Maine Personal Financial Information Organizer

Instant download

Description

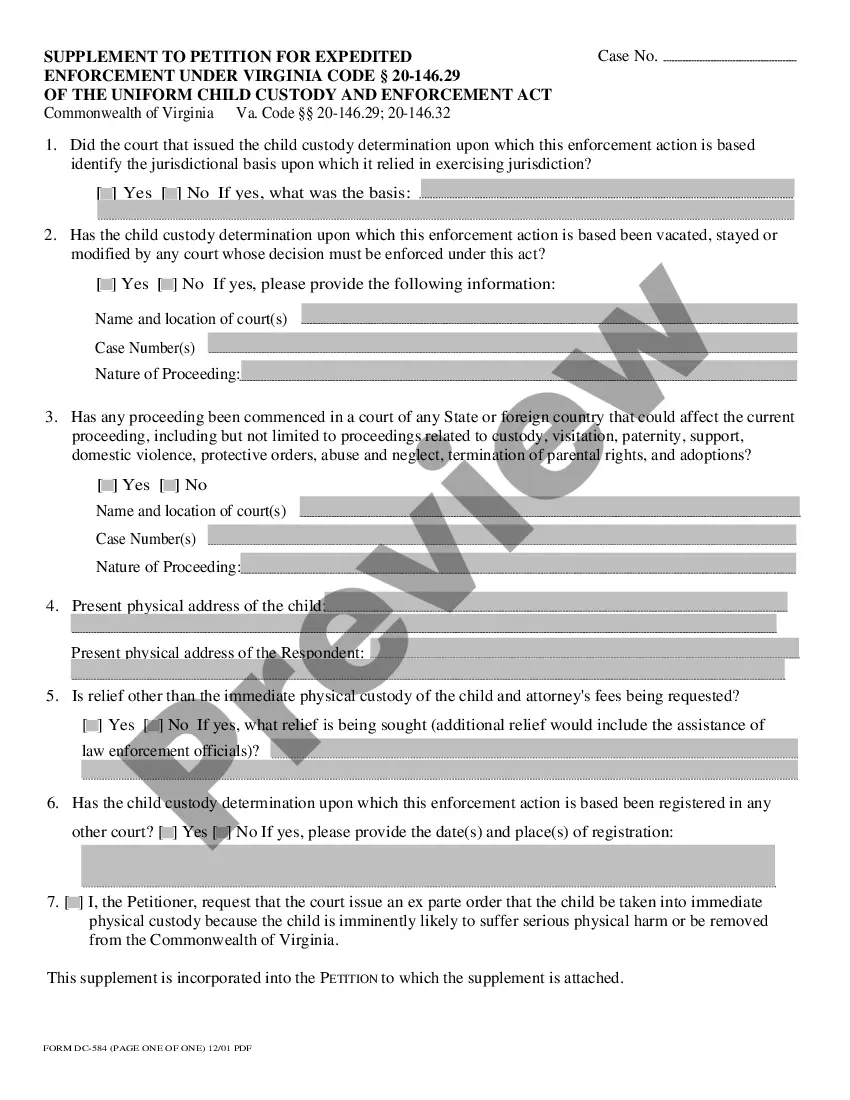

This form contains information regarding Bank Accounts, Investment Retirement Plans, Credit Card and Charge Accounts, Professional Advisors, and Miscellaneous Forms.

Free preview

How to fill out Personal Financial Information Organizer?

You can spend hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are evaluated by experts.

You can download or print the Maine Personal Financial Information Organizer from their service.

If available, utilize the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Maine Personal Financial Information Organizer.

- All legal document templates you obtain are your property indefinitely.

- To get an additional copy of the purchased form, visit the My documents section and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city you prefer.

- Check the form description to confirm you have chosen the right form.