Maine Power of Attorney by Trustee of Trust

Description

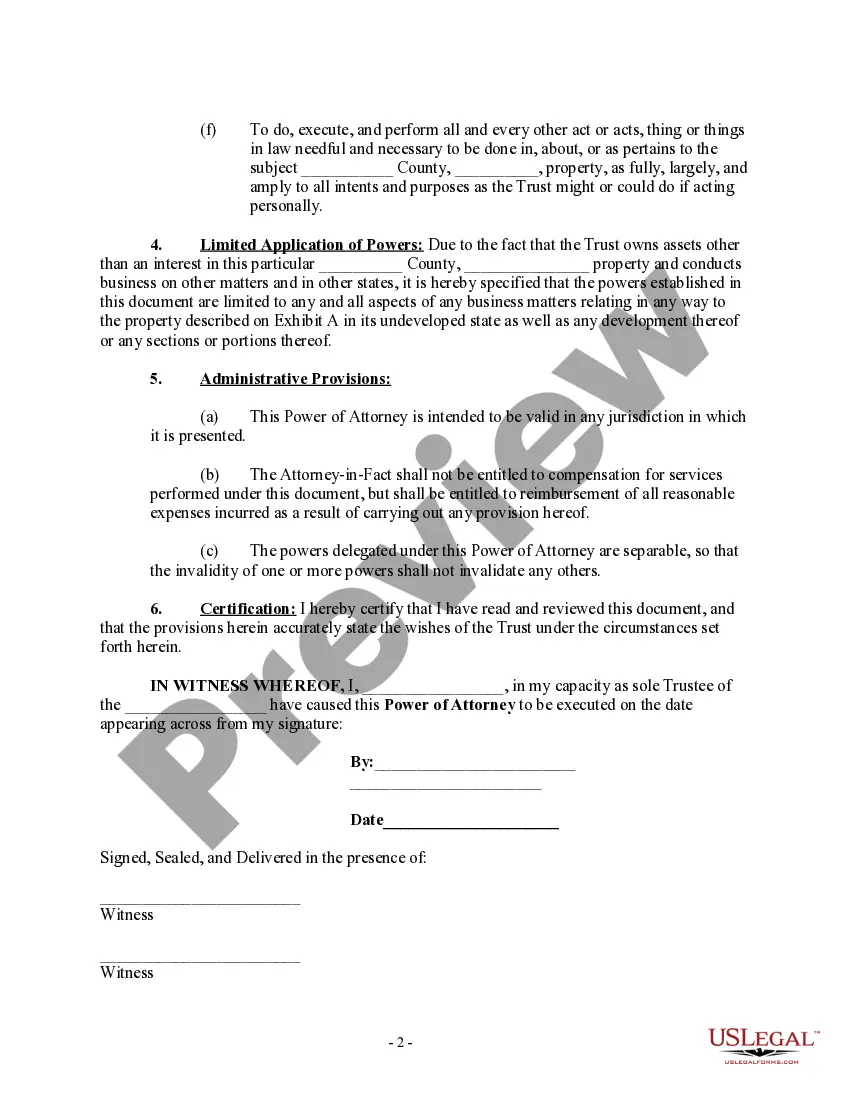

How to fill out Power Of Attorney By Trustee Of Trust?

If you need to complete, acquire, or print authorized document templates, use US Legal Forms, the largest assortment of authorized kinds, which can be found on-line. Take advantage of the site`s basic and convenient lookup to discover the paperwork you want. Various templates for enterprise and personal uses are sorted by classes and states, or key phrases. Use US Legal Forms to discover the Maine Power of Attorney by Trustee of Trust in just a handful of mouse clicks.

If you are already a US Legal Forms client, log in to your accounts and click the Down load option to get the Maine Power of Attorney by Trustee of Trust. You may also access kinds you earlier saved within the My Forms tab of your respective accounts.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape to the right town/nation.

- Step 2. Use the Review method to look over the form`s content material. Don`t neglect to see the explanation.

- Step 3. If you are unsatisfied with all the form, take advantage of the Research industry near the top of the display to discover other versions in the authorized form format.

- Step 4. After you have discovered the shape you want, select the Buy now option. Choose the prices strategy you favor and add your credentials to sign up for an accounts.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal accounts to finish the transaction.

- Step 6. Pick the formatting in the authorized form and acquire it in your system.

- Step 7. Comprehensive, modify and print or sign the Maine Power of Attorney by Trustee of Trust.

Each and every authorized document format you acquire is your own permanently. You have acces to each form you saved with your acccount. Go through the My Forms segment and pick a form to print or acquire again.

Compete and acquire, and print the Maine Power of Attorney by Trustee of Trust with US Legal Forms. There are thousands of professional and state-distinct kinds you may use for your enterprise or personal requirements.

Form popularity

FAQ

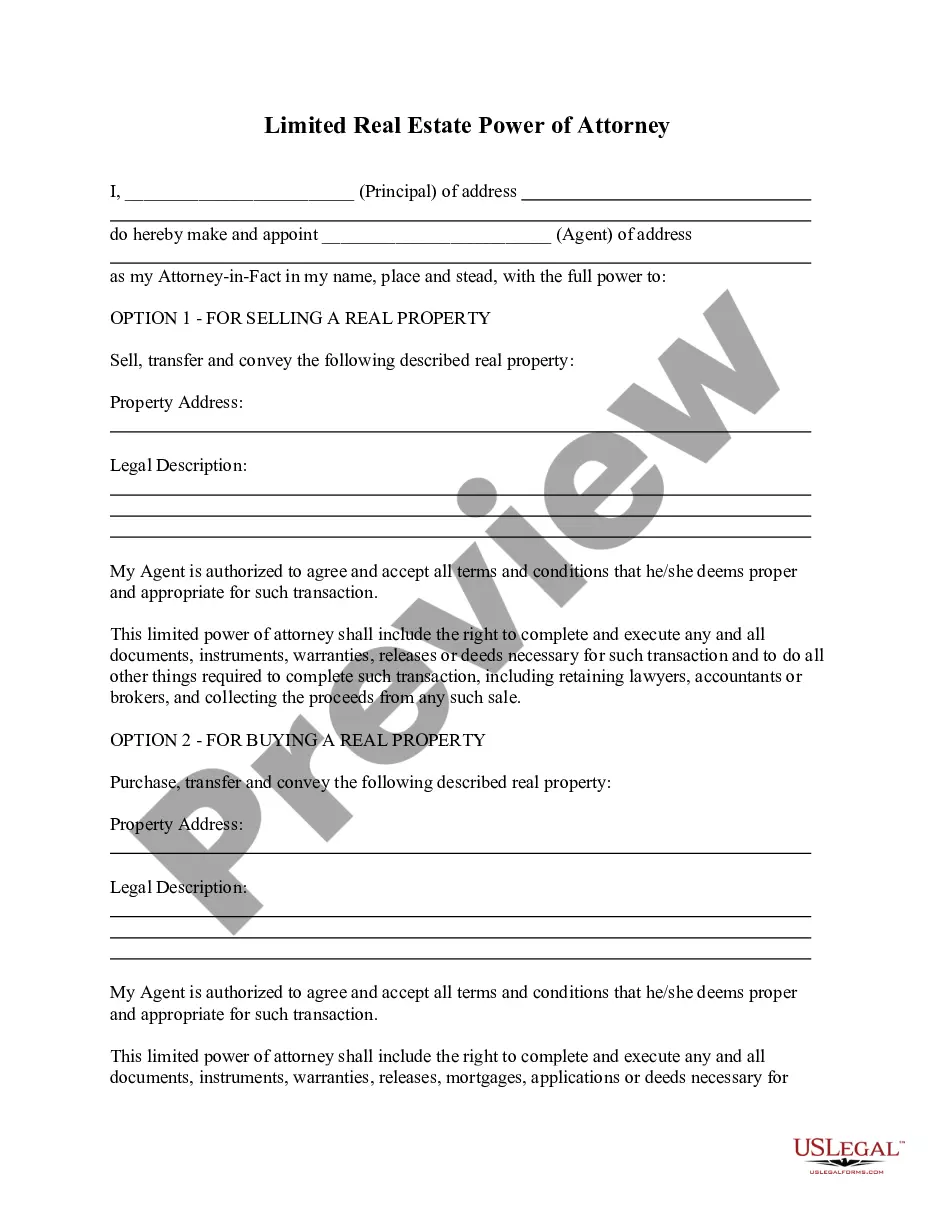

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property. Typically the trustee will have the power to manage, control, improve, and maintain all real and personal trust property.

1) Duty to Inform Beneficiaries (Section 16060). 2) Duty to Provide Terms of Trust at Beneficiary's Request (Section 16060.7). 3) Duty to Report at Beneficiary's Request (Section 16061).

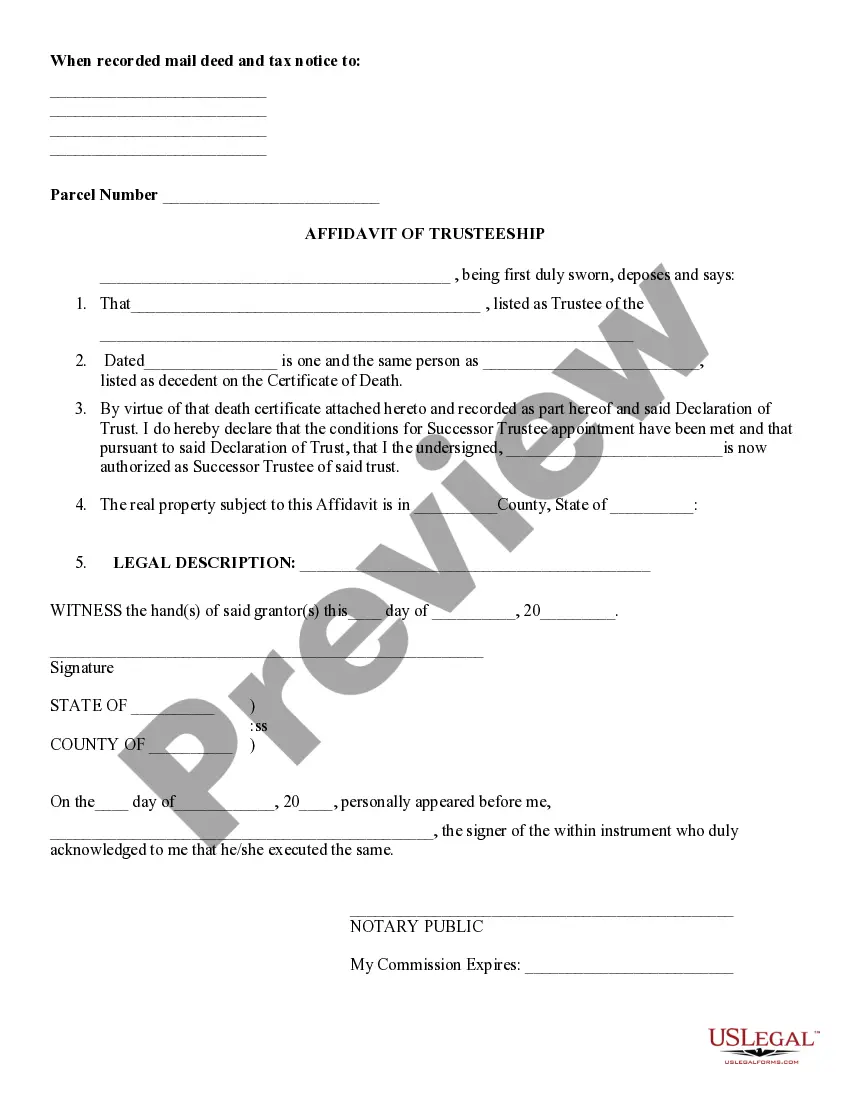

A Trustee is a person who acts as a custodian for the assets held within a Trust. He or she is responsible for managing and administering the finances of a Trust per the instructions given. Often, the person who creates the Trust is the Trustee until they can no longer fill the role due to incapacitation or death.

A Power of Attorney (POA) is a legal document that gives someone legal authority to act for you while you are still alive. The Trustee to an Estate is generally the person authorized to manage your estate's assets following your death.

In a trust structure, a trustee holds your business for the benefit of others (the beneficiaries). A trustee can be a person or a company, and is responsible for everything in the trust, including income and losses.

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

Section 25 of the Trustee Act 1925 allows a trustee to grant a power of attorney delegating their functions as a trustee to the attorney. Section 25 provides a short form of power by which a single donor can delegate trustee functions under a single trust to a single donee. Trustees can use other forms.

All trustees have the power to manage trust assets. This may include the sale and purchase of trust property and making investments. The trustee must decide whether to use its power to manage assets on a case-by-case basis and must only consider relevant factors when deciding to exercise any power.

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.