Maine Grantor Retained Annuity Trust

Description

How to fill out Grantor Retained Annuity Trust?

US Legal Forms - one of the most prominent collections of legal templates in the United States - provides an extensive selection of legal document formats that you can download or print.

By utilizing the website, you can access numerous templates for professional and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of templates like the Maine Grantor Retained Annuity Trust within moments.

If you already hold a subscription, Log In and download the Maine Grantor Retained Annuity Trust from the US Legal Forms repository. The Download button will appear on every template you view. You have access to all previously downloaded templates within the My documents section of your account.

Process the transaction. Use your Visa or MasterCard or PayPal account to finalize the transaction.

Select the format and download the template to your device. Make modifications. Fill out, amend, print, and sign the downloaded Maine Grantor Retained Annuity Trust. Every template you add to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the template you need. Access the Maine Grantor Retained Annuity Trust with US Legal Forms, one of the most extensive libraries of legal document formats. Utilize a plethora of professional and state-specific templates that cater to your business or personal needs.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you get started.

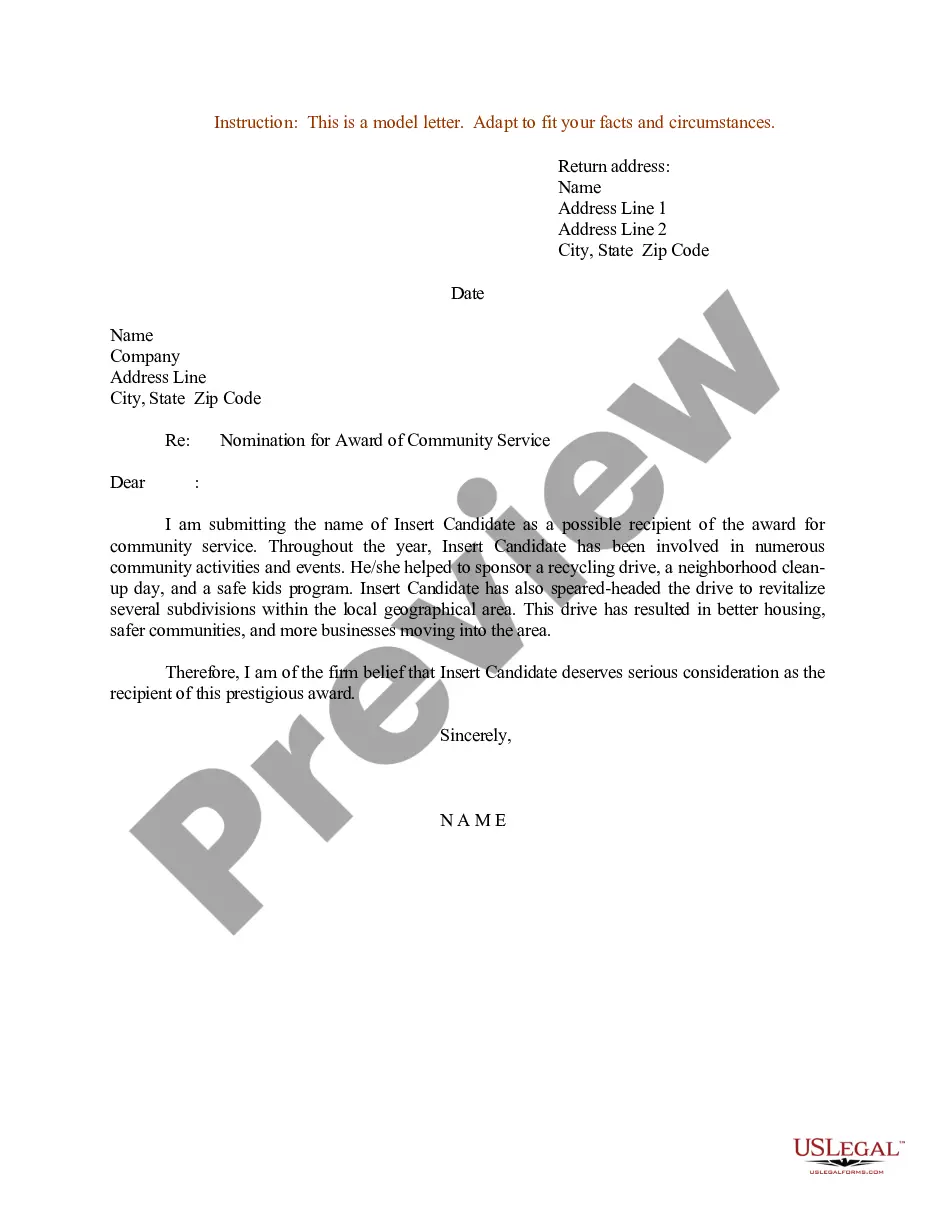

- Ensure you have chosen the correct template for your city/state. Select the Preview button to review the form's content.

- Check the form description to confirm that you have selected the appropriate template.

- If the template does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the template, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you desire and provide your credentials to register for an account.

Form popularity

FAQ

Grantor Retained Income Trust, Definition A grantor retained income trust allows the person who creates the trust to transfer assets to it while still being able to receive net income from trust assets. The grantor maintains this right for a fixed number of years.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

With respect to income taxes, the grantor is treated as the owner of the assets during the GRAT term and reports all income earned by the GRAT on his individual income tax return. To avoid having to file its own fiduciary income tax return, the GRAT should not apply for a separate taxpayer identification number.

GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

A GRAT is an irrevocable trust that allows the trust's creator known as the grantor to direct certain assets into a temporary trust and freeze its value, removing additional appreciation from the grantor's estate and giving it to heirs with minimal estate or gift tax liability.

A GRAT may be an ideal vehicle for the transfer of significant appreciation on an asset. Assume the client owns an interest in a business that may go public in the near future. If the client transfers the business interest to a short-term zeroed-out GRAT, most of the appreciation will be transferred tax free.

In other words, during the initial term of the GRAT (the term that the Grantor is to receive the annuity payments) the Grantor will be taxed on all of the income earned by the GRAT during each such year, including capital gains.