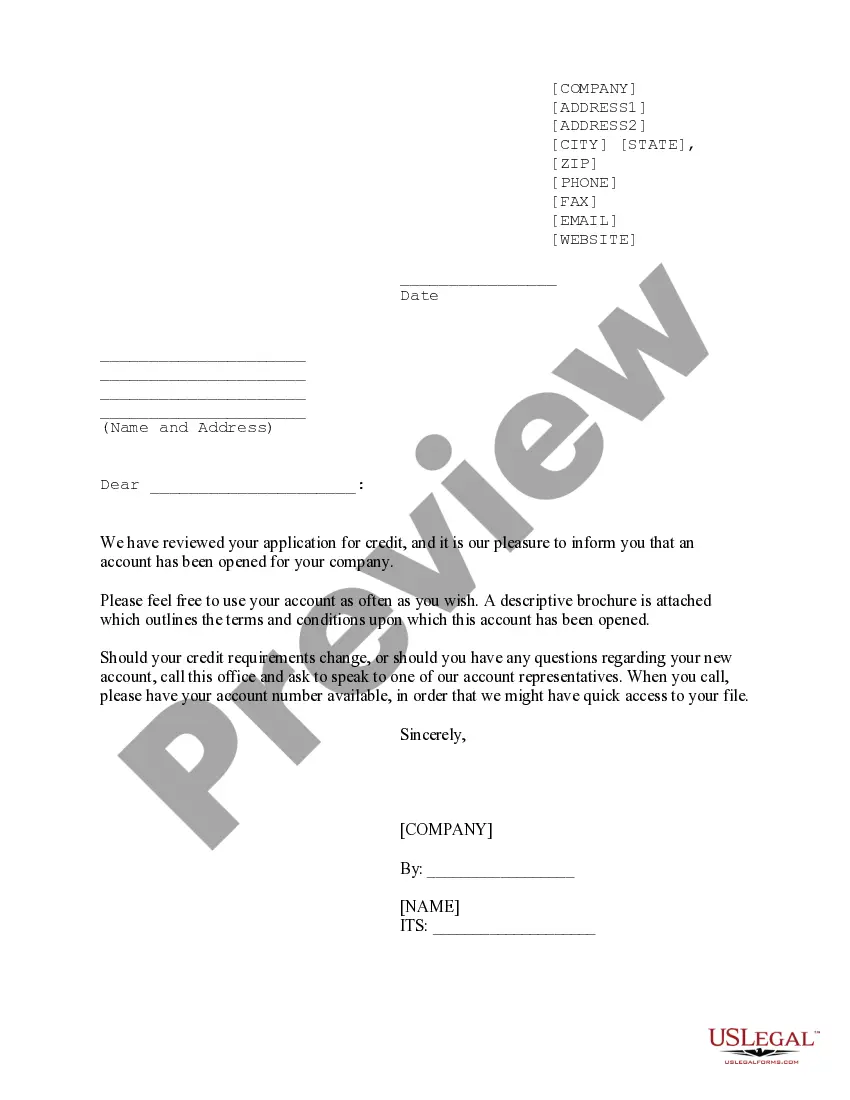

Maine Credit Approval Form

Description

How to fill out Credit Approval Form?

It is feasible to dedicate time online looking for the sanctioned document template that satisfies the state and federal requirements you need.

US Legal Forms provides thousands of sanctioned forms that are reviewed by professionals.

You can effortlessly obtain or print the Maine Credit Approval Form from my support.

Additionally, use the Preview option, if available, to peruse the document template.

- If you possess a US Legal Forms account already, you can Log In and select the Obtain option.

- Then, you can complete, modify, print, or sign the Maine Credit Approval Form.

- Each governmental document template you acquire is yours permanently.

- To get another copy of any purchased form, visit the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/region of your choice.

- Review the form outline to confirm you have picked the right form.

Form popularity

FAQ

Maine does provide e-file options for various tax forms. You can complete these forms online and submit them electronically, which makes filing simpler. Check the Maine Revenue Services website for the latest e-file forms. The Maine Credit Approval Form may also be available for e-filing, aiding your tax submission.

Many tax forms in Maine can be e-filed, including individual income tax forms. It's convenient and can simplify the filing process. Ensure that you check the specific eligibility of each form on the Maine Revenue Services website. The Maine Credit Approval Form may also be available for e-filing, making tax submission quicker.