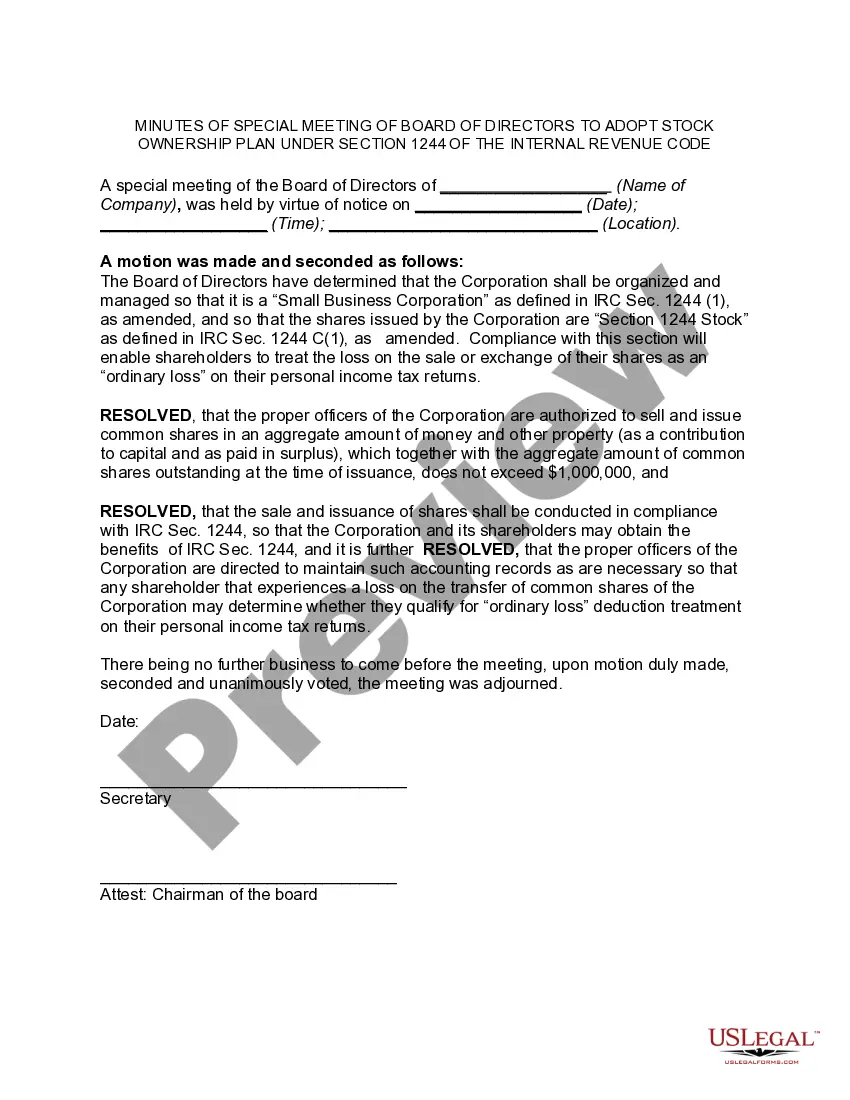

Maine Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

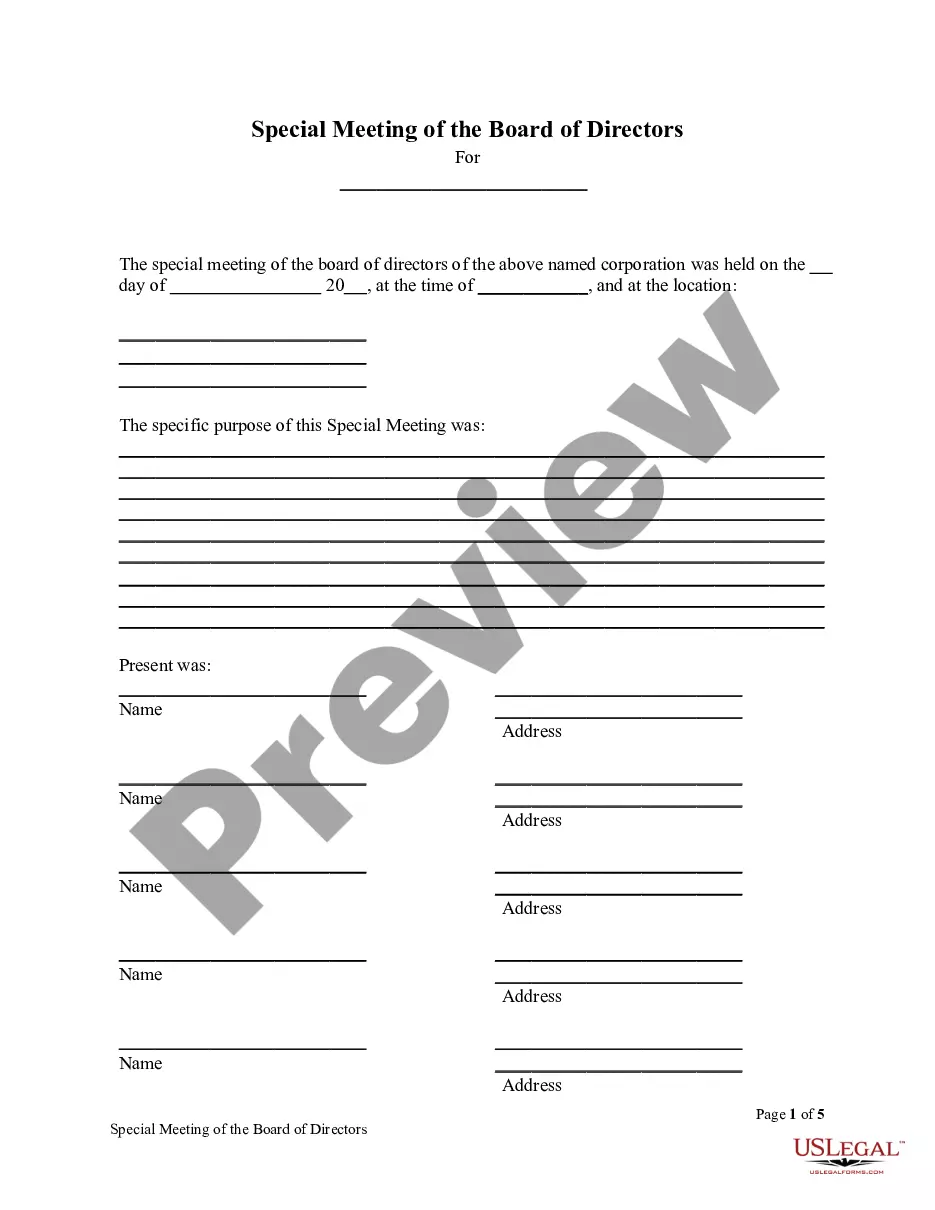

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

Are you presently in a circumstance where you require documents for occasional business or particular purposes nearly every working day.

There are numerous authentic document templates accessible online, but finding forms you can trust is challenging.

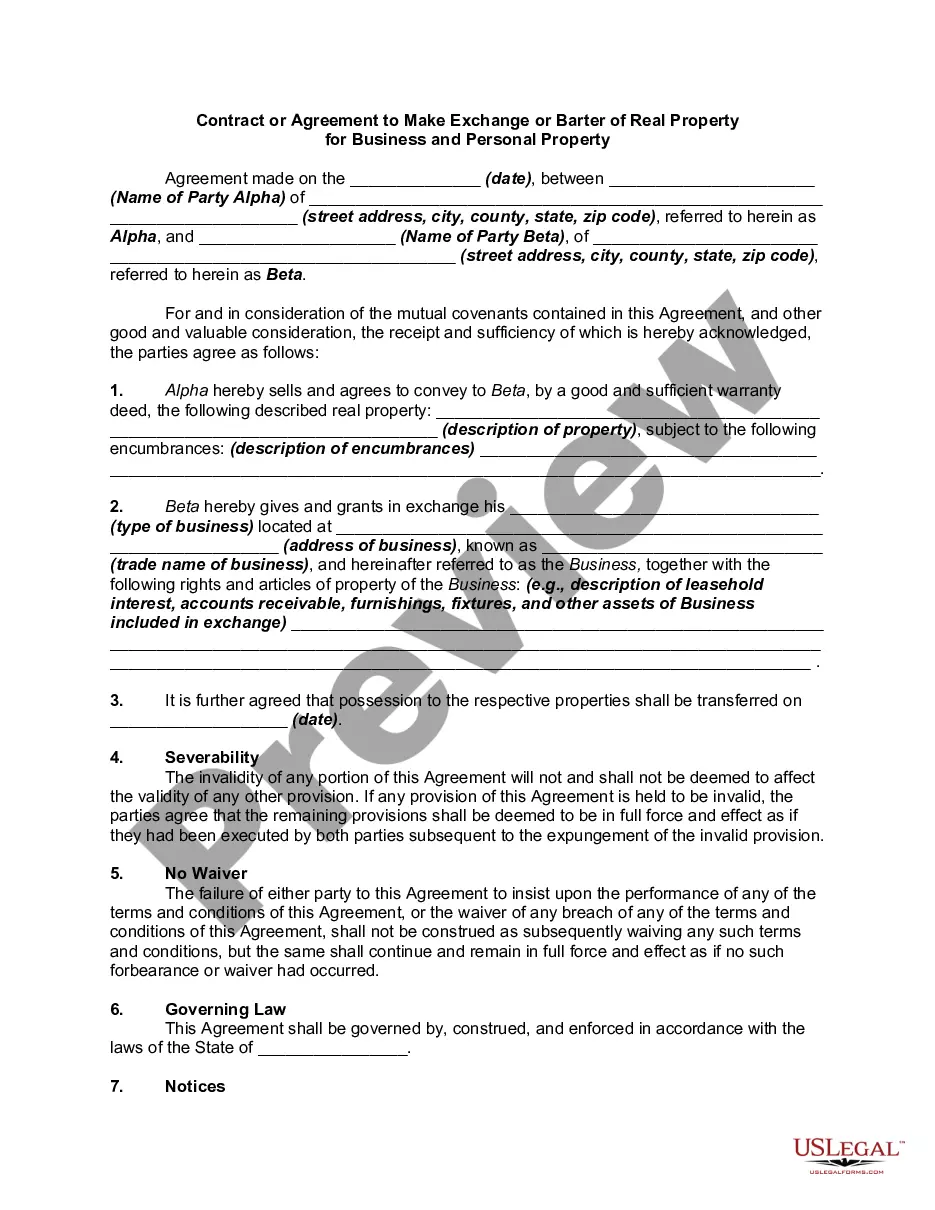

US Legal Forms offers a vast array of form templates, such as the Maine Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, that are designed to comply with federal and state regulations.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

Select a suitable file format and download your copy. You can find all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Maine Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code anytime, if required. Simply access the needed form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and begin easing your life a bit.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Maine Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your appropriate city/region.

- Utilize the Preview button to review the document.

- Read the description to confirm you have selected the correct form.

- If the form does not match your requirements, use the Search field to locate a form that suits your needs and criteria.

- When you find the correct form, click Buy now.

Form popularity

FAQ

A special shareholder meeting is sometimes called to handle issues that occur in between annual meetings, and often have certain requirements for calling and holding the meeting. Annual shareholder meetings have become something that is expected from investors.

An annual general meeting, or annual shareholder meeting, is primarily held to allow shareholders to vote on both company issues and the selection of the company's board of directors. In large companies, this meeting is typically the only time during the year when shareholders and executives interact.

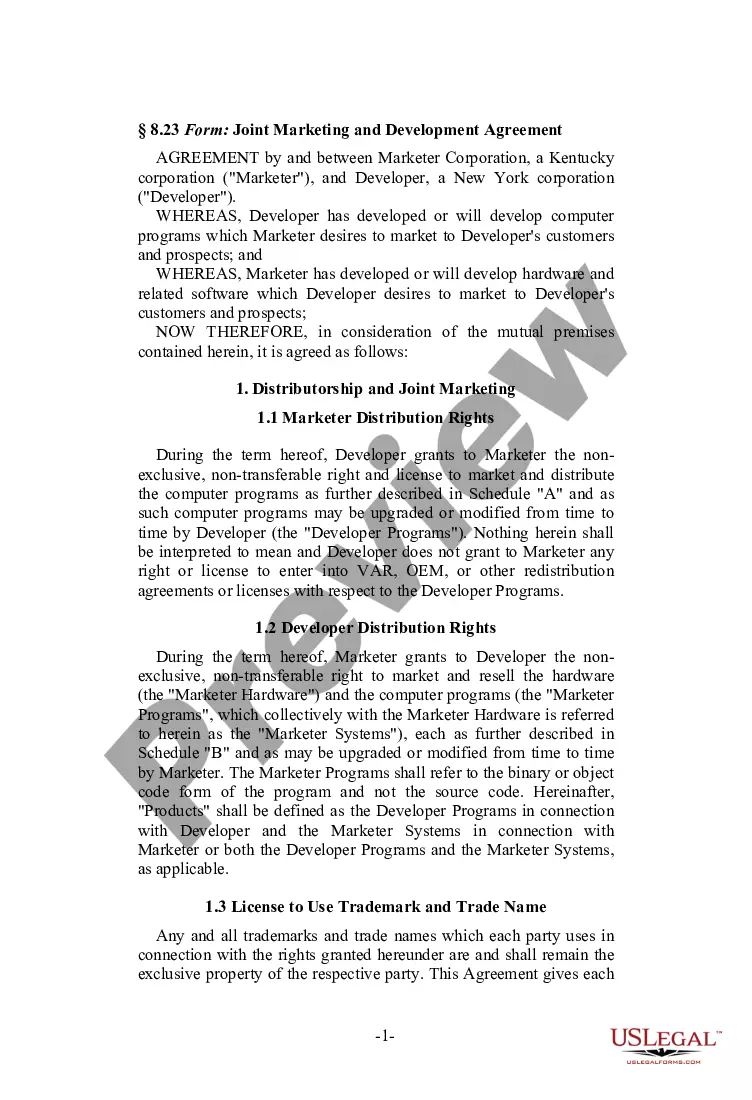

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Legal Definition of special meeting : a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

The determination of whether stock qualifies as Section 1244 stock is made at the time of issuance. Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test.

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.