Maine Assignment and Assumption of Equipment (Personal Property) Lease Pursuant to Asset Purchase Agreement

Description

How to fill out Assignment And Assumption Of Equipment (Personal Property) Lease Pursuant To Asset Purchase Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal document templates that you can download or create.

By using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms like the Maine Assignment and Assumption of Equipment (Personal Property) Lease Pursuant to Asset Purchase Agreement within moments.

If you already hold a subscription, Log In and retrieve the Maine Assignment and Assumption of Equipment (Personal Property) Lease Pursuant to Asset Purchase Agreement from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

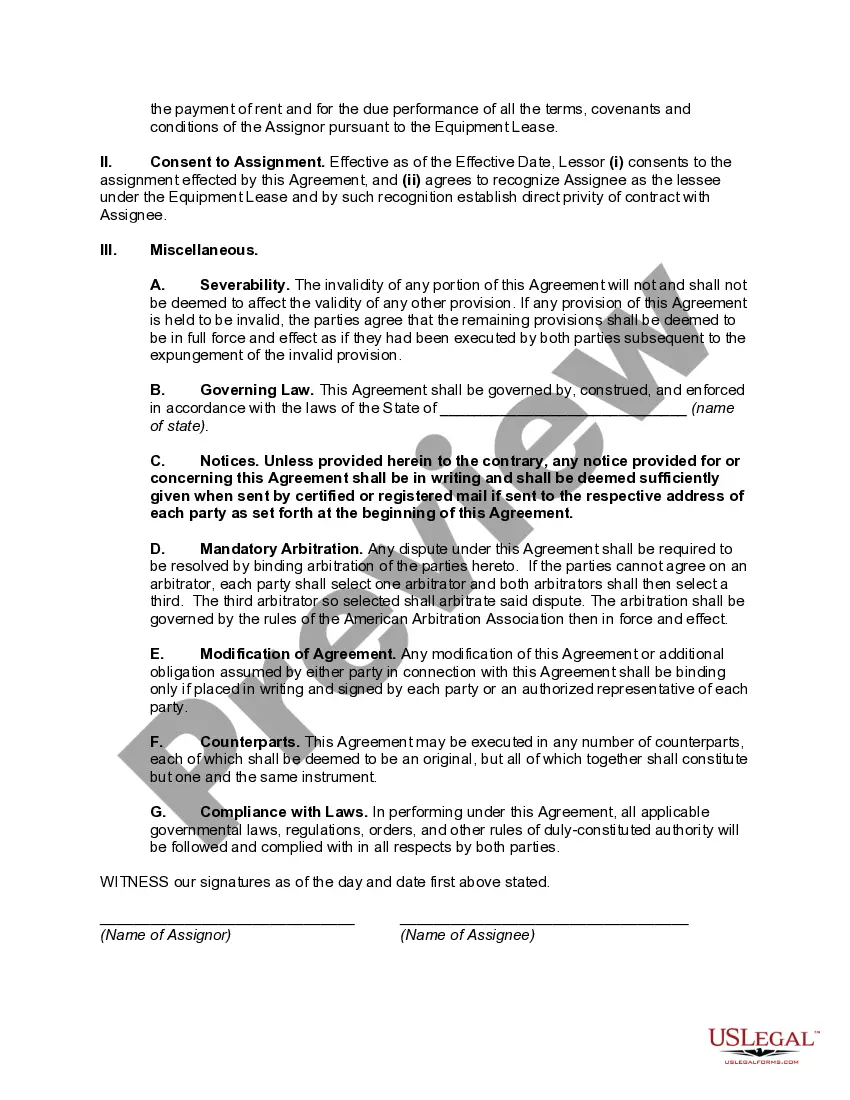

Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the saved Maine Assignment and Assumption of Equipment (Personal Property) Lease Pursuant to Asset Purchase Agreement. Each template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Obtain access to the Maine Assignment and Assumption of Equipment (Personal Property) Lease Pursuant to Asset Purchase Agreement through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you would like to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the right form for your city/state.

- Click the Review button to check the form's content.

- Examine the form description to confirm you have selected the correct form.

- If the form is not suitable for your needs, use the Search field at the top of the screen to find the one that does.

- If you are pleased with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

When a buyer assumes a loan it is with the lender's knowledge and approval. An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process.

Property Rights Assignment Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, etc. to another entity through a written agreement. For example, a payee assigns rights for collecting note payments to a bank.

An assumption agreement, sometimes called an assignment and assumption agreement, is a legal document that allows one party to transfer rights and/or obligations to another party. It allows one party to "assume" the rights and responsibilities of the other party.

An assumption agreement, sometimes called an assignment and assumption agreement, is a legal document that allows one party to transfer rights and/or obligations to another party. It allows one party to "assume" the rights and responsibilities of the other party.

Release of the Debtor. In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

Assumption is like an Assignment except the seller is released from all liability under the terms of the lease. This is rare and it almost never happens. Sublease is where possession is transferred to the buyer (subleasee) with the seller retaining all the same rights as though he/she were the tenant.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability.

An assignment and assumption of lease is a legal real estate document that allows one party to transfer rights and obligations of a lease to another party. Often used in real estate transactions and mortgage lending, the assignment and assumption of lease agreement requires the landlord to consent to move forward.

Every commercial lease contains an assignment provision that lays out the landlord's and the tenant's rights and obligations in the event that the tenant seeks to assign the lease.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement. Do yourself a favor and get the necessary criteria organized in advance.