Maine Accredited Investor Representation Letter: A Comprehensive Description and Types Keywords: Maine, accredited investor representation letter, SEC, private placement, investment opportunities, eligibility criteria, financial sophistication, net worth, income requirements, exemptions. Introduction: The Maine Accredited Investor Representation Letter refers to a legal document utilized by various financial entities, such as investment firms, brokers, and private placement issuers, to confirm an individual's accredited investor status as defined by the Securities and Exchange Commission (SEC). This letter ensures compliance with federal regulations and assists in providing eligible investors access to exclusive investment opportunities. The letter is an essential element in private placements and other investment processes, safeguarding both the investor's interests and the issuer's legal requirements. Types of Maine Accredited Investor Representation Letters: 1. Standard Maine Accredited Investor Representation Letter: This type of representation letter is commonly used to establish an individual's accredited investor status. It encompasses detailed information about the investor's qualifications and eligibility criteria, such as their net worth, income, professional certifications, and financial sophistication. A standard Maine Accredited Investor Representation Letter serves as a general declaration of an investor's ability to participate in investment opportunities that are restricted to accredited individuals. 2. Maine Accredited Investor Representation Letter for Institutional Investors: Institutional investors, including banks, insurance companies, and pension funds, may require a specific type of representation letter that caters to their unique requirements. These letters emphasize the legal qualifications and certifications relevant to institutional investors' investment decision-making processes. Maine Accredited Investor Representation Letters for institutional investors may include additional documentation and disclosures to address the complexity of large-scale investments. 3. Maine Accredited Investor Representation Letter for Entities: This type of representation letter is designed for legal entities, such as corporations, limited liability companies (LCS), and partnerships, seeking accredited investor status. It details the entity's overall financial condition, assets, and relevant certifications necessary to classify it as an accredited investor. Maine Accredited Investor Representation Letters for entities also establish the authorized representatives who are capable of making investment decisions on behalf of the entity. 4. Exemption-Specific Maine Accredited Investor Representation Letter: Certain investment opportunities may qualify for exemptions under SEC regulations. As a result, an exemption-specific Maine Accredited Investor Representation Letter is required to verify an investor's eligibility for these specific exemptions. Common exemptions include Regulation D (Rule 506), Regulation A, and Regulation S exemptions. These letters reflect the unique criteria set forth by each exemption and ensure that investors meet the necessary requirements to participate in exempt offerings. Conclusion: The Maine Accredited Investor Representation Letter is a vital document in the investment process, serving to verify an individual's or entity's accredited investor status. By supplying detailed information about an investor's financial qualifications, income, net worth, and other relevant factors, these letters play a crucial role in ensuring compliance with federal regulations. Whether it is a standard representation letter, one for institutional investors, entities, or exemption-specific, these letters enable eligible investors to access exclusive investment opportunities while upholding legal requirements.

Maine Accredited Investor Representation Letter

Description

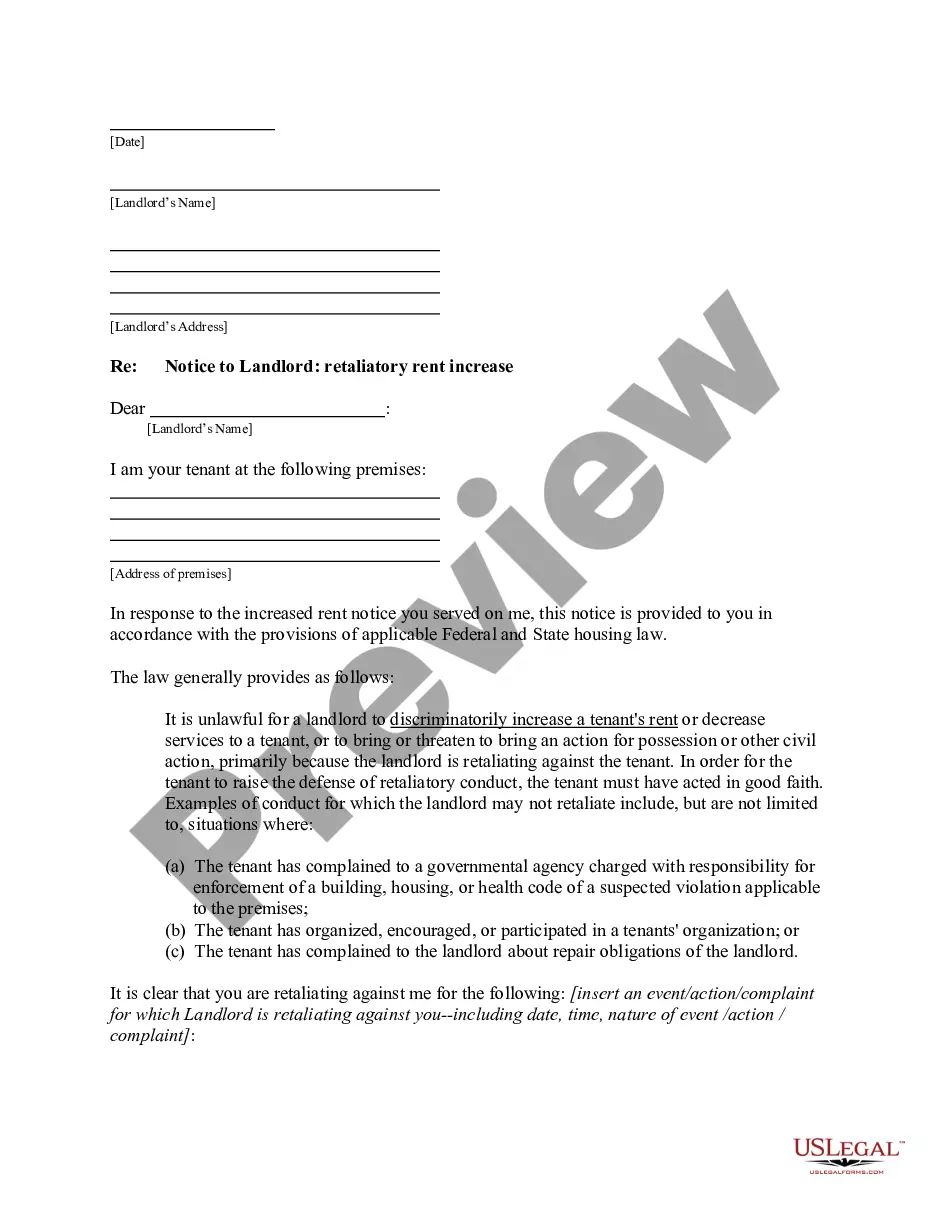

How to fill out Maine Accredited Investor Representation Letter?

It is possible to devote hrs on the Internet looking for the authorized record format that fits the state and federal specifications you need. US Legal Forms offers thousands of authorized varieties that happen to be examined by professionals. You can actually down load or print out the Maine Accredited Investor Representation Letter from my support.

If you already possess a US Legal Forms account, it is possible to log in and then click the Down load button. After that, it is possible to full, change, print out, or indication the Maine Accredited Investor Representation Letter. Each authorized record format you get is your own forever. To acquire an additional version associated with a obtained type, check out the My Forms tab and then click the related button.

Should you use the US Legal Forms website the first time, adhere to the easy recommendations below:

- Initially, make certain you have selected the proper record format for that county/city of your liking. Read the type description to make sure you have selected the correct type. If offered, make use of the Preview button to appear through the record format as well.

- If you want to get an additional edition of your type, make use of the Lookup discipline to find the format that meets your needs and specifications.

- After you have discovered the format you would like, just click Buy now to carry on.

- Find the prices plan you would like, enter your credentials, and register for your account on US Legal Forms.

- Total the financial transaction. You can use your charge card or PayPal account to fund the authorized type.

- Find the formatting of your record and down load it in your product.

- Make modifications in your record if necessary. It is possible to full, change and indication and print out Maine Accredited Investor Representation Letter.

Down load and print out thousands of record layouts utilizing the US Legal Forms website, that provides the biggest assortment of authorized varieties. Use professional and express-distinct layouts to tackle your business or person needs.

Form popularity

FAQ

In short, one could now become accredited, regardless of financial means, if they held one of three financial licenses in good standing: the Series 7 (license for public securities brokers), the Series 65 (license for investment advisers), or the Series 82 (license for private securities brokers).

In a Rule 506(b) offering, investors can self-certify, so this is where the opportunity for an investor to falsify their qualifications comes in. In a Rule 506(c) offering, investors must provide reasonable assurance to the Syndicator that they are accredited, which must be dated within 90 days of the investment.

Investor Representation Letter means a letter from initial investors of a Bond offering that includes but is not limited to a certification that they reasonably meet the standards of a Sophisticated Investor or Qualified Institutional Buyer, that they are purchasing Bonds for their own account, that they have the

A qualified institutional buyer (QIB) representation letter for an unlegended Rule 144A offering of securities by a Canadian issuer. The QIB representation letter relates to a concurrent public offering in Canada and an offering in the United States conducted in reliance on Rule 144A under the Securities Act.

There are essentially three approaches: (1) the issuer itself can verify each investor's status, (2) the investor's accountant, lawyer, or another professional can verify the investor's status, or (3) the issuer can hire a third-party verification service to verify each investor's status.

An accredited investor is a person or entity that is allowed to invest in securities that are not registered with the Securities and Exchange Commission (SEC). To be an accredited investor, an individual or entity must meet certain income and net worth guidelines.

The purpose of this Statement is to obtain information relating to whether or not you are an accredited investor as defined in Securities and Exchange Regulation D as well as your knowledge and experience in financial and business matters and to your ability to bear the economic risks of an investment in the Company.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

Some documents that can prove an investor's accredited status include:Tax filings or pay stubs;A letter from an accountant or employer confirming their actual and expected annual income; or.IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.