Maine LLC Operating Agreement for Rental Property

Description

How to fill out LLC Operating Agreement For Rental Property?

It is feasible to spend hours online trying to locate the legal document format that complies with the federal and state requirements you need.

US Legal Forms offers an extensive collection of legal forms that are vetted by experts.

You can easily download or print the Maine LLC Operating Agreement for Rental Property from the service.

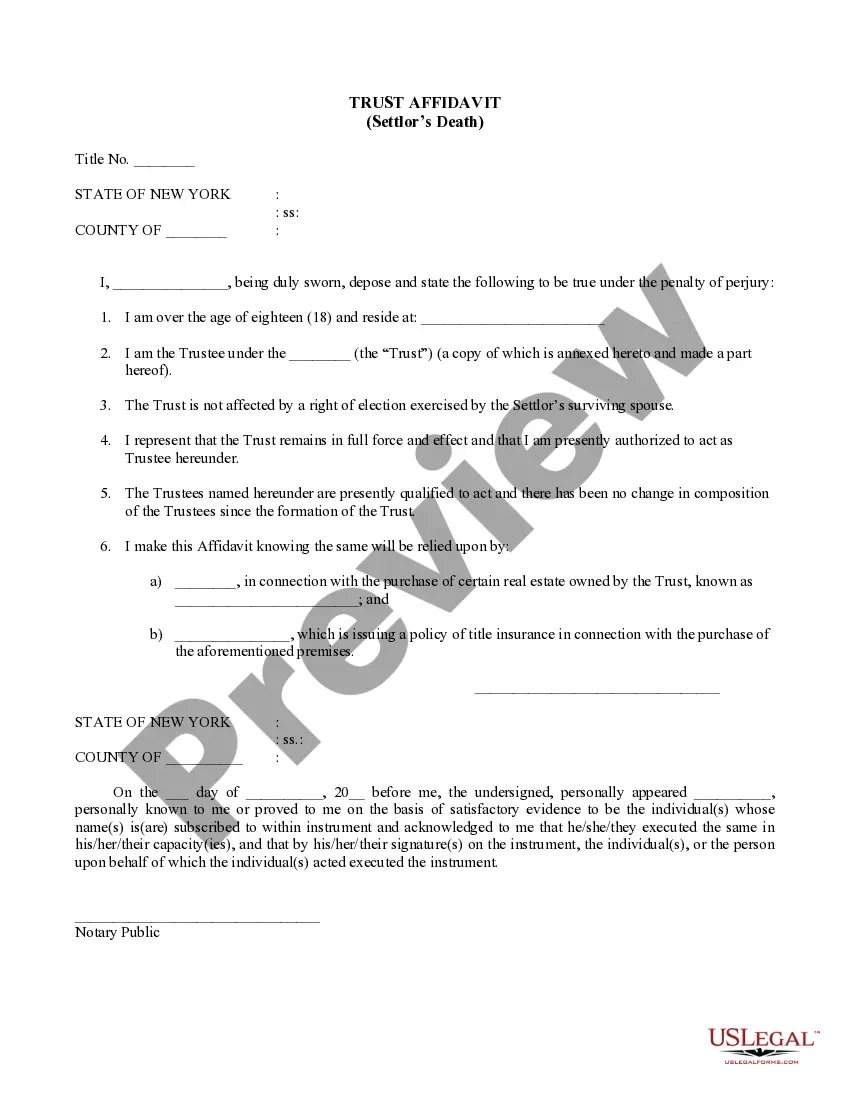

If available, use the Review button to browse through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, edit, print, or sign the Maine LLC Operating Agreement for Rental Property.

- Each legal document format you obtain is yours permanently.

- To get an additional copy of a purchased form, visit the My documents tab and click the related button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document format for your state/city of choice.

- Check the form description to make sure you have chosen the right form.

Form popularity

FAQ

A Maine LLC Operating Agreement for Rental Property provides numerous benefits. It establishes rules for management and operation, reducing misunderstandings among members. Additionally, it can protect your personal assets from liabilities related to the rental property, which adds a layer of security. Using a tool like uslegalforms can simplify the process of creating an effective operating agreement tailored to your needs.

According to Maine Revised Statutes Section 31-1531(1B), every Maine LLC must have an operating agreement in place. It'll prevent conflict among your business partners.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

How Your LLC Will Be Taxed. Owners pay self-employment tax on business profits. Owners pay state income tax on any profits, minus state allowances or deductions. Owners pay federal income tax on any profits, minus federal allowances or deductions.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

He concluded By statute, a limited liability company is a party to its own limited liability company agreement, regardless of whether the limited liability company executes its own limited liability company agreement.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

To start a Maine LLC, you'll need to file the Certificate of Formation with the Maine Secretary of State, which costs $175. You can apply by mail. The Certificate of Formation is the legal document that officially creates your Maine Limited Liability Company.