Maine Assignment of Profits of Business

Description

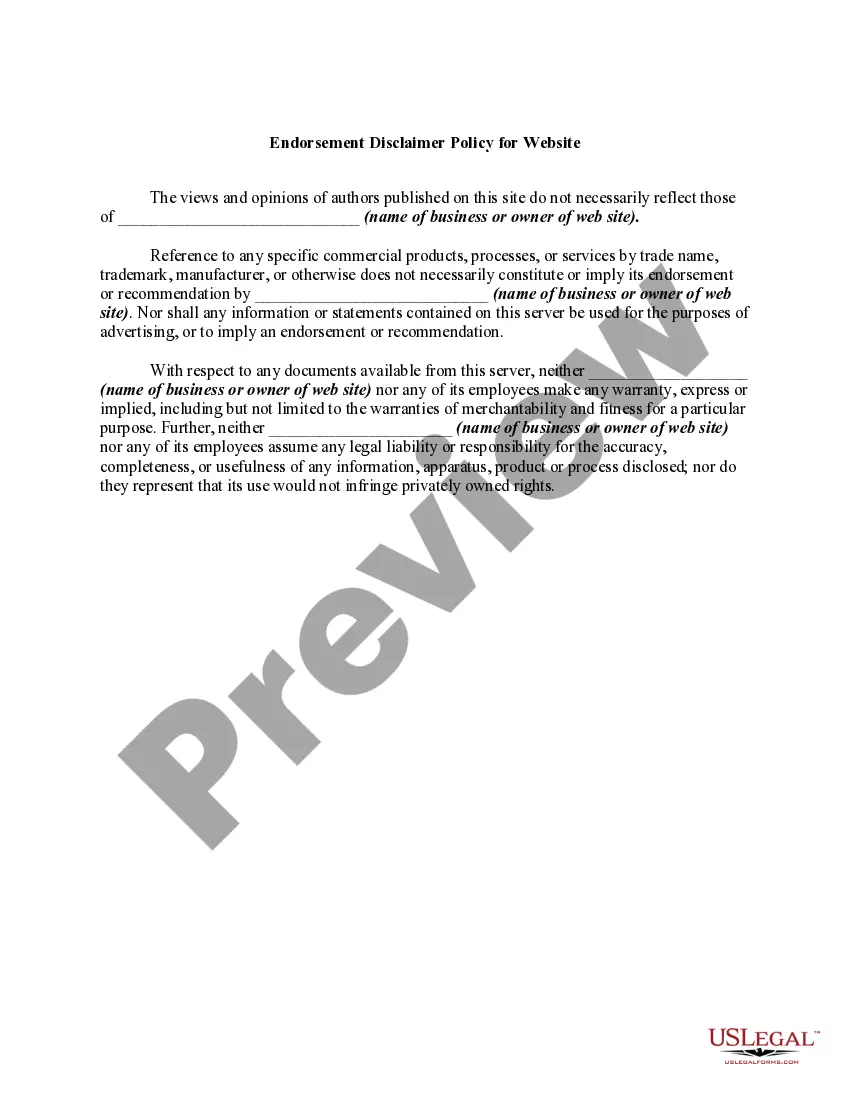

How to fill out Assignment Of Profits Of Business?

If you need to finish, obtain, or produce sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Multiple templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Maine Assignment of Profits of Business with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Acquire button to find the Maine Assignment of Profits of Business.

- You can also access forms you previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/country.

- Step 2. Utilize the Review option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Limited Liability Companies (LLCs) Like S corporations, standard LLCs are pass-through entities and are not required to pay income tax to either the federal government or the State of Maine.

The full company tax rate is 30% and the lower company tax rate is 27.5%. From the 20172018 income year, your business is eligible for the lower rate if it's a base rate entity.

Under the new law, a corporation has nexus with Maine if the corporation is organized or commercially domiciled in Maine or if, in Maine, any of the following thresholds are exceeded: $250,000 of property, $250,000 in payroll, $500,000 in sales in Maine, or 25% of the corporation's total property, payroll, or sales is

At Summer Budget 2015, the government announced legislation setting the Corporation Tax main rate (for all profits except ring fence profits) at 19% for the years starting 1 April 2017, 2018 and 2019 and at 18% for the year starting 1 April 2020.

Tax on corporate profits is defined as taxes levied on the net profits (gross income minus allowable tax reliefs) of enterprises. It also covers taxes levied on the capital gains of enterprises.

One of the biggest tax advantages of a limited liability company is the ability to avoid double taxation. The Internal Revenue Service (IRS) considers LLCs as pass-through entities. Unlike C-Corporations, LLC owners don't have to pay corporate federal income taxes.

If your LLC is taxed as a sole proprietorship: You pay an annual LLC fee, which depends on your LLC's gross income. You pay California income tax on your net LLC income (rates range from 1% to 13.3%).

Income taxes are based on the gross profit that your business earns after subtracting operating expenses from gross revenue. You must pay federal income tax on the profit that your business earns by April 15 of the year following the year in which you earned the income.

The corporation must file a corporate tax return, IRS Form 1120, and pay taxes at a corporate income tax rate on any profits. If a corporation will owe taxes, it must estimate the amount of tax due for the year and make quarterly payments to the IRS by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.