Maine Employee Payroll Record

Description

How to fill out Employee Payroll Record?

Have you found yourself in a situation where you require documentation for both professional or specific purposes nearly every day.

There are numerous official document formats available online, but finding templates you can trust is challenging.

US Legal Forms offers a multitude of template formats, such as the Maine Employee Payroll Record, designed to comply with state and federal requirements.

Once you find the right form, click Buy now.

Select the pricing plan you desire, enter the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Employee Payroll Record template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/county.

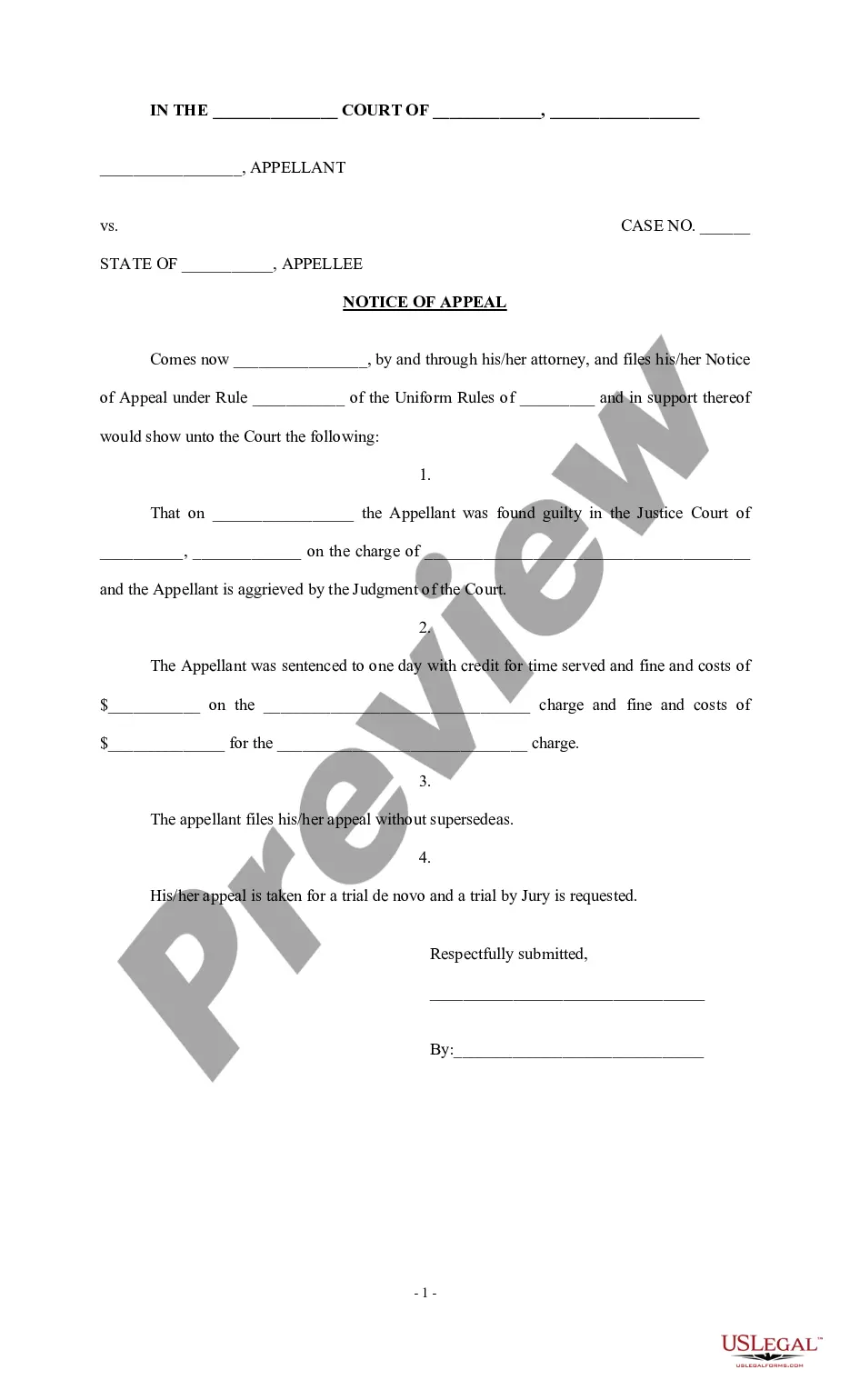

- Use the Preview option to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search field to find the form that matches your requirements.

Form popularity

FAQ

To look up public records in Maine, you can start by visiting the Maine Secretary of State's website. This site provides access to various public records, including the Maine Employee Payroll Record. You may also visit local government offices or use online databases specifically designed for public records. Utilizing services like US Legal Forms can streamline your search and provide the necessary documentation related to payroll records.

The record of an employee's payroll history is referred to as a Maine Employee Payroll Record. This document summarizes the hours worked, wages earned, and deductions taken over a specific period. Maintaining an accurate payroll history is crucial for compliance with labor laws and for providing necessary information during audits. You can efficiently manage your payroll records and keep them organized with the help of uslegalforms.

When managing a Maine Employee Payroll Record, it's essential to document details like the employee's name, Social Security number, wage rate, hours worked, and tax deductions. These elements create a complete picture of your employee's earnings and tax responsibilities. Additionally, having accurate records helps ensure compliance with state regulations and can protect your business in case of disputes. Using a reliable platform like uslegalforms can simplify this documentation process.

Preparing payroll requires essential information such as employee names, Social Security numbers, wage rates, and tax withholding preferences. Additionally, employers should collect any information related to benefits and deductions that may affect employees' compensation. By utilizing a reliable platform like USLegalForms to maintain your Maine Employee Payroll Record, you can store and organize this critical data efficiently.

For employees, payroll tax means that a percentage of their earnings is withheld to cover federal and state taxes before they receive their paycheck. These withholdings also contribute to Social Security, Medicare, and any other applicable local taxes. Understanding this process can lead you to better manage your finances and maintain an accurate Maine Employee Payroll Record that plays a crucial role in your yearly tax return.

Maine payroll tax operates by withholding a portion of an employee’s earnings for state income tax, Social Security, and Medicare. Employers must regularly report these withholdings to both state and federal agencies, ensuring that employees meet their tax obligations. Maintaining accurate Maine Employee Payroll Records simplifies this process for employers, helping to avoid costly mistakes.

In Maine, payroll taxes consist of both state income tax and other local taxes that are applicable based on where you work. The state income tax rates vary, and specific payroll tax percentage is deducted from employees' gross wages. Managing these details within the framework of your Maine Employee Payroll Record ensures you remain compliant while keeping your records organized and precise.