Maine Software Sales Agreement

Description

How to fill out Software Sales Agreement?

You can spend hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast collection of legal forms that are reviewed by professionals.

You can easily acquire or generate the Maine Software Sales Agreement from the service.

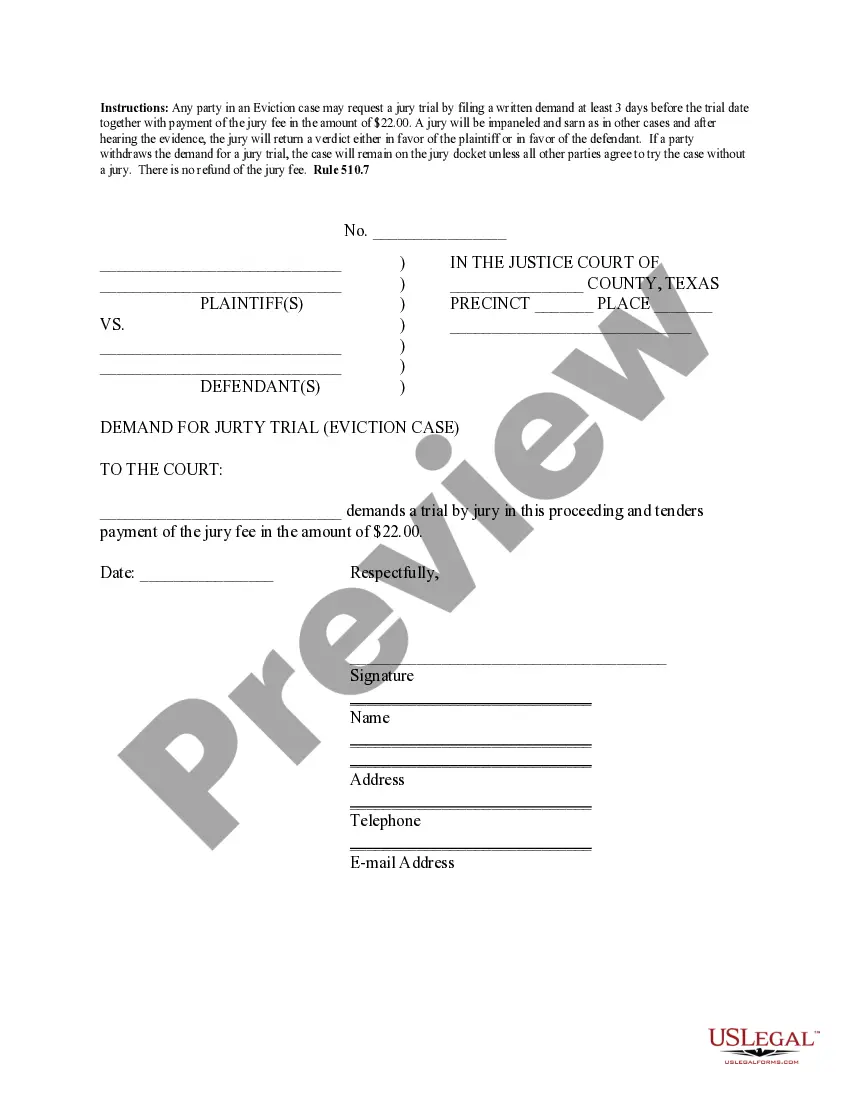

If available, utilize the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- After that, you may complete, modify, print, or sign the Maine Software Sales Agreement.

- Each legal document template you buy is yours indefinitely.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form information to ensure you have chosen the appropriate type.

Form popularity

FAQ

A Maine resident or business does not escape sales tax by purchasing out-of-state. Another situation where use tax applies is when a business withdraws goods from inventory for its own use. Use tax, in this case, is due at the time of withdrawal. In either situation, use tax is based on the purchase price of the item.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Collecting Sales Tax The state sales tax rate is 5.5% and Maine doesn't have local sales tax rates.

The following services are subject to the Service Provider Tax in MaineAncillary Services.Rental of Video Media and Video Equipment.Rental of Furniture, Audio Media and Equipment pursuant to a Rental-Purchase Agreement.Telecommunications Services.Installation, Maintenance or Repair of Telecommunications Equipment.More items...

In the state of Maine, legally sales tax is required to be collected from tangible, physical products being sold to a consumer. Several examples of exceptions to this tax are most grocery products, certain types of prescription medication, some medical equipment, and certain items associated with commerce.

Goods that are subject to sales tax in Maine include physical property, like furniture, home appliances, and motor vehicles. Groceries, Prescription medicine, and gasoline are all tax-exempt.

Maine likely does not require sales tax on Software-as-a-Service. Why does Maine not require sales tax on Software-as-a-Service (SaaS)?

Sales of canned software - downloaded are subject to sales tax in Maine. Sales of custom software - delivered on tangible media are exempt from the sales tax in Maine. Sales of custom software - downloaded are exempt from the sales tax in Maine.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax.