Maine Job Sharing Policy

Description

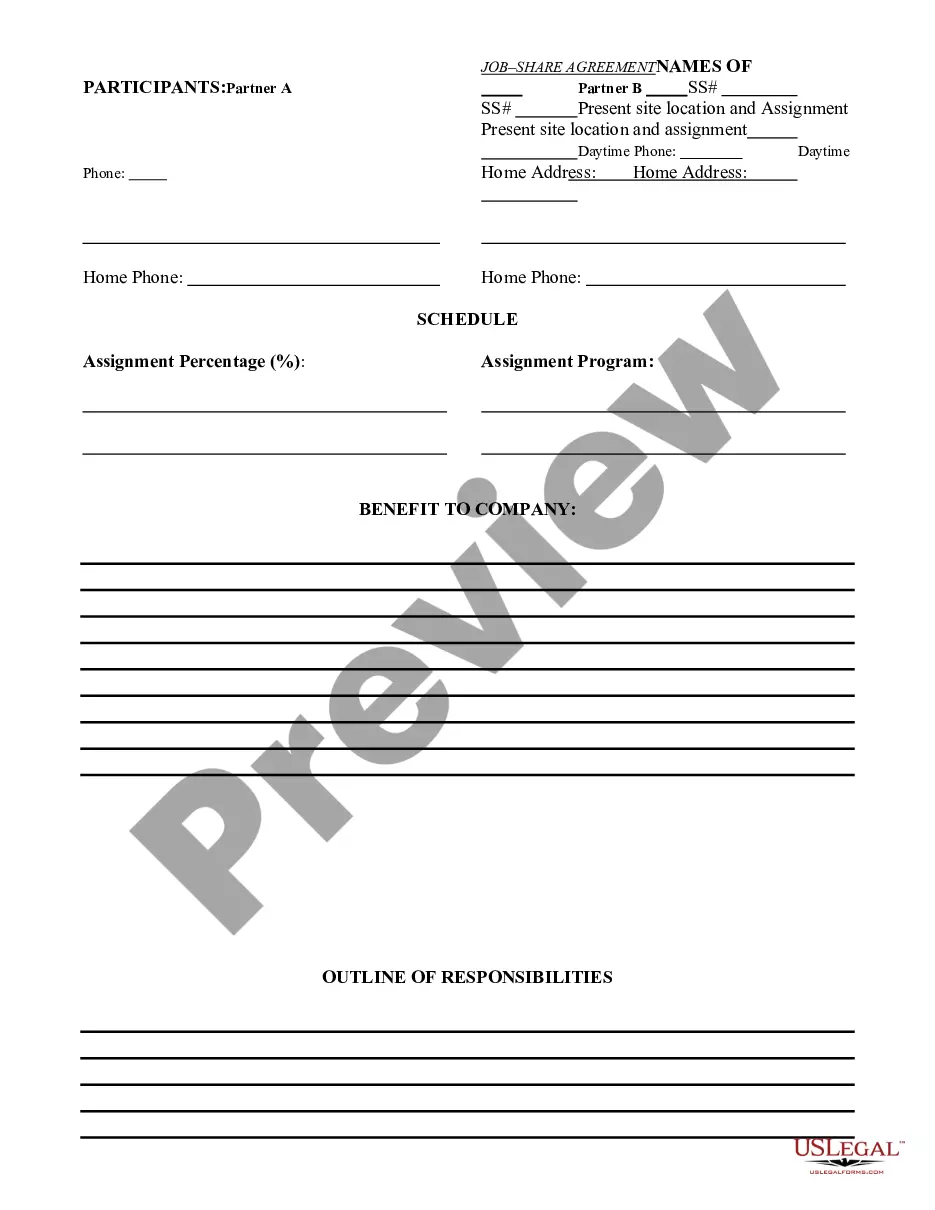

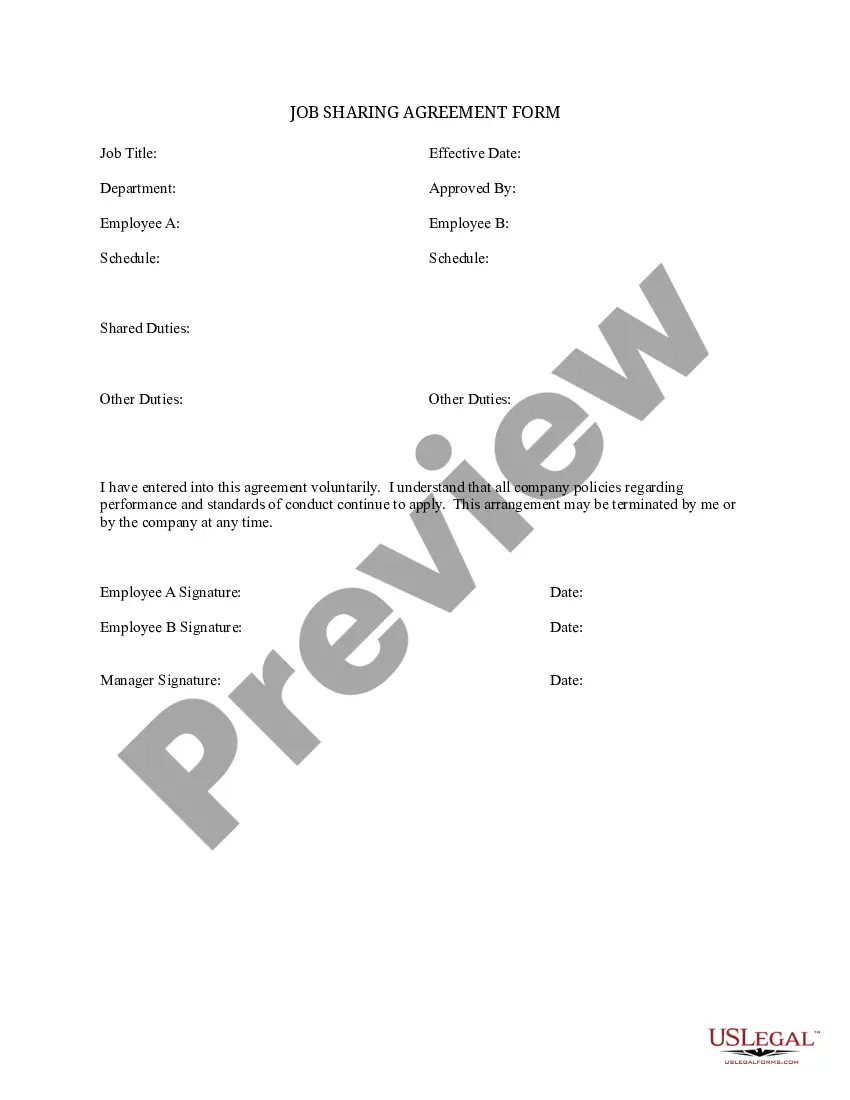

How to fill out Job Sharing Policy?

Selecting the ideal authorized document template can be a challenge.

Naturally, there are numerous templates accessible online, but how do you find the legal document you seek.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple steps to follow: First, ensure you have chosen the correct form for your city/state. You can examine the document using the Review option and check the form description to confirm it fits your requirements. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are sure that the form is suitable, click the Purchase now button to get the form. Select the pricing plan you prefer and provide the required information. Create your account and pay for your purchase using your PayPal account or credit card. Choose the document format and download the legal document template to your computer. Complete, edit, print, and sign the obtained Maine Job Sharing Policy. US Legal Forms is indeed the largest collection of legal forms where you can find a variety of document templates. Take advantage of the service to acquire professionally crafted documents that adhere to state regulations.

- The service offers thousands of templates, including the Maine Job Sharing Policy, suitable for both business and personal needs.

- All forms are reviewed by professionals and comply with state and federal requirements.

- If you are already registered, Log In to your account and click on the Download button to acquire the Maine Job Sharing Policy.

- Use your account to browse through the legal forms you may have purchased earlier.

- Visit the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

Your first $100.00 will not affect your unemployment check. Earning greater than $100.00 will be deducted from your benefits. If you earn more than $100.00 or more in excess of your weekly benefit amount, you will not be eligible for benefits for that week.

Under the new rules, you can work up to 7 days per week without losing full unemployment benefits for that week, if you work 30 hours or fewer and earn $504 or less in gross pay excluding earnings from self-employment.

Can someone be covered by unemployment for reduced or part-time work? A. Yes, Maine has unemployment coverage for part-time work. The individual should file for benefits and MDOL will review and determine if the individual is eligible for partial benefit based on number of hours worked.

States with workshare programs include Arizona, Arkansas, California, Colorado, Connecticut, Florida, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Texas, Vermont, Washington, and Wisconsin.

Florida. The Short Time Compensation program helps employers retain their workforce in times of temporary slowdown by encouraging work sharing as an alternative to layoffs.

The minimum state UI weekly benefit amount is currently $80, and the maximum is $462. The minimum weekly benefit amount under the federal PUA program is $172 and the maximum $462. Essentially, a person who earned $10,000 per quarter, and was otherwise eligible for unemployment benefits, would receive $454 per week.

As long as you continue to meet your responsibilities for receiving benefits, you may be able to earn wages from part-time work and still collect a partial benefit (including the weekly federal $300) while building up to your normal weekly hours.

The Work-Share Program provides an alternative to laying off employees. It allows employees to keep working but with fewer hours. While you are working fewer hours, we pay part of your regular unemployment benefits. You must have reduced normal weekly work hours by at least 10% but by no more than 40%.

Waiting-Period Week: Maine law requires a one week "waiting period" prior to paying benefits. You MUST file a Weekly Certification for this week, but you will not receive a benefit payment for the week. The first week in your new benefit year will normally serve as your waiting period.

The Back to Work program, administered by the Maine Department of Labor and the Department of Economic and Community Development, will provide employers a one-time $1,500 payment for eligible workers who start jobs between June 15 and June 30 or a $1,000 payment for eligible workers who start jobs in July to