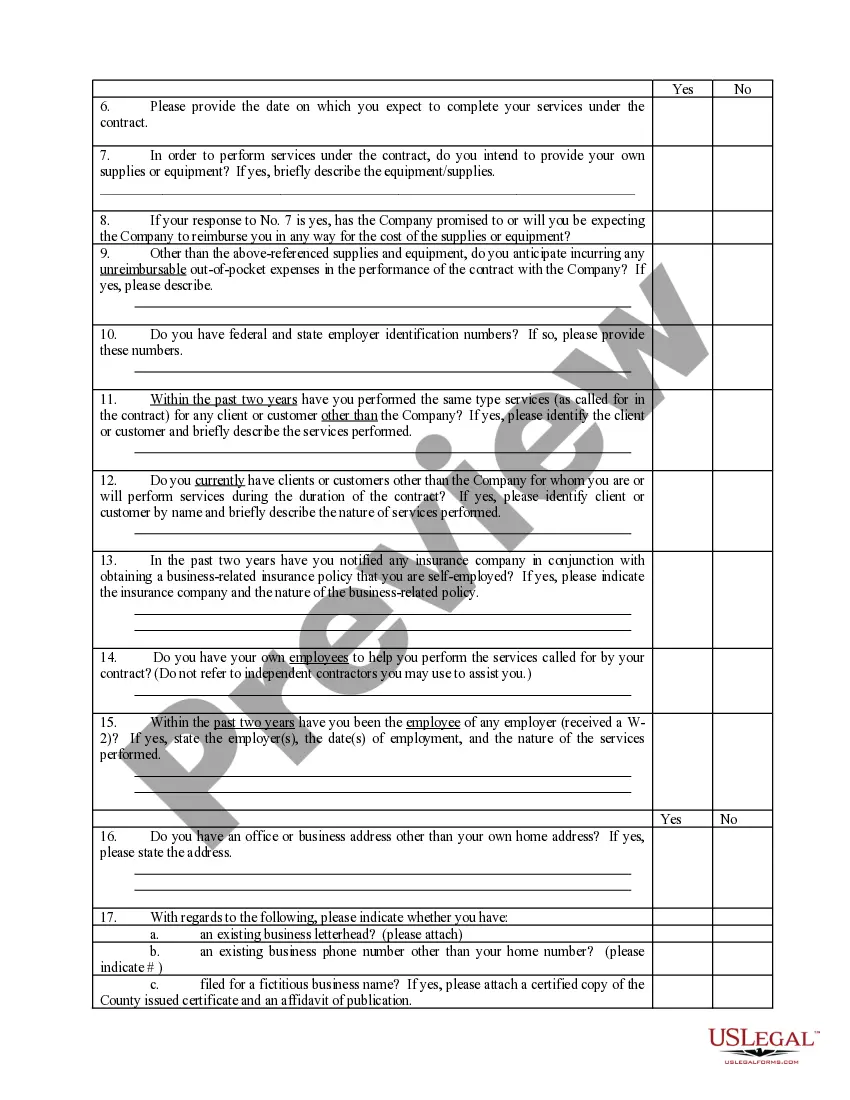

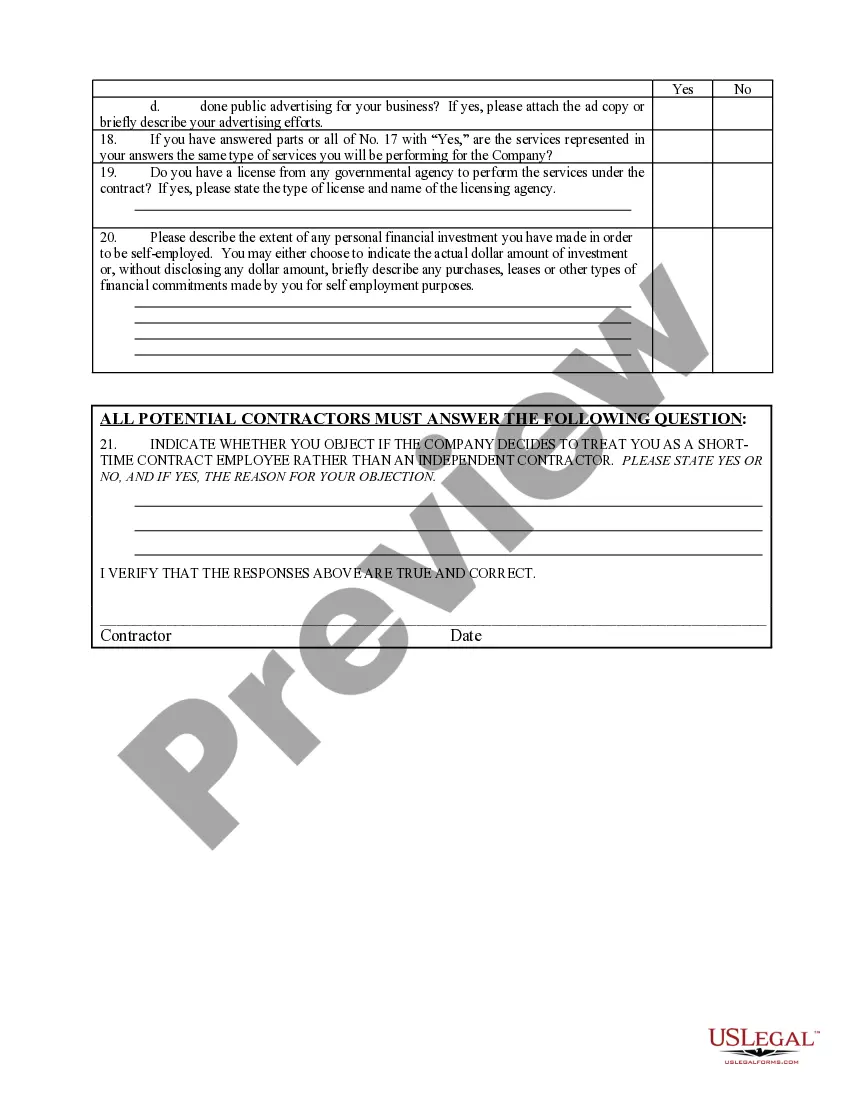

Maine Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a vast array of legal form templates that you can download or print.

By utilizing the website, you can obtain thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms like the Maine Self-Employed Independent Contractor Questionnaire within a few minutes.

If you already have an account, Log In and retrieve the Maine Self-Employed Independent Contractor Questionnaire from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the purchase.

Find the format and download the form onto your device. Edit. Fill out, modify, and print and sign the downloaded Maine Self-Employed Independent Contractor Questionnaire. Every template added to your account has no expiration date and is your personal property forever. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Obtain access to the Maine Self-Employed Independent Contractor Questionnaire with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you want to use US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to review the content of the form.

- Examine the form overview to confirm you have chosen the right document.

- If the document does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Independent Contractor Interview Questions:Why did you choose to become an independent contractor?Can you tell me about the project that you are proudest of?Have you ever had difficulty meeting deadlines?How do you track your performance?What would you do if you encountered unexpected difficulties on a project?

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.