Maine Debt Adjustment Agreement with Creditor

Description

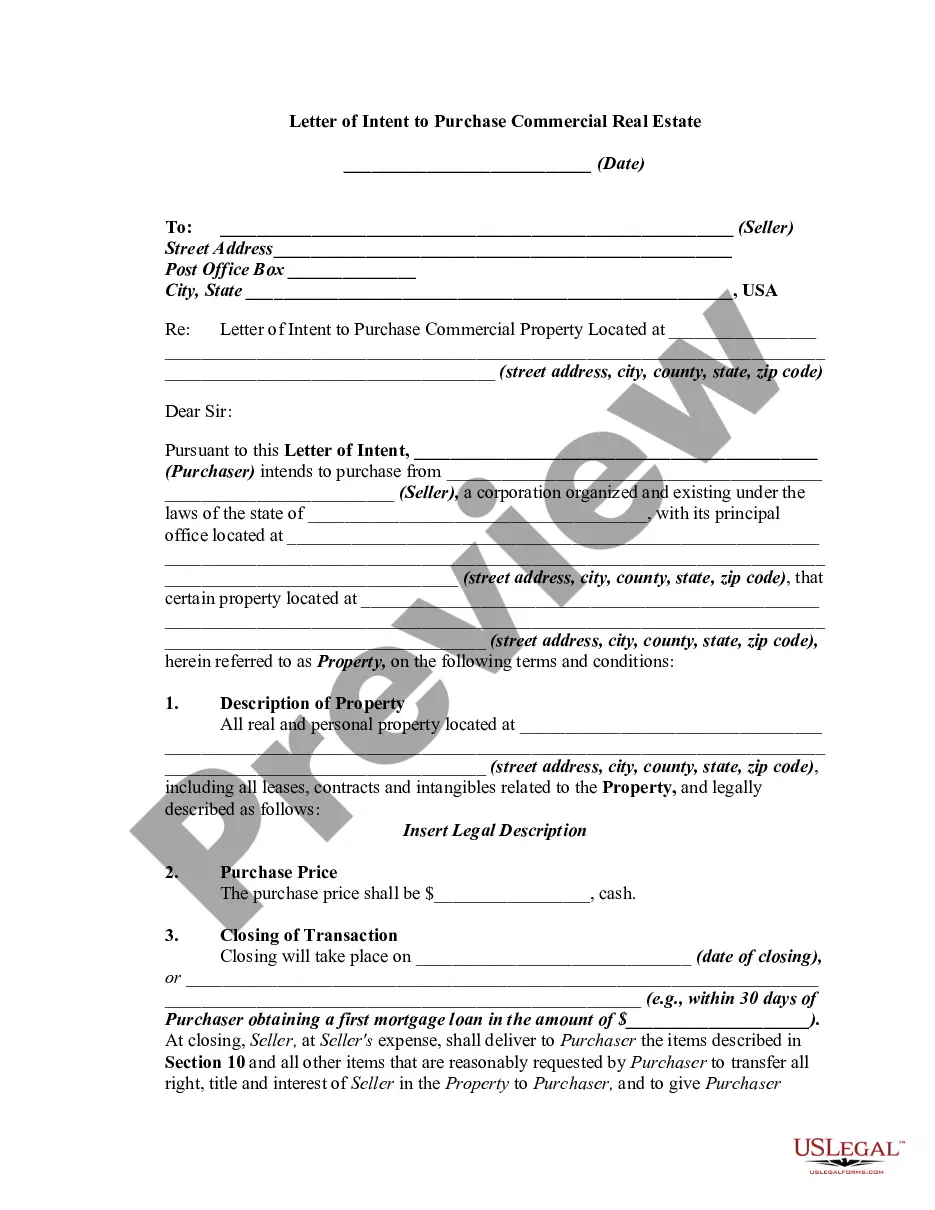

How to fill out Debt Adjustment Agreement With Creditor?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous authentic document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast selection of form templates, such as the Maine Debt Adjustment Agreement with Creditor, that are designed to comply with state and federal regulations.

Once you find the correct form, simply click Acquire now.

Select the payment plan you desire, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Maine Debt Adjustment Agreement with Creditor template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to view the form.

- Review the information to confirm you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

If the debtor does not show up at the hearing, the court may issue a bench warrant for the debtor's arrest. If the debtor shows up, you will have the chance to ask him or her questions about where he or she works and what bank accounts, property, belongings, stocks, or any other assets the debtor may have.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you havesuch as late payments or settled debtsthe better.

When you settle an account, its balance is brought to zero, but your credit report will show the account was settled for less than the full amount. Settling an account instead of paying it in full is considered negative because the creditor agreed to take a loss in accepting less than what it was owed.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Aim to Pay 50% or Less of Your Unsecured Debt If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offerabout 15%and negotiate from there.