Maine Jury Instruction - 10.10.2 Debt vs. Equity

Description

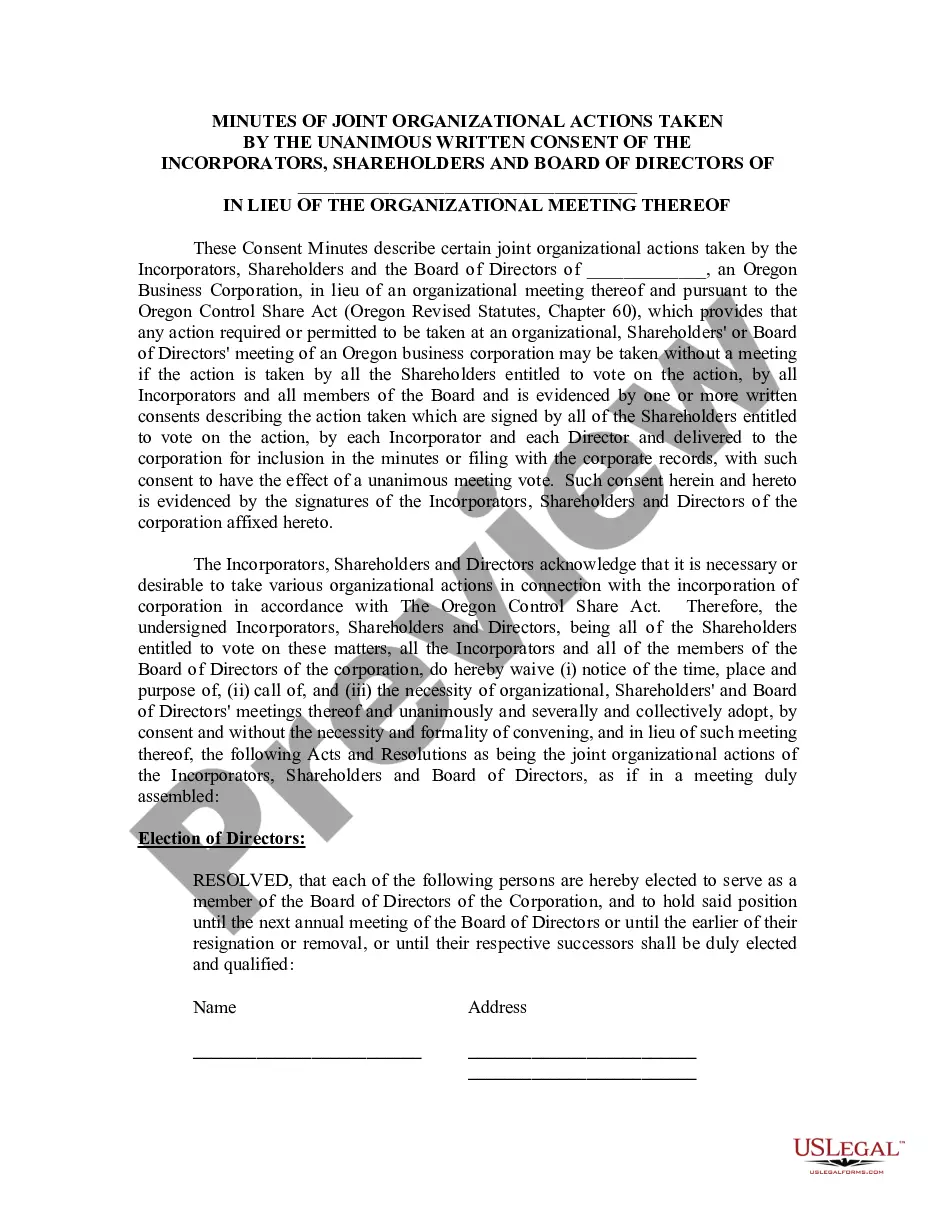

How to fill out Jury Instruction - 10.10.2 Debt Vs. Equity?

Are you presently inside a position that you will need documents for both business or person uses almost every day? There are a lot of legitimate papers layouts available on the net, but finding ones you can trust is not easy. US Legal Forms provides thousands of develop layouts, much like the Maine Jury Instruction - 10.10.2 Debt vs. Equity, which are created to satisfy state and federal requirements.

If you are presently informed about US Legal Forms website and have your account, simply log in. After that, you may acquire the Maine Jury Instruction - 10.10.2 Debt vs. Equity design.

Unless you provide an bank account and would like to start using US Legal Forms, follow these steps:

- Obtain the develop you need and ensure it is for the correct town/county.

- Make use of the Review button to examine the shape.

- See the explanation to actually have selected the appropriate develop.

- If the develop is not what you are trying to find, make use of the Search industry to get the develop that fits your needs and requirements.

- Once you get the correct develop, click on Get now.

- Pick the pricing strategy you desire, fill in the desired information and facts to create your money, and buy the transaction making use of your PayPal or bank card.

- Choose a convenient file structure and acquire your version.

Get all the papers layouts you have purchased in the My Forms food selection. You can aquire a extra version of Maine Jury Instruction - 10.10.2 Debt vs. Equity at any time, if possible. Just click on the required develop to acquire or produce the papers design.

Use US Legal Forms, probably the most substantial assortment of legitimate types, to save lots of some time and steer clear of faults. The service provides professionally created legitimate papers layouts which you can use for a variety of uses. Generate your account on US Legal Forms and commence creating your way of life easier.