Maine Daily Accounts Receivable

Description

How to fill out Daily Accounts Receivable?

If you wish to completely, obtain, or create legitimate document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Leverage the website's straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

- Use US Legal Forms to locate the Maine Daily Accounts Receivable in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Maine Daily Accounts Receivable.

- You can also find forms you have previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

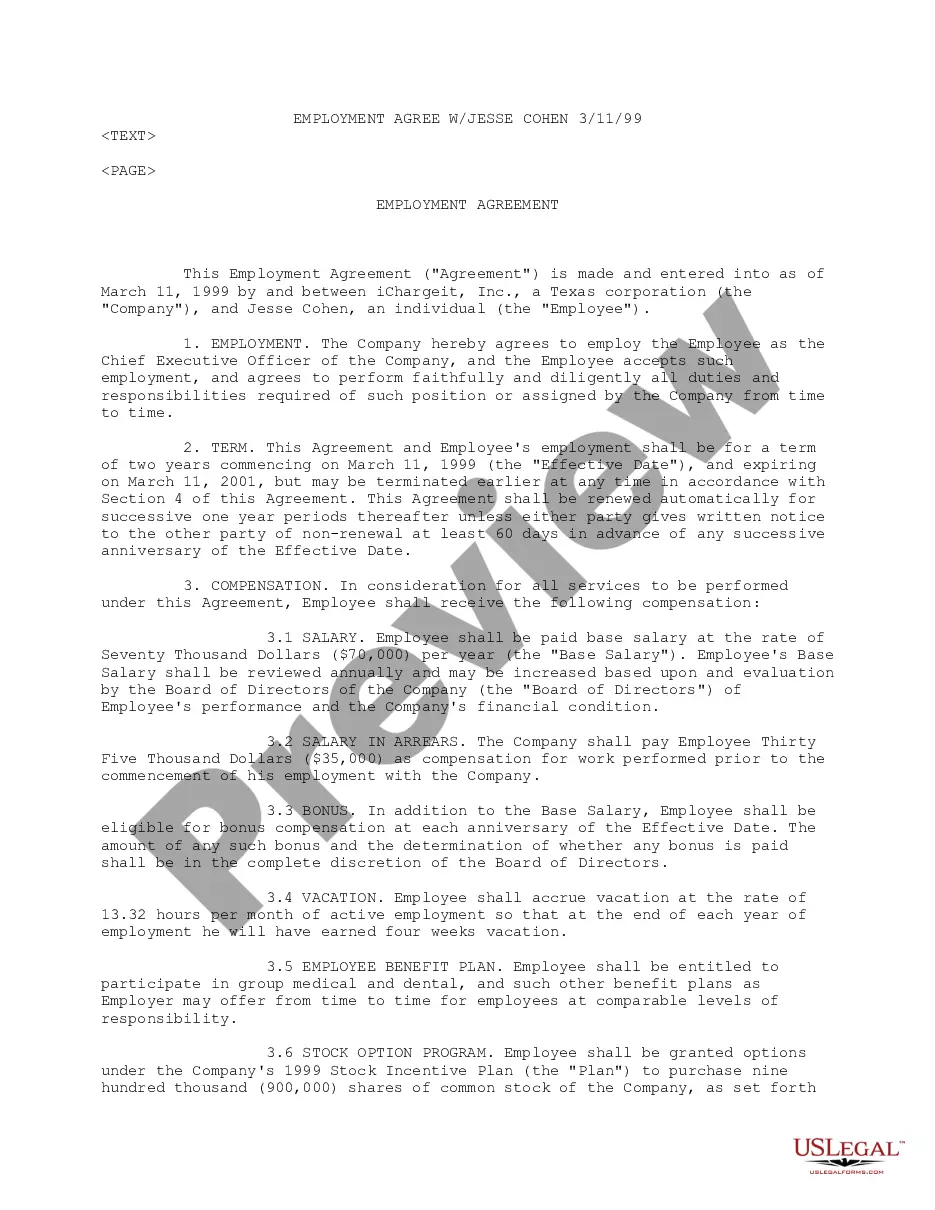

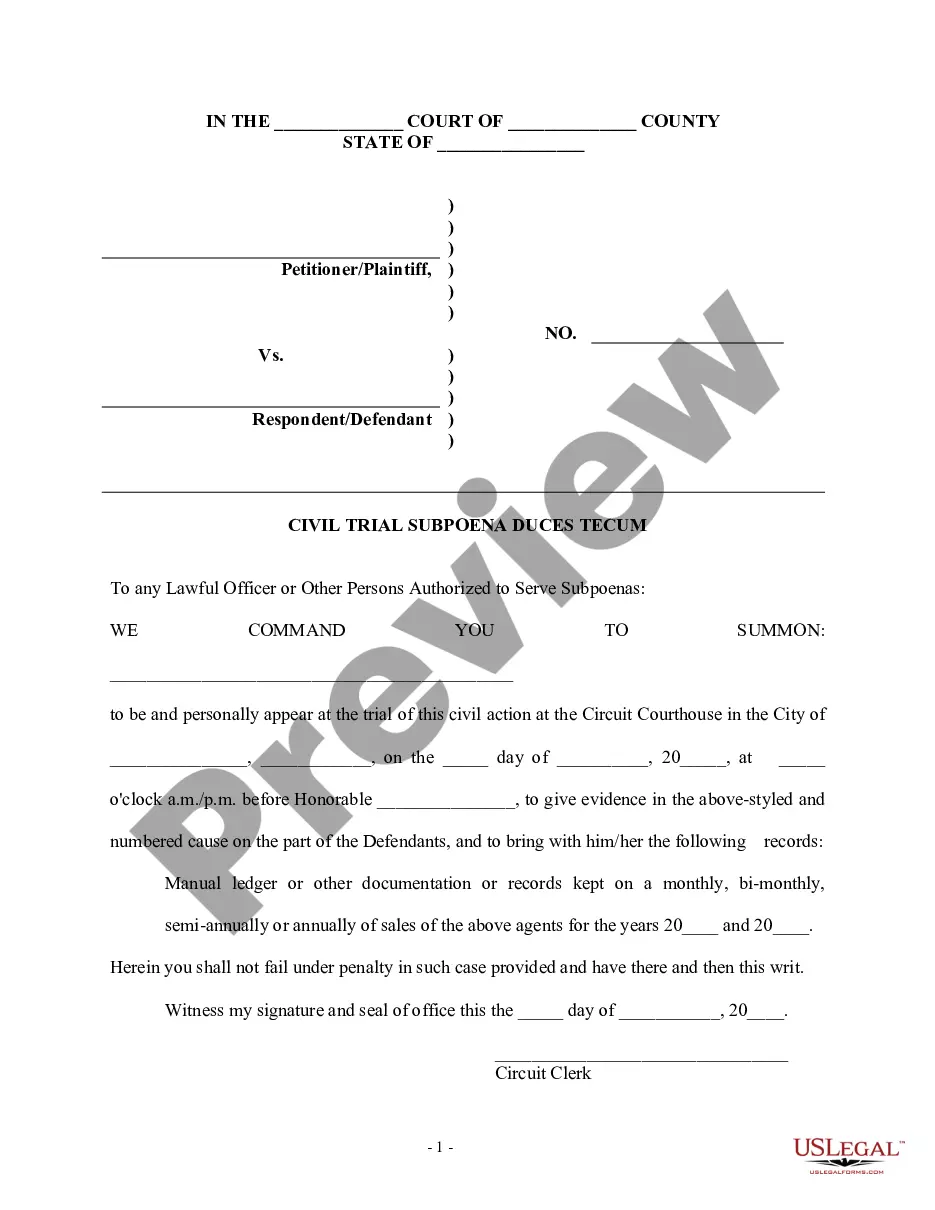

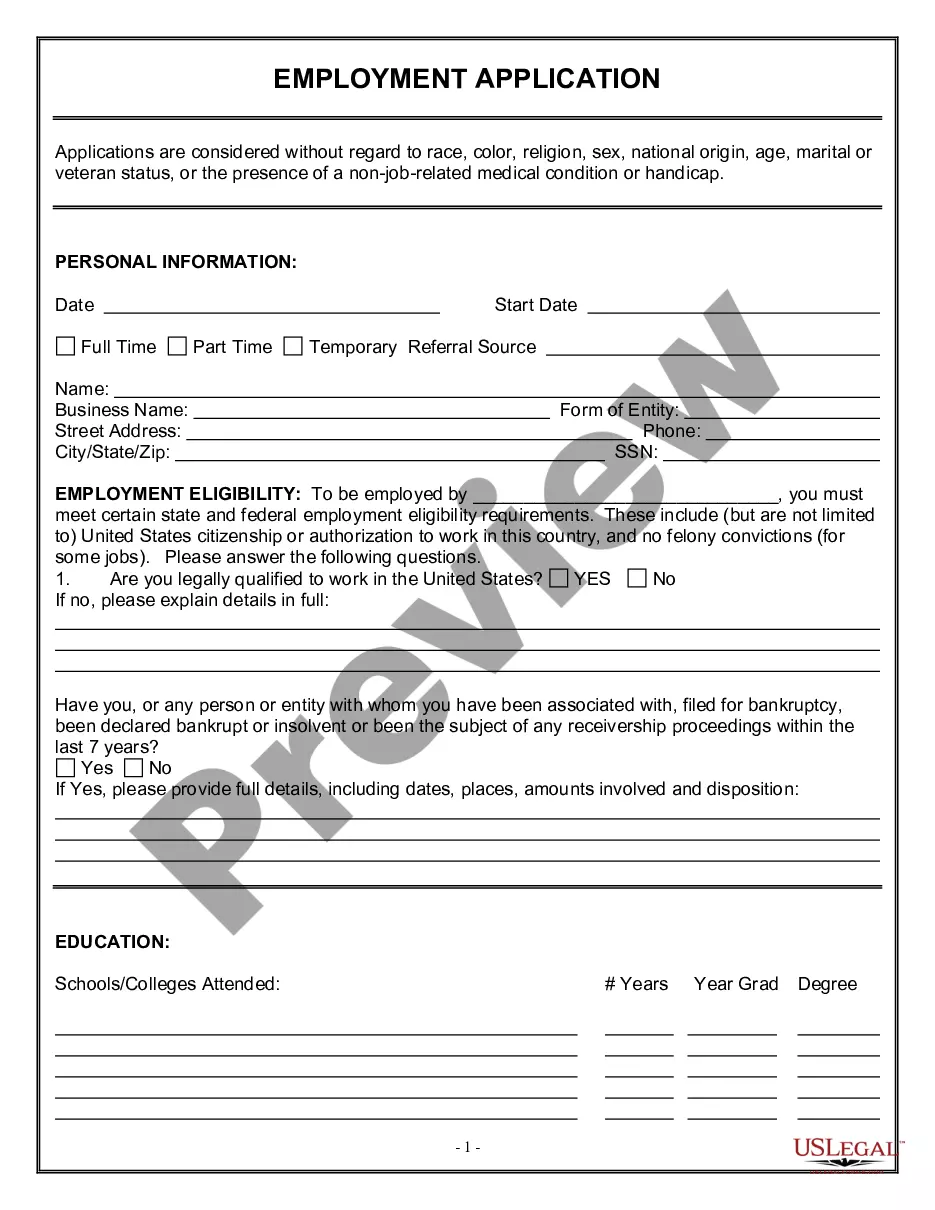

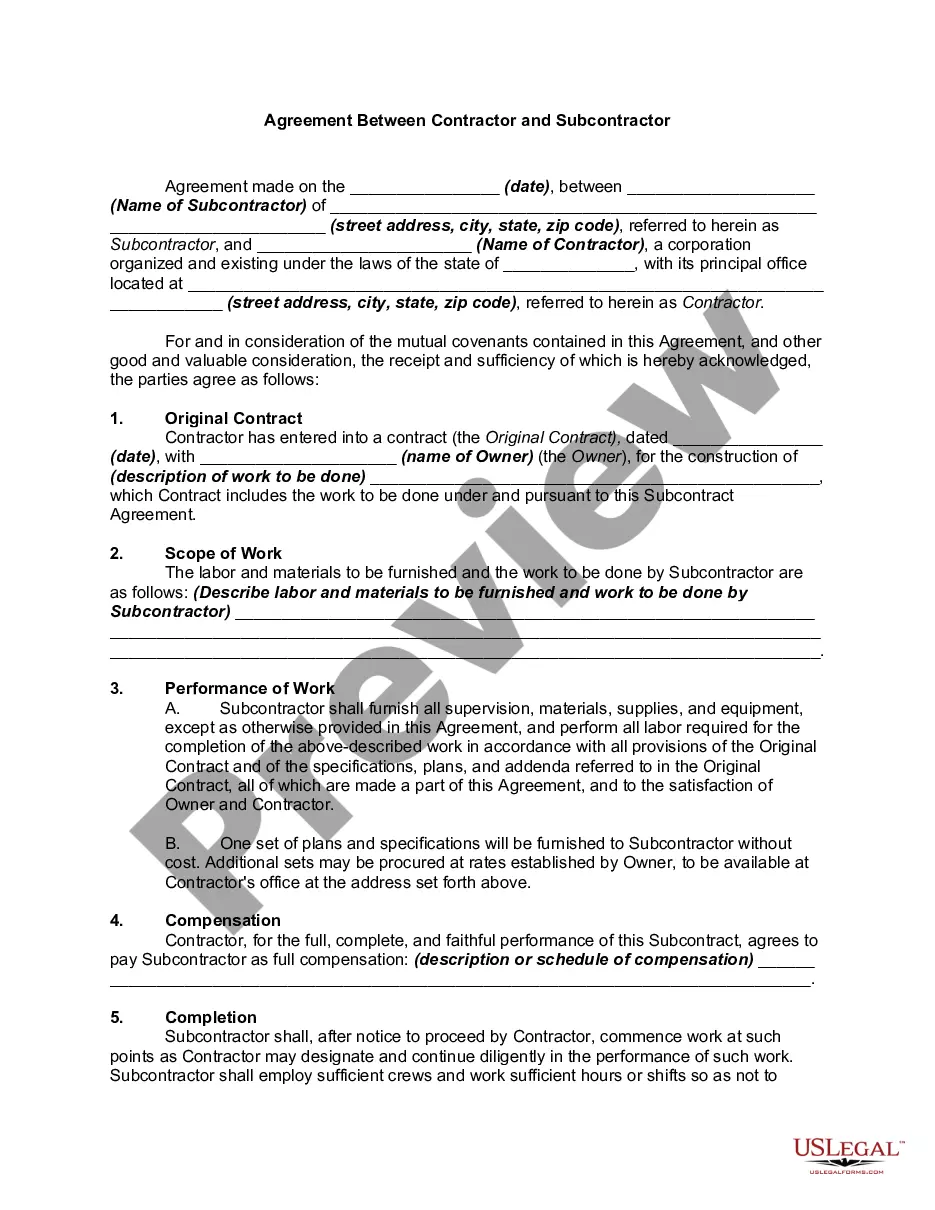

- Step 1. Ensure you have selected the form for your respective state/area.

- Step 2. Use the Preview feature to review the content of the form. Be sure to read the description.

Form popularity

FAQ

To compute DSO, divide the average accounts receivable during a given period by the total value of credit sales during the same period and multiply the result by the number of days in the period being measured.

The formula for Accounts Receivable Days is: Accounts Receivable Days = (Accounts Receivable / Revenue) x Number of Days In Year.

The formula for Accounts Receivable Days is: Accounts Receivable Days = (Accounts Receivable / Revenue) x Number of Days In Year.

To calculate days in AR,Compute the average daily charges for the past several months add up the charges posted for the last six months and divide by the total number of days in those months.Divide the total accounts receivable by the average daily charges. The result is the Days in Accounts Receivable.21-Feb-2022

Accounts receivable days is the number of days that a customer invoice is outstanding before it is collected.

The schedule of accounts receivable is a report that lists all amounts owed by customers. The report lists each outstanding invoice as of the report date, aggregated by customer.

It is an uncomfortable and, often times, frustrating task. Everyone's personalities are different, but some are better suited to credit management teams than others. If you tend to be a hot head, that may be a bad habit to have when you're collecting unpaid invoices often.

Accounts receivable are found on a firm's balance sheet, and since they represent funds owed to the company they are booked as an asset.

To calculate the collection period ratio, divide your average outstanding receivables by annual credit sales. Then multiply the resulting decimal by 365 (the number of days in a year). This gives you the average number of days customers take to pay their accounts.

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.10-May-2021