Maine Worksheet for Making a Budget is a comprehensive tool designed to help individuals and households effectively manage their finances and track their expenses. This worksheet provides a structured framework to create a realistic budget plan tailored to individual needs and goals. By utilizing this worksheet, individuals can gain a better understanding of their income, expenses, and financial situation, thereby enabling them to make informed decisions and achieve financial stability. The Maine Worksheet for Making a Budget includes various sections and categories to assist in organizing financial information. These sections typically consist of: 1. Income: This section allows users to record their various sources of income, such as salaries, wages, rental income, or any other sources of revenue. It helps individuals assess their total income and provides a clear picture of their financial inflow. 2. Fixed Expenses: This category focuses on recurring expenses, such as mortgage payments, loan repayments, insurance premiums, and other fixed costs that need to be budgeted. It ensures that individuals plan and allocate funds for these obligatory expenses accordingly. 3. Variable Expenses: This section covers day-to-day expenses that may vary from month to month. It includes groceries, dining out, entertainment, transportation costs, and other discretionary spending. By tracking and managing these variable expenses, individuals can better control their spending habits and find areas where they can cut costs, if necessary. 4. Savings and Investments: This category emphasizes the importance of saving and investing for future financial goals. It encourages individuals to allocate a predetermined amount from their income towards savings and allows for tracking investments, such as retirement accounts or college funds. 5. Miscellaneous Expenses: This section allows individuals to record any incidental or unexpected expenses that may not fit into other categories. It includes costs like repairs, medical emergencies, and other unforeseen circumstances. Different types of Maine Worksheets for Making a Budget may vary in their format, level of detail, or additional features. For instance: 1. Basic Maine Worksheet: Suitable for beginners, this worksheet provides a simple framework with essential sections to create a basic budget plan. 2. Detailed Maine Worksheet: Designed for individuals seeking a more comprehensive approach, this worksheet includes additional sections, such as debt management, income tax planning, and long-term financial goal tracking. 3. Digital Maine Worksheet: Some versions of this worksheet are available in digital format, allowing users to input data electronically and calculate totals and summaries automatically. 4. Maine Worksheet for Couples: This variation of the budgeting worksheet is tailored specifically for couples or households with shared expenses, offering separate sections to track individual incomes and joint expenses. In summary, the Maine Worksheet for Making a Budget is a valuable financial management tool with various types available to suit different preferences and needs. Whether individuals prefer a basic or detailed format, electronic or paper-based, utilizing this worksheet enables them to gain control over their finances and work towards achieving long-term financial success.

Maine Worksheet for Making a Budget

Description

How to fill out Maine Worksheet For Making A Budget?

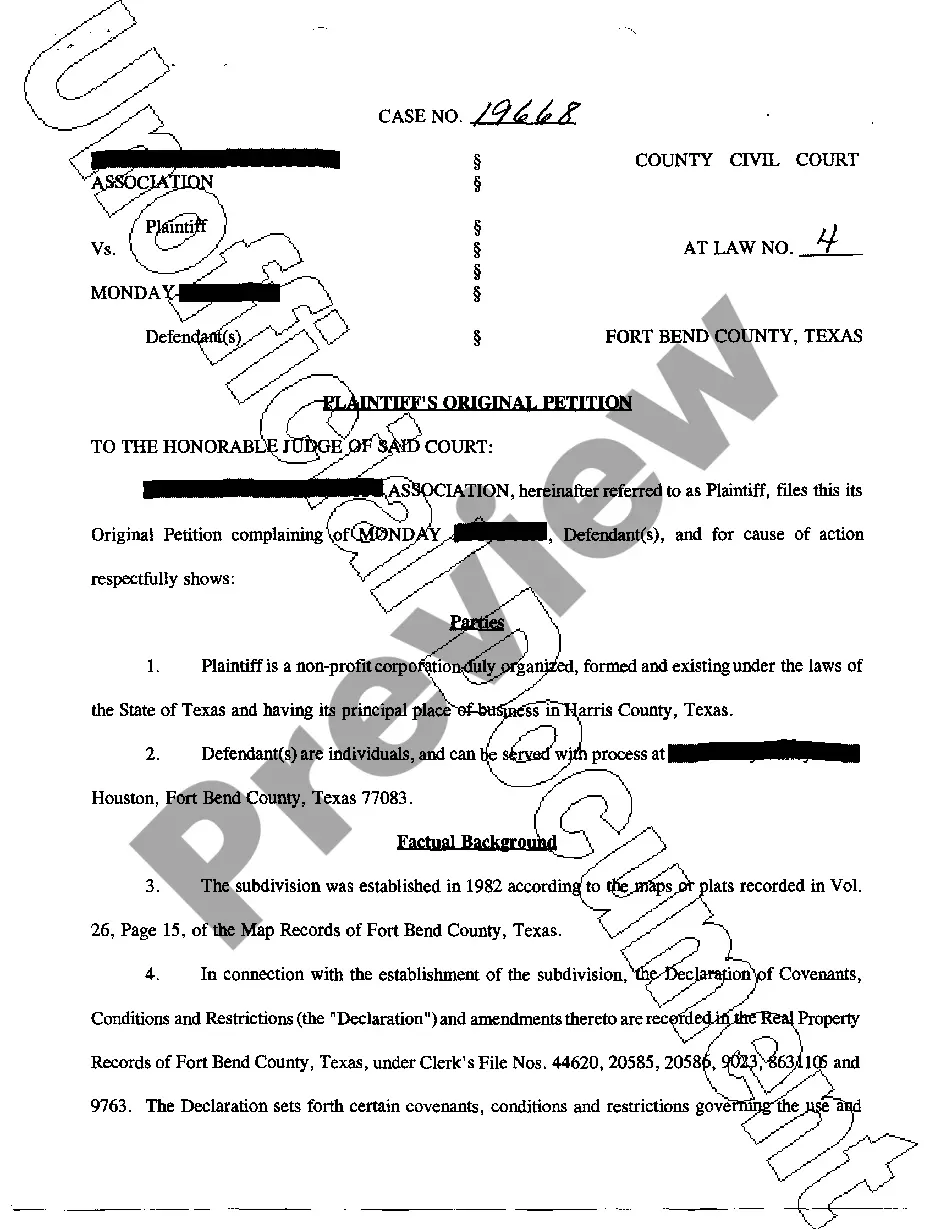

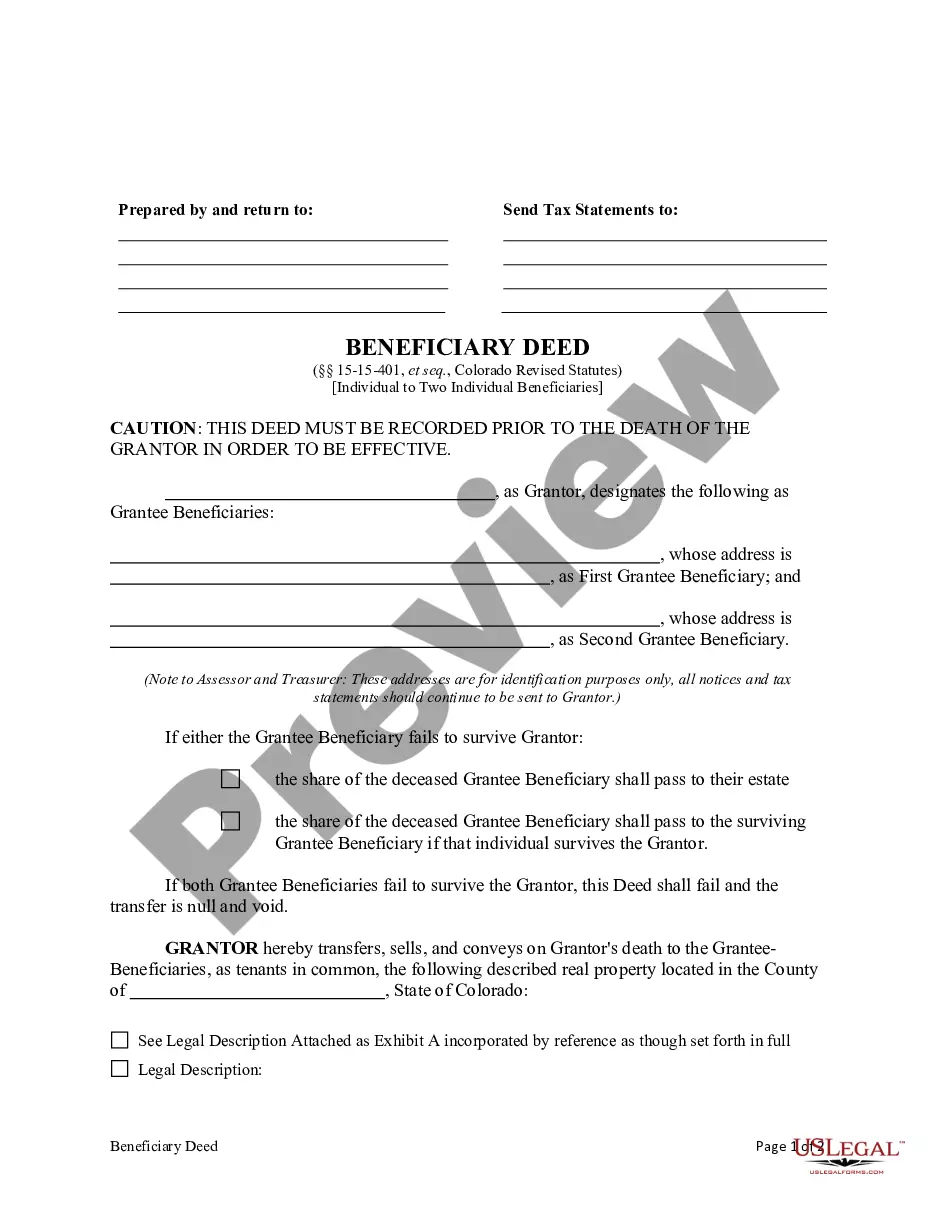

If you have to full, acquire, or printing legal file templates, use US Legal Forms, the largest variety of legal kinds, which can be found online. Use the site`s basic and handy search to find the documents you need. Various templates for business and specific functions are sorted by groups and suggests, or keywords. Use US Legal Forms to find the Maine Worksheet for Making a Budget with a number of clicks.

Should you be already a US Legal Forms consumer, log in to the bank account and click on the Obtain option to obtain the Maine Worksheet for Making a Budget. You can even access kinds you formerly saved inside the My Forms tab of your own bank account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have chosen the form for your appropriate town/land.

- Step 2. Use the Preview solution to look over the form`s content material. Never overlook to read the explanation.

- Step 3. Should you be unsatisfied with the form, take advantage of the Look for area towards the top of the monitor to discover other models from the legal form design.

- Step 4. Upon having identified the form you need, click on the Acquire now option. Select the pricing plan you choose and add your qualifications to sign up for the bank account.

- Step 5. Process the transaction. You can use your bank card or PayPal bank account to finish the transaction.

- Step 6. Select the formatting from the legal form and acquire it on your gadget.

- Step 7. Full, modify and printing or indicator the Maine Worksheet for Making a Budget.

Every legal file design you buy is your own property for a long time. You might have acces to every form you saved within your acccount. Go through the My Forms area and choose a form to printing or acquire once more.

Remain competitive and acquire, and printing the Maine Worksheet for Making a Budget with US Legal Forms. There are millions of professional and state-certain kinds you can use for your personal business or specific requires.

Form popularity

FAQ

5 Steps to Successful BudgetingStep 1: Automate essential, recurring living expenses.Step 2: Automate savings.Step 3: Establish a debt reduction plan.Step 4: Commit to a spending plan.Step 5: Account for irregular expenses.15-Jun-2018

How to Make a Budget Plan: 6 Easy StepsSelect your budget template or application.Collect all your financial paperwork or electronic bill information.Calculate your monthly income.Establish a list of your monthly expenses.Categorize your expenses and designate spending values.Adjust your budget accordingly.

How to Make a Budget Plan: 6 Easy StepsSelect your budget template or application.Collect all your financial paperwork or electronic bill information.Calculate your monthly income.Establish a list of your monthly expenses.Categorize your expenses and designate spending values.Adjust your budget accordingly.

How to Create a Monthly Budget in 6 StepsTOTAL YOUR MONTHLY TAKE-HOME PAY.ADD UP WHAT YOU SPEND ON FIXED EXPENSES.ADD UP WHAT YOU SPEND ON NON-MONTHLY COSTS.ADD UP CONTRIBUTIONS TO FINANCIAL GOALS.ADD UP YOUR DISCRETIONARY SPENDING.DO SOME SIMPLE MATH.

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.

How to Make a Budget Plan: 6 Easy StepsSelect your budget template or application.Collect all your financial paperwork or electronic bill information.Calculate your monthly income.Establish a list of your monthly expenses.Categorize your expenses and designate spending values.Adjust your budget accordingly.03-Mar-2021

Ideally, it just needs five key elements:Plan out every cent. A budget is essentially a blueprint for what you are going to spend in the next month.Know much you make.Treat yourself.Base yourself in reality.Be flexible.29-Apr-2015