load or produce. Making use of the web site, you will get a huge number of kinds for enterprise and personal purposes, categorized by types, says, or keywords.You will discover the newest versions of kinds like the Maine Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose within minutes.

If you currently have a monthly subscription, log in and down load Maine Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose in the US Legal Forms local library. The Obtain switch can look on every develop you view. You get access to all previously downloaded kinds from the My Forms tab of your profile.

In order to use US Legal Forms the very first time, listed below are basic recommendations to obtain started off:

- Ensure you have picked out the right develop for the town/county. Go through the Review switch to check the form`s content material. Look at the develop outline to ensure that you have chosen the appropriate develop.

- In the event the develop doesn`t match your demands, utilize the Lookup area on top of the screen to get the one who does.

- If you are content with the shape, validate your choice by visiting the Buy now switch. Then, pick the costs prepare you like and give your qualifications to sign up for the profile.

- Approach the transaction. Make use of Visa or Mastercard or PayPal profile to complete the transaction.

- Choose the formatting and down load the shape on the gadget.

- Make adjustments. Fill out, modify and produce and sign the downloaded Maine Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose.

Each template you added to your money does not have an expiration particular date and it is the one you have eternally. So, if you wish to down load or produce another version, just go to the My Forms area and click on around the develop you require.

Gain access to the Maine Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose with US Legal Forms, the most comprehensive local library of authorized document web templates. Use a huge number of expert and express-particular web templates that fulfill your company or personal requires and demands.