Maine Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed: Dear [Creditor's Name], RE: Agreement to Temporarily Postpone Monthly Payments I am writing to confirm our recent discussion regarding my financial situation and the need to temporarily postpone my monthly payments. I am currently experiencing [financial hardship/unexpected circumstances] and would greatly appreciate your understanding and cooperation during this challenging time. As a responsible borrower, I understand the importance of meeting my financial obligations and maintaining a good credit standing. However, due to the circumstances mentioned above, I am unable to make the agreed-upon monthly payments at this time. I propose a temporary postponement of payment for [specific duration, e.g., three months] or until my financial situation improves. This will allow me to allocate my limited resources towards covering other essential expenses during this unprecedented time. I assure you that this request is not made lightly, and I remain committed to fulfilling my financial obligations. I kindly request your consideration and support in granting this temporary payment postponement. By doing so, it will enable me to get through this challenging period while maintaining a positive relationship with your esteemed institution. Please find enclosed all relevant documents supporting my current financial situation, including [any required proof such as bank statements, layoff notices, medical bills, etc.]. I trust that these documents will provide a clear picture of the circumstances that have necessitated this temporary adjustment. If necessary, I am more than willing to discuss this matter further or provide any additional information to assist in your decision-making process. I am hopeful that you will recognize the seriousness of my situation and grant the temporary postponement as outlined above. I am committed to resuming regular payments promptly once my financial situation stabilizes. In the meantime, please be assured that I will communicate any changes or updates promptly. I appreciate your understanding, flexibility, and support during this challenging time. Thank you for your attention to this matter. Kindly confirm your agreement to temporarily postpone my monthly payments by signing and returning the copy of this letter. I eagerly await your positive response and look forward to a satisfactory resolution. Yours sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] Keywords: Maine, letter, creditor, monthly payments, temporarily postpone, agreement, financial hardship, unexpected circumstances, responsible borrower, credit standing, challenging time, postponed payment, duration, limited resources, essential expenses, commitment, request, positive relationship, documents, proof, bank statements, layoff notices, medical bills, decision-making process, stable financial situation, updates, flexibility, support, attention.

Maine Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

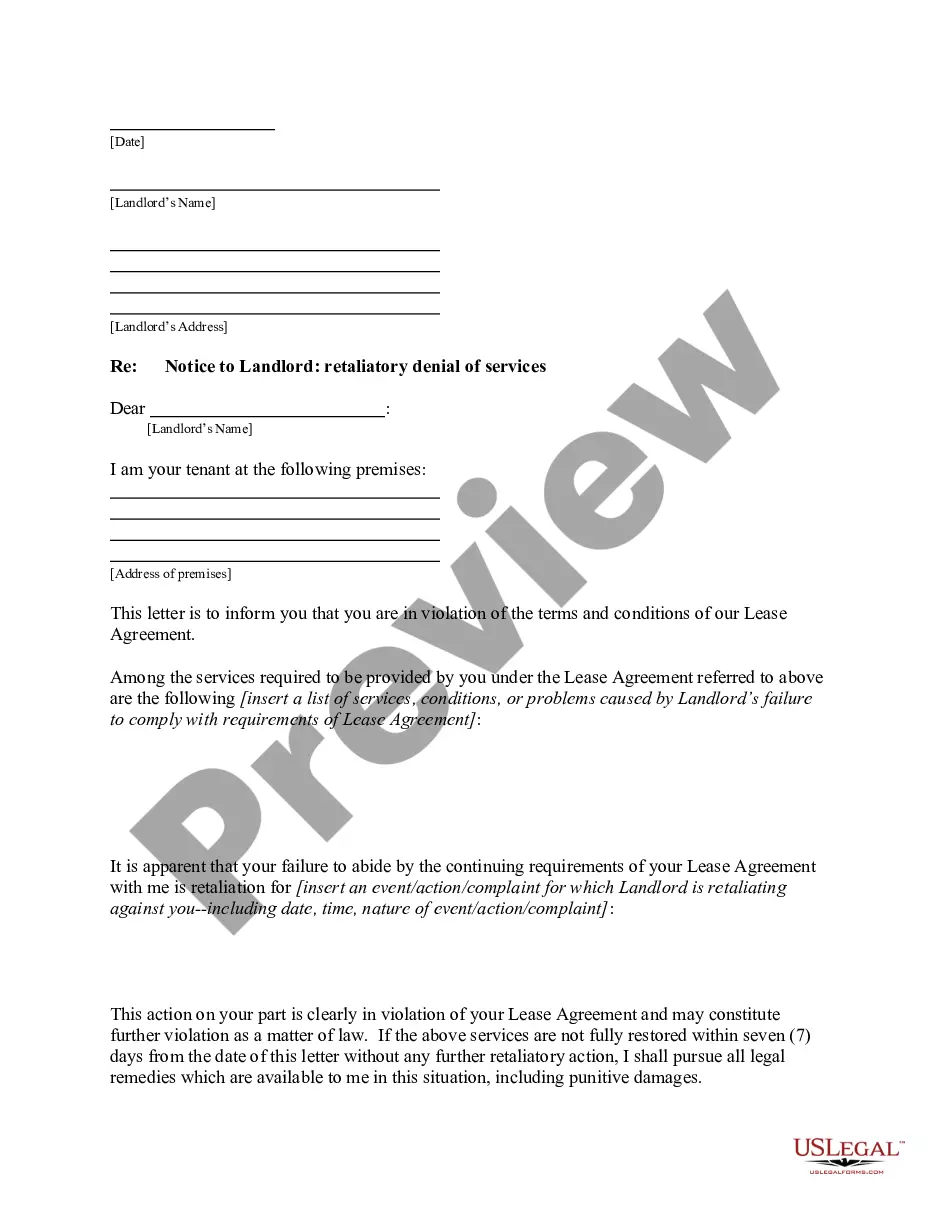

How to fill out Letter To Creditor Confirming Agreement That Monthly Payments Be Temporarily Postponed?

If you have to comprehensive, acquire, or printing legitimate record themes, use US Legal Forms, the biggest collection of legitimate types, that can be found on the Internet. Use the site`s simple and convenient research to discover the papers you will need. Various themes for enterprise and person uses are sorted by categories and says, or key phrases. Use US Legal Forms to discover the Maine Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed within a couple of click throughs.

When you are presently a US Legal Forms buyer, log in in your accounts and click on the Down load option to obtain the Maine Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. You can also access types you formerly saved in the My Forms tab of your accounts.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for your right city/region.

- Step 2. Make use of the Review choice to look over the form`s articles. Do not forget to see the explanation.

- Step 3. When you are unhappy together with the develop, make use of the Look for discipline at the top of the monitor to get other types in the legitimate develop format.

- Step 4. After you have discovered the shape you will need, go through the Buy now option. Pick the prices program you like and put your references to sign up to have an accounts.

- Step 5. Process the purchase. You should use your credit card or PayPal accounts to accomplish the purchase.

- Step 6. Find the file format in the legitimate develop and acquire it on your own gadget.

- Step 7. Complete, change and printing or indicator the Maine Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Each legitimate record format you get is the one you have for a long time. You possess acces to every single develop you saved in your acccount. Click the My Forms portion and choose a develop to printing or acquire once more.

Remain competitive and acquire, and printing the Maine Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed with US Legal Forms. There are thousands of professional and express-particular types you can use to your enterprise or person requirements.

Form popularity

FAQ

(Cordially describe your greetings). We will try our best to make the payment on time and apologize for the inconvenience caused to you. I ask you to consider my request for postponement of the last day for the advance payment of the money promised according to the deal signed between us and your company (date).

To become eligible for moratorium, customers should have no more than 2-EMIs overdue in any of their loans as of February 29, 2020. Any new loans disbursed after 31st March 2020 will not be eligible for moratorium.

1. The definition of a moratorium is an authorized delay in an activity or obligation. An example of a moratorium is a deferment on the payback on loans. noun.

How to prepare to talk with your creditorsThe specifics of your account. If you're calling to discuss a current account or loan, be sure to have a current statement on hand.An explanation of your situation.A repayment option/plan.Proof of your situation.A cool head.

With all due respect, it is stated that I am (Your name) and I requested for a loan previous month. The returning date of the loan is very near and I am not being able to collect the whole of the money. (Describe in your own words). So, I am writing this to request for a Loan instalment.

I/We, will/would like to state here that, due to the impact of disruptions on account of COVID-19 pandemic, I/We shall not be able to repay my/our monthly installments of aforesaid loan account /service my/our interest charged on Working Capital Account as mentioned above.

Whether you're in arrears or struggling to keep on top of your regular payments, asking your creditors to freeze interest and charges can help you clear your debts and get back on track quicker. They may agree to freeze interest for an agreed length of time if you tell them about your financial difficulties.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

A moratorium period refers to a particular period during the loan tenor in which you do not have to pay any equated monthly instalments (EMIs).