Maine Self-Employed Independent Contractor Employment Agreement — Commission for New Business A Maine Self-Employed Independent Contractor Employment Agreement is a legally binding document that outlines the terms and conditions between a self-employed individual and a business entity, where the contractor is responsible for generating new business and earning commissions based on their performance. Keyword: Maine Self-Employed Independent Contractor Employment Agreement In Maine, individuals who work as independent contractors have the freedom to pursue various business opportunities, working as their own boss. However, for proper organization and establishing clear expectations, it is crucial to have a comprehensive Self-Employed Independent Contractor Employment Agreement in place. The Maine Self-Employed Independent Contractor Employment Agreement starts by clearly identifying both parties involved: the independent contractor and the business entity. It includes their legal names, addresses, and contact information. Keyword: Commission for New Business One of the key components of this agreement centers around commission-based compensation for new business generated by the contractor. The agreement specifies the commission percentage or structure, ensuring transparency and understanding between the contractor and the business entity. The commission structure may vary depending on the industry and the nature of the services provided. It is important to mention that there can be various types of Maine Self-Employed Independent Contractor Employment Agreements specifically tailored to different sectors, such as sales, freelance writing, consulting, marketing, and more. Types of Maine Self-Employed Independent Contractor Employment Agreement — Commission for New Business: 1. Sales: This agreement is commonly used in sales-driven roles, where the independent contractor is responsible for generating leads, closing deals, and earning commissions based on the sales revenue generated. 2. Freelance Writing: In this agreement, the independent contractor is a writer hired by a business entity to provide content creation services. The contractor may earn commissions by securing new writing projects or generating income through content licensing or sales. 3. Consulting: This agreement caters to independent contractors who provide specialized advice or expertise in various fields. The contractor may earn commissions by attracting new clients to the business entity or by securing long-term consulting contracts. 4. Marketing: This agreement is suitable for independent contractors who focus on marketing and promotional activities for a business. The contractor may earn commissions based on the successful acquisition of new customers or achieving specific marketing goals. Conclusion: Maine Self-Employed Independent Contractor Employment Agreements that include commission-based compensation for new business are essential for establishing clear terms and expectations between the contractor and the business entity. It is crucial to tailor the agreement to the specific industry, ensuring that the commission structure aligns with the nature of the services provided. By having a comprehensive agreement in place, both parties can operate with confidence, knowing their rights and responsibilities are protected.

Maine Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

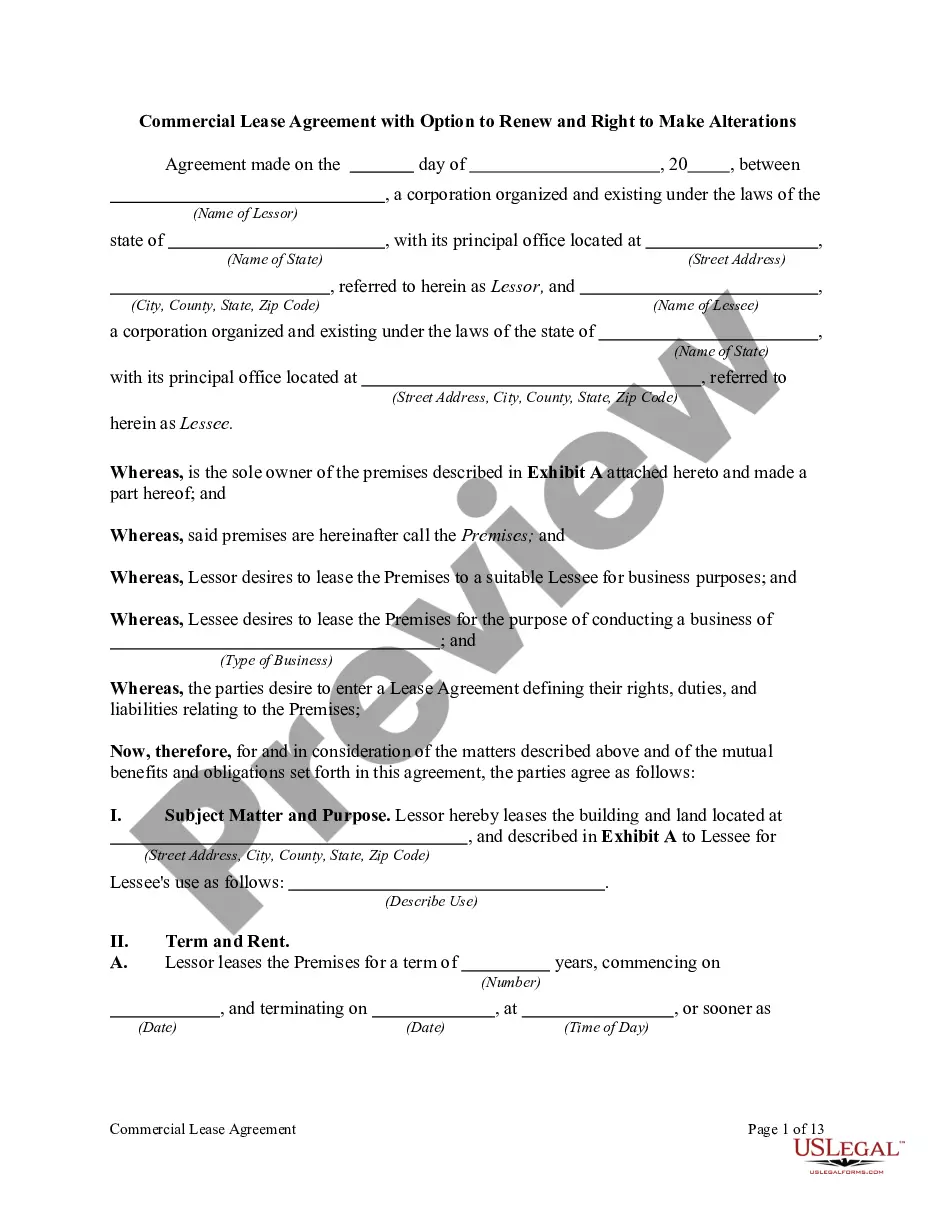

How to fill out Maine Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

US Legal Forms - among the greatest libraries of authorized forms in the United States - provides a variety of authorized file themes you can acquire or printing. Using the website, you may get thousands of forms for enterprise and individual uses, sorted by groups, suggests, or keywords and phrases.You can get the most up-to-date models of forms like the Maine Self-Employed Independent Contractor Employment Agreement - commission for new business within minutes.

If you have a membership, log in and acquire Maine Self-Employed Independent Contractor Employment Agreement - commission for new business in the US Legal Forms collection. The Acquire button can look on each develop you see. You have accessibility to all in the past acquired forms in the My Forms tab of the account.

If you want to use US Legal Forms the very first time, listed here are simple instructions to help you get began:

- Ensure you have picked out the proper develop to your metropolis/region. Go through the Preview button to analyze the form`s content. See the develop outline to ensure that you have chosen the right develop.

- In case the develop does not suit your demands, make use of the Search field on top of the monitor to find the one that does.

- Should you be satisfied with the form, validate your option by simply clicking the Get now button. Then, opt for the rates prepare you prefer and give your accreditations to register to have an account.

- Procedure the purchase. Make use of your charge card or PayPal account to complete the purchase.

- Select the format and acquire the form on your own device.

- Make adjustments. Fill out, modify and printing and indicator the acquired Maine Self-Employed Independent Contractor Employment Agreement - commission for new business.

Every single design you put into your account does not have an expiry day and is also your own eternally. So, if you wish to acquire or printing another duplicate, just visit the My Forms portion and click on the develop you want.

Gain access to the Maine Self-Employed Independent Contractor Employment Agreement - commission for new business with US Legal Forms, by far the most comprehensive collection of authorized file themes. Use thousands of professional and status-specific themes that satisfy your business or individual needs and demands.

Form popularity

FAQ

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.