Maine Checklist for Corporate Minutes: A Comprehensive Guide for Businesses Introduction: In Maine, corporate minutes serve as vital documentation for businesses to record official meetings and decisions made by the company's board of directors and shareholders. To ensure compliance with state regulations and maintain proper corporate governance, it is essential to adhere to a checklist when preparing corporate minutes in Maine. This article aims to outline a detailed description of what comprises a Maine Checklist for Corporate Minutes, incorporating relevant keywords for easy reference. Maine Checklist for Corporate Minutes: 1. Date and Time: Include the accurate date and time of the meeting at the beginning of the minute, ensuring all attendees are aware of the proceedings. 2. Attendees: List the names and positions of all individuals present at the meeting, including board members, officers, shareholders, legal advisors, and any other relevant personnel involved. 3. Quorum Verification: Confirm the presence of a quorum, which is the minimum number of members required to conduct official business. It's crucial to state the number of attendees and whether a quorum was present. 4. Approval of Previous Meeting Minutes: Record any amendments, corrections, or approval of the minutes from the previous meeting. This is an essential step to ensure accurate and up-to-date documentation. 5. Reports and Presentations: Detail reports, presentations, or discussions conducted during the meeting. This might include financial reports, project updates, market analysis, legal matters, or other significant topics discussed. 6. Resolutions and Decisions: Document any resolutions, decisions, or actions taken by the board of directors and shareholders during the meeting. These may include approvals for contracts, mergers, acquisitions, capital investments, officer appointments, dividends, or any other corporate-related decisions. 7. Voting Results: Outline the outcomes of any voting held during the meeting, specifying the proposal, the voters' names, their positions, and whether the vote passed, failed, or abstained. 8. Announcement of Adjournment: Clearly state the conclusion of the meeting, along with the date and time of adjournment. Additional Types of Maine Checklist for Corporate Minutes: 1. Annual Shareholders Meeting Minutes Checklist: Specifically designed for documenting a company's annual shareholders meeting, this checklist focuses on summarizing discussions related to company performance, financial reports, officer elections, audit reports, and any other important issues specific to the annual meeting. 2. Special Meeting Minutes Checklist: Used for any special meetings called by the board of directors to address urgent matters that cannot wait until the next regular meeting. This checklist emphasizes the specific topic at hand and the corresponding resolutions or decisions made. 3. Board of Directors Meeting Minutes Checklist: Tailored specifically for recording board of directors' meetings, this checklist outlines discussions related to strategy, corporate governance, regulatory compliance, executive appointments, company policies, and long-term planning. Conclusion: Adhering to the Maine Checklist for Corporate Minutes is crucial for businesses operating in the state. By following these guidelines, companies can ensure compliance, maintain proper documentation, and foster good corporate governance practices. Whether it is the general checklist for corporate minutes, the annual shareholders meeting checklist, the special meeting checklist, or the board of directors meeting checklist, accurate minute-taking is essential for legal compliance and facilitating transparent decision-making processes within organizations in Maine.

Maine Checklist for Corporate Minutes

Description

How to fill out Maine Checklist For Corporate Minutes?

Are you currently in the situation in which you will need paperwork for sometimes enterprise or individual functions nearly every day time? There are plenty of lawful record web templates available on the net, but getting ones you can rely is not straightforward. US Legal Forms gives a huge number of develop web templates, much like the Maine Checklist for Corporate Minutes, which can be created in order to meet federal and state demands.

If you are previously knowledgeable about US Legal Forms internet site and have an account, just log in. Afterward, you are able to down load the Maine Checklist for Corporate Minutes design.

If you do not have an accounts and would like to begin using US Legal Forms, adopt these measures:

- Discover the develop you will need and ensure it is for the appropriate city/county.

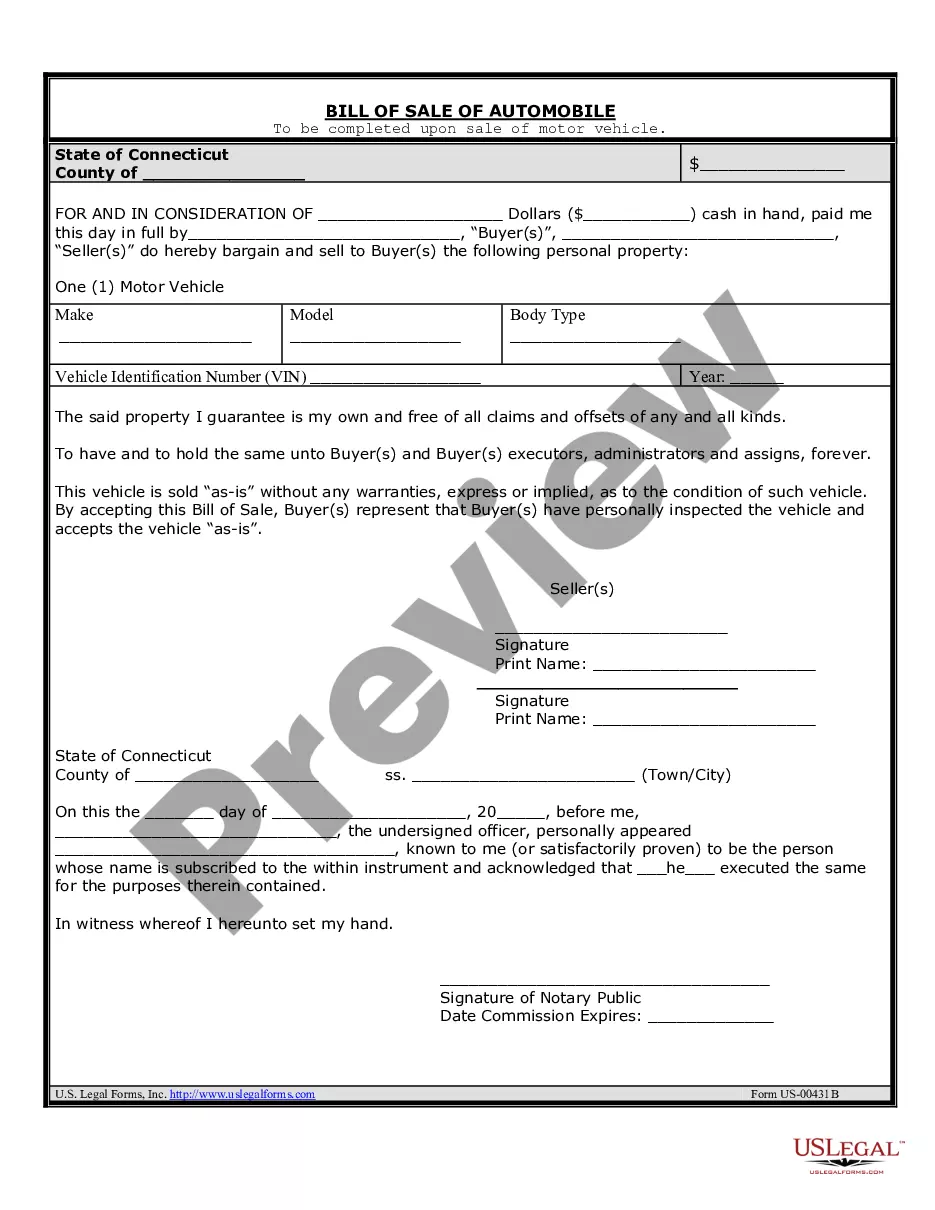

- Make use of the Review option to review the shape.

- See the description to actually have chosen the appropriate develop.

- In the event the develop is not what you are seeking, take advantage of the Look for industry to obtain the develop that meets your needs and demands.

- When you find the appropriate develop, simply click Get now.

- Pick the costs strategy you desire, submit the required information and facts to make your bank account, and pay for the transaction making use of your PayPal or credit card.

- Decide on a hassle-free data file formatting and down load your copy.

Find every one of the record web templates you might have purchased in the My Forms food selection. You can get a additional copy of Maine Checklist for Corporate Minutes whenever, if possible. Just select the required develop to down load or produce the record design.

Use US Legal Forms, probably the most substantial variety of lawful types, to save time and steer clear of mistakes. The assistance gives skillfully made lawful record web templates which can be used for a range of functions. Make an account on US Legal Forms and begin making your way of life easier.