Maine Letter from Debtor | Credit Card Company | Lower Interest Rate | Request | Certain Period of Time Maine Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time is a formal communication submitted by a debtor residing in the state of Maine to their respective credit card company. This letter serves as a formal request to lower the ongoing interest rate on the debtor's credit card for a specific period. Debtors in Maine often encounter financial difficulties and seek ways to ease their financial burden. One viable option is to request a lower interest rate from their credit card company. By doing so, debtors hope to reduce the overall debt obligation and make it more manageable within a specific timeframe. There are different types of Maine Letters from Debtors to Credit Card Companies that request a lower interest rate for a certain period of time. 1. Standard Lower Interest Rate Request: This type of letter is commonly used when the debtor wants a general reduction in their credit card's ongoing interest rate. The debtor may explain their financial circumstances, such as job loss, medical expenses, or unexpected financial hardships, to support their request for a lower interest rate. They typically request a specific time period during which the reduced rate would apply. 2. Temporary Financial Hardship Request: Some debtors encounter temporary financial difficulties due to unforeseen circumstances like a sudden illness, loss of income, or natural disasters. In this type of letter, debtors clearly describe the nature of the hardship, providing relevant documentation and a proposed new lower interest rate for a specific period to align with their expected recovery timeline. 3. Balance Transfer Promotion Request: Debtors occasionally come across credit card companies offering promotional balance transfer rates with lower or even 0% interest for a limited term. In this case, debtors may write a letter requesting to be included in such promotions. This letter would explain their current financial situation and ask for eligibility to transfer the existing credit card balance to the new card with a lower or interest-free rate for the specified period. In all variations of the Maine Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, debtors should include relevant details such as their account number, outstanding balance, current interest rate, and desired lower interest rate along with the requested period. Additionally, it is advisable to provide any supporting documentation, like proof of financial hardships or medical bills, to strengthen the request's credibility. By writing a well-crafted Maine Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, debtors aim to negotiate favorable terms with their credit card company, reduce their financial burden, and regain control over their personal finances.

Maine Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Maine Letter From Debtor To Credit Card Company Requesting A Lower Interest Rate For A Certain Period Of Time?

If you want to comprehensive, down load, or print out authorized file templates, use US Legal Forms, the most important assortment of authorized varieties, that can be found online. Make use of the site`s simple and handy search to obtain the documents you will need. A variety of templates for enterprise and personal purposes are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to obtain the Maine Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time in a handful of mouse clicks.

Should you be already a US Legal Forms buyer, log in for your profile and click the Obtain switch to find the Maine Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. You may also accessibility varieties you formerly delivered electronically within the My Forms tab of your own profile.

If you use US Legal Forms initially, refer to the instructions below:

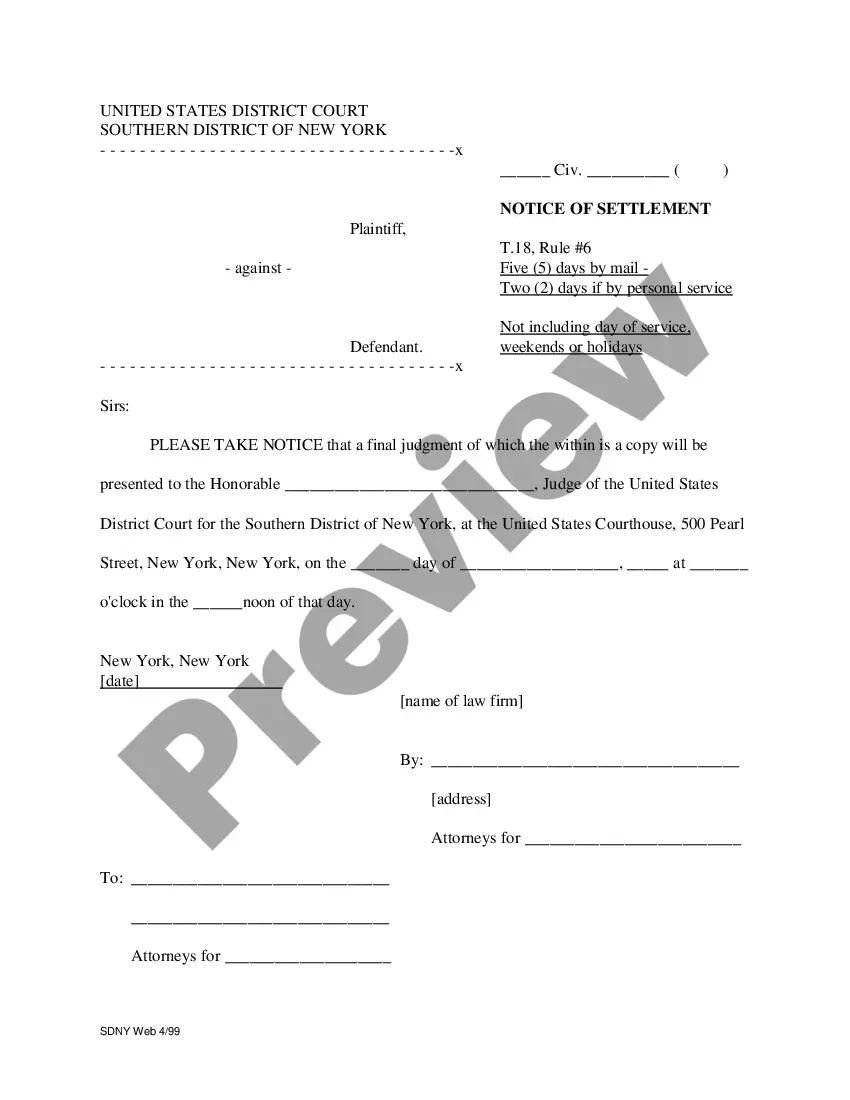

- Step 1. Ensure you have selected the form for the right metropolis/land.

- Step 2. Use the Preview choice to look over the form`s content material. Do not forget to read through the information.

- Step 3. Should you be unsatisfied using the form, utilize the Research field at the top of the display to discover other types of your authorized form design.

- Step 4. When you have found the form you will need, click on the Get now switch. Choose the prices program you favor and add your accreditations to register for the profile.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal profile to perform the transaction.

- Step 6. Select the file format of your authorized form and down load it in your product.

- Step 7. Complete, change and print out or signal the Maine Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

Every authorized file design you buy is the one you have permanently. You have acces to every single form you delivered electronically with your acccount. Go through the My Forms area and choose a form to print out or down load yet again.

Remain competitive and down load, and print out the Maine Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time with US Legal Forms. There are many professional and state-particular varieties you may use for your enterprise or personal requirements.