Maine Purchase Invoice

Description

How to fill out Purchase Invoice?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Maine Purchase Invoice in just seconds.

If you already have a subscription, Log In and download the Maine Purchase Invoice from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, modify, and print the downloaded Maine Purchase Invoice. Each template you add to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Maine Purchase Invoice with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure that you've selected the correct form for your city/county.

- Click the Preview button to review the form's content.

- Review the description of the form to ensure you've chosen the right one.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, select your desired payment plan and provide your credentials to register for an account.

Form popularity

FAQ

To be considered a resident of Maine, you usually need to establish a permanent home and live there for at least six months. This residency period is crucial for tax purposes and benefits eligibility. Knowing the requirements can help you manage your obligations better, particularly when dealing with considerations like the Maine Purchase Invoice. Be sure to gather the necessary documents to confirm your residency status.

The 183 day rule works by tracking the number of days you physically spend in Maine within a calendar year. If you exceed the 183-day threshold, Maine might classify you as a resident, impacting your taxes. This can affect your financial transactions, including the management of your Maine Purchase Invoice. Accurate record-keeping of your time spent in and out of the state will help you stay compliant.

In Maine, property taxes can be waived for residents who reach the age of 65, but there are specific conditions. To qualify, you must meet income and residency requirements, and you often need to apply for this exemption. It is beneficial to be aware of how this impacts your financial planning, especially in relation to documents such as a Maine Purchase Invoice. Consider contacting your local assessor to understand your options.

In Maine, you can typically live for up to six months without changing your residency. After this period, your tax obligations may shift, especially if you maintain a home or job in another state. To avoid complications, it is important to understand how your living situation relates to your Maine Purchase Invoice and other financial matters. Make sure to check local regulations as they can vary.

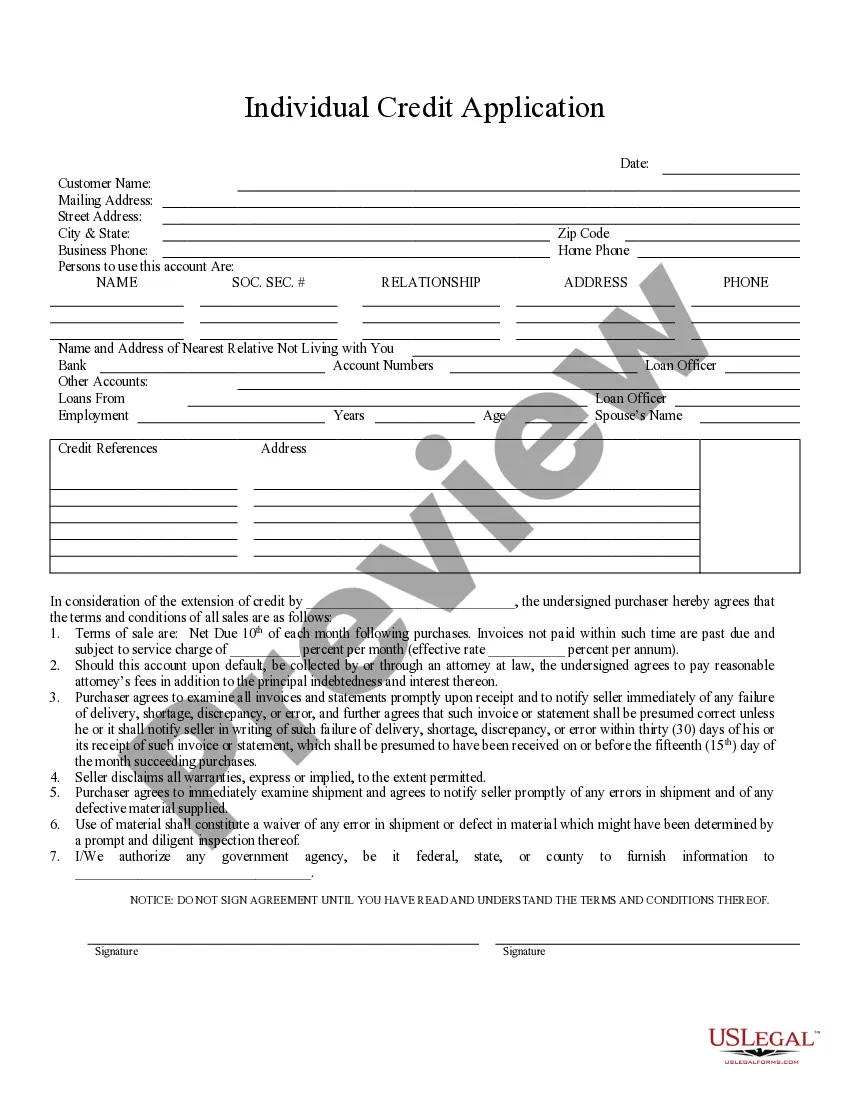

To fill out a purchase order, start by noting your company’s name and the vendor’s information. Include the date, a unique purchase order number, and a line-by-line listing of items with quantities and prices. By using resources like USLegalForms, you can conveniently generate a professional Maine Purchase Invoice that keeps your transactions organised.

Filling out a purchase order involves adding relevant details such as the buyer's name, purchase order number, delivery address, and payment terms. Make sure to specify each item needed, along with their quantities and prices. This structured approach helps create a clear Maine Purchase Invoice that minimizes confusion between parties.

When writing a purchase order, begin with a clear title such as 'Purchase Order for Office Supplies'. List the items like pens and notebooks, specifying the quantities and unit prices. By including these details, your Maine Purchase Invoice will be clear and easy to understand for the seller as well.

To create a purchase order, start by identifying the items you need and the quantities required. Next, gather vendor information and include it on the order. Using platforms like USLegalForms can simplify this process by providing templates for a Maine Purchase Invoice that meet your business needs.

A purchase order is a document that a buyer sends to a seller to confirm a purchase. For instance, if a business in Maine needs to buy office supplies, it can issue a purchase order detailing the items, quantities, and agreed prices. The Maine Purchase Invoice generated from this order can serve as proof of the transaction.

While an invoice is not required to create a purchase order, it becomes essential post-transaction. The invoice serves as a confirmation of the goods or services rendered, allowing for accurate record-keeping. Managing your Maine Purchase Invoice properly ensures a smoother financial audit and accountability.