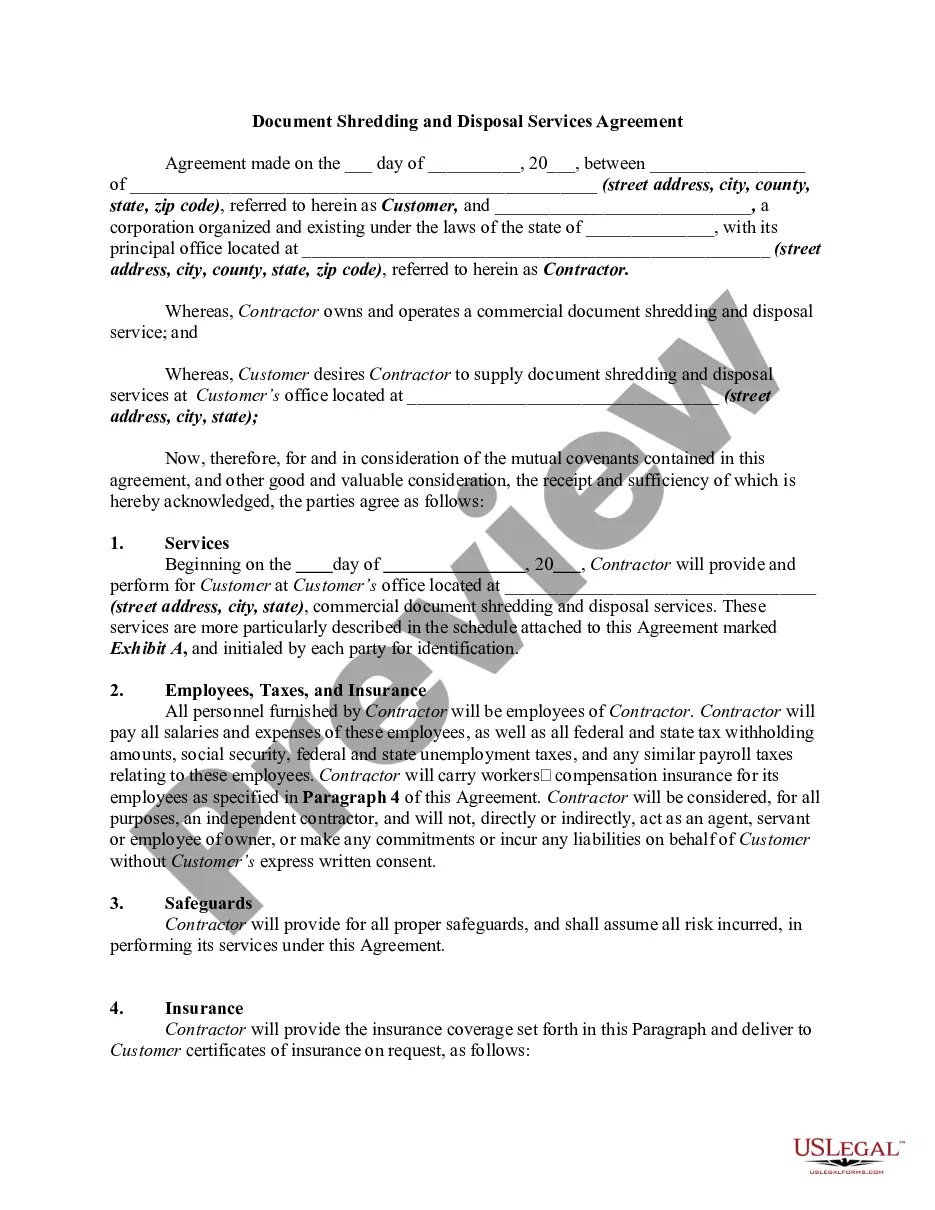

Maine Partnership Agreement for LLC is a legal document outlining the partnership terms and responsibilities between two or more partners forming a Limited Liability Company (LLC) in the state of Maine. This agreement serves as a guidebook for the partners and defines their roles, rights, obligations, and profit distribution within the LLC. It acts as the core foundation for the business relationship between partners, ensuring smooth operations and minimizing potential conflicts or misunderstandings. The Maine Partnership Agreement for LLC typically covers various crucial aspects that partners need to address. These include the initial capital contributions by partners, their profit and loss allocation, decision-making processes, dispute resolution mechanisms, buyout or withdrawal provisions, and dissolution procedures. Partnerships in Maine can utilize different types of Partnership Agreements for LLC according to their specific requirements and preferences. Some common types of Partnership Agreements for LLC in Maine include: 1. General Partnership Agreement: This type of agreement is suitable for LCS where all partners have equal rights and share equally in profits, losses, and management responsibilities. 2. Limited Partnership Agreement: A Limited Partnership (LP) agreement is chosen when there are both general partners and limited partners. General partners manage the business and have unlimited liability, while limited partners contribute capital but typically have limited liability. 3. Limited Liability Partnership Agreement: A Limited Liability Partnership (LLP) agreement offers liability protection to all partners, meaning they are not personally responsible for the acts or debts of others in the partnership. 4. Family Limited Partnership Agreement: This type of agreement is well-suited for family-owned LCS, where members of the same family operate the business together. The Maine Partnership Agreement for LLC is a customizable document that can be tailored according to the specific needs, objectives, and circumstances of the partners forming the LLC. It is highly recommended consulting with legal professionals or attorneys experienced in Maine business laws while preparing or modifying this agreement to ensure compliance with all relevant regulations.

Maine Partnership Agreement for LLC

Description

How to fill out Maine Partnership Agreement For LLC?

US Legal Forms - one of many largest libraries of legitimate kinds in America - gives a wide range of legitimate record web templates it is possible to acquire or printing. Utilizing the website, you can find thousands of kinds for company and individual reasons, sorted by types, claims, or key phrases.You will find the most up-to-date models of kinds just like the Maine Partnership Agreement for LLC in seconds.

If you already have a membership, log in and acquire Maine Partnership Agreement for LLC from the US Legal Forms catalogue. The Download switch can look on every single kind you see. You get access to all formerly acquired kinds from the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, allow me to share basic recommendations to obtain began:

- Make sure you have picked the best kind to your metropolis/area. Click on the Review switch to examine the form`s information. See the kind description to actually have selected the appropriate kind.

- In the event the kind does not satisfy your requirements, use the Research field near the top of the monitor to discover the the one that does.

- Should you be satisfied with the form, confirm your option by clicking on the Get now switch. Then, opt for the costs strategy you favor and supply your credentials to register on an bank account.

- Method the deal. Utilize your credit card or PayPal bank account to finish the deal.

- Find the formatting and acquire the form on your own system.

- Make modifications. Fill up, change and printing and indication the acquired Maine Partnership Agreement for LLC.

Each web template you included in your account does not have an expiration date and is your own for a long time. So, if you would like acquire or printing an additional backup, just go to the My Forms area and then click about the kind you need.

Get access to the Maine Partnership Agreement for LLC with US Legal Forms, the most extensive catalogue of legitimate record web templates. Use thousands of professional and status-specific web templates that satisfy your company or individual needs and requirements.