Maine Cash Disbursements and Receipts refer to the financial transactions involving the distribution and collection of funds in the state of Maine. These processes play a crucial role in the management and tracking of money within various government departments, agencies, and organizations. Cash disbursements in Maine involve the outflow of funds from a designated account to pay for goods, services, or obligations. This includes payment of salaries to government employees, procurement of supplies, settling bills, making grant payments, and executing authorized financial obligations. Cash disbursements ensure that funds are appropriately allocated and spent according to established guidelines, regulations, and budgetary considerations. On the other hand, cash receipts in Maine involve the inflow of funds into designated accounts. These receipts can include tax payments, government fees, fines, licenses, permits, and other sources of revenue for the state. Proper management of cash receipts ensures accurate recording and appropriate allocation of funds, facilitating transparency and accountability in the financial process. Maine also has different types of cash disbursements and receipts, each serving a specific purpose: 1. Personal Services Payments: This type of cash disbursement covers salaries, wages, and benefits paid to government employees, such as state workers, educators, and public servants. 2. Vendor Payments: Cash disbursements under this category involve payments made to external suppliers, contractors, or vendors for goods, services, or facilities provided to government departments or agencies. 3. Grant Payments: Maine's cash disbursements also include payments made to recipients who have been awarded grants from state or federal programs. These grants could support various initiatives, such as education, healthcare, infrastructure development, or research projects. 4. Debt Service Payments: Cash disbursements in this group refer to payments made towards servicing the state's debts, including principal and interest payments on loans or bonds issued by the government. Regarding cash receipts, some significant types include: 1. Tax Payments: Maine collects various taxes, such as income tax, sales tax, property tax, and corporate tax, which contribute to the cash receipts of the state. 2. Government Fees and Fines: Cash receipts also include the fees and fines levied by government agencies for services rendered or penalties imposed for violations of regulations. 3. Licenses and Permits: Maine generates cash receipts from licenses and permits issued to businesses, individuals, or organizations for operating specific activities, such as professional licenses, fishing licenses, or construction permits. 4. Federal Aids and Grants: Cash receipts can also comprise federal aids and grants received by Maine, which can support various public programs, infrastructure projects, or social welfare initiatives. In summary, Maine Cash Disbursements and Receipts encompass the financial transactions associated with the distribution and collection of funds within the state. Proper management of cash disbursements and receipts ensures accountability, transparency, and efficient use of funds to serve the needs of the state and its residents.

Maine Cash Disbursements and Receipts

Description

How to fill out Maine Cash Disbursements And Receipts?

It is possible to devote hrs on the Internet looking for the legal document web template that suits the state and federal specifications you need. US Legal Forms supplies a large number of legal types that happen to be analyzed by experts. It is possible to download or print out the Maine Cash Disbursements and Receipts from my service.

If you already have a US Legal Forms bank account, you are able to log in and then click the Down load option. After that, you are able to comprehensive, change, print out, or indication the Maine Cash Disbursements and Receipts. Each legal document web template you purchase is yours permanently. To acquire one more duplicate of any purchased form, visit the My Forms tab and then click the related option.

Should you use the US Legal Forms internet site for the first time, adhere to the straightforward recommendations under:

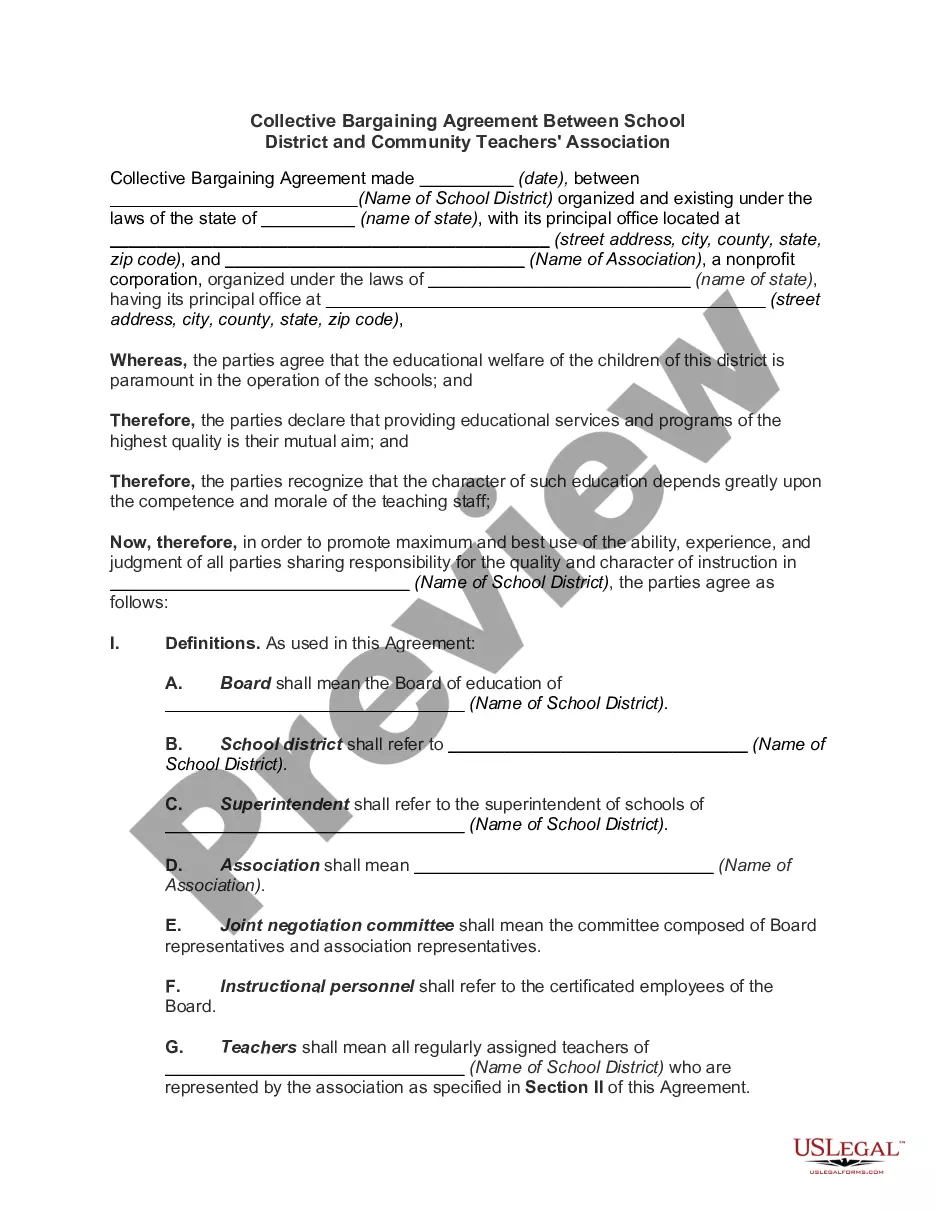

- Initially, make sure that you have selected the right document web template for that region/metropolis of your choice. See the form outline to ensure you have picked the correct form. If readily available, utilize the Review option to check throughout the document web template too.

- If you would like discover one more version in the form, utilize the Look for area to get the web template that meets your needs and specifications.

- Upon having identified the web template you want, just click Buy now to carry on.

- Select the pricing prepare you want, type in your qualifications, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal bank account to pay for the legal form.

- Select the format in the document and download it to your product.

- Make alterations to your document if possible. It is possible to comprehensive, change and indication and print out Maine Cash Disbursements and Receipts.

Down load and print out a large number of document web templates while using US Legal Forms website, which offers the biggest variety of legal types. Use skilled and status-particular web templates to deal with your company or person requirements.