Statutory Guidelines [Appendix A(7) IRC 5891] regarding rules for structured settlement factoring transactions.

Maine Structured Settlement Factoring Transactions

Description

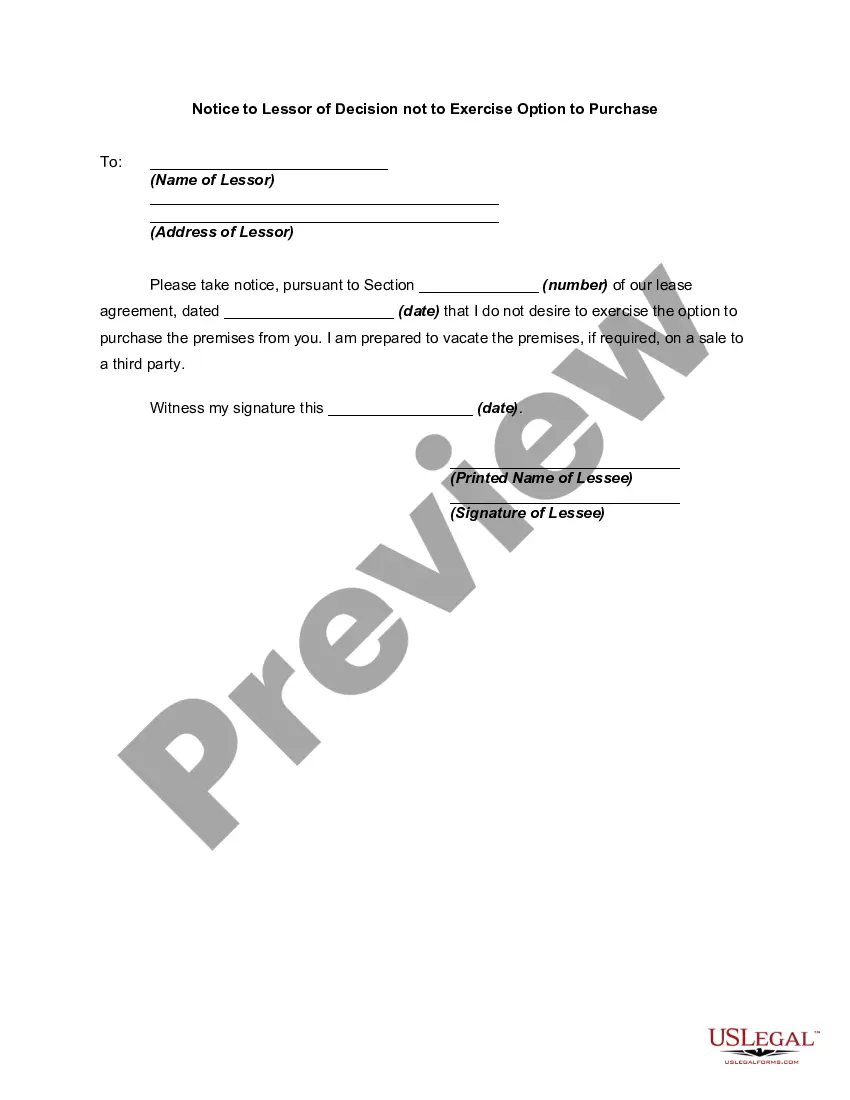

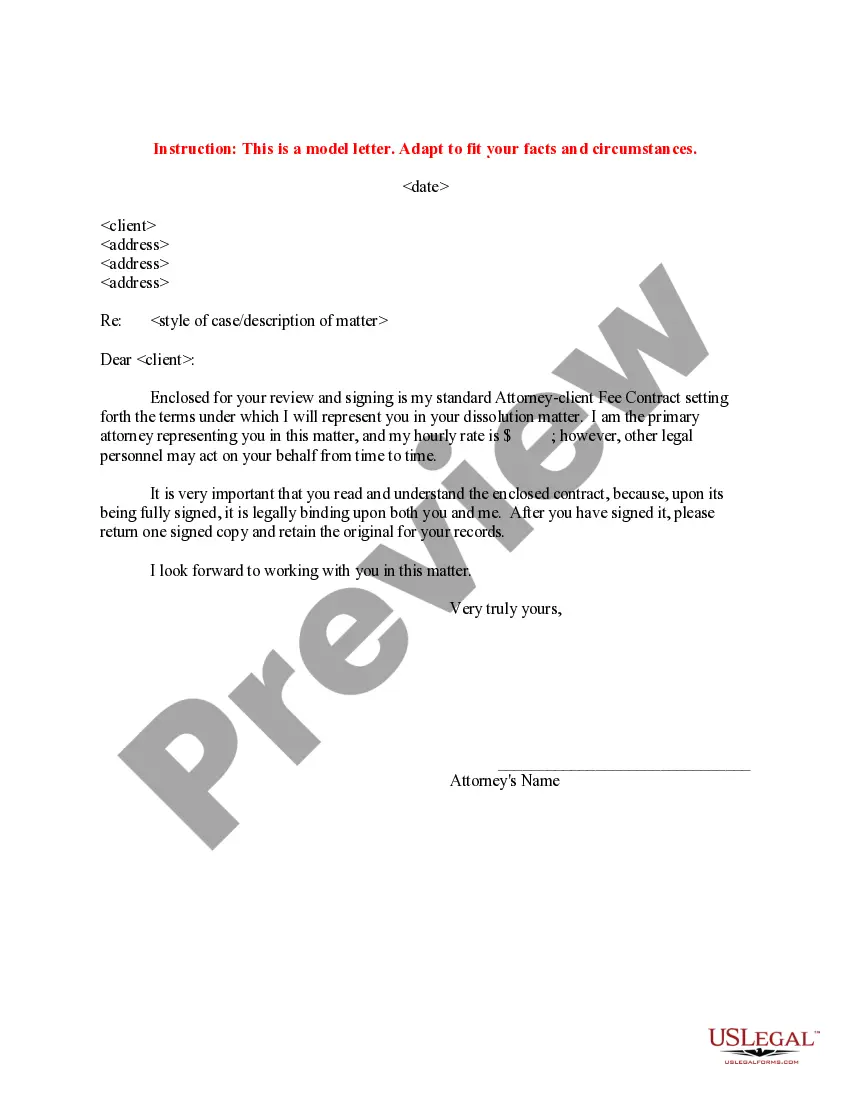

How to fill out Structured Settlement Factoring Transactions?

You are able to commit time on the web looking for the legitimate papers format that suits the state and federal demands you want. US Legal Forms offers a large number of legitimate kinds that are reviewed by experts. You can actually acquire or print out the Maine Structured Settlement Factoring Transactions from your service.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Download switch. Next, it is possible to total, modify, print out, or indication the Maine Structured Settlement Factoring Transactions. Each and every legitimate papers format you purchase is yours forever. To obtain yet another version for any obtained form, visit the My Forms tab and then click the related switch.

If you are using the US Legal Forms internet site for the first time, adhere to the easy instructions below:

- Very first, be sure that you have chosen the correct papers format to the region/city that you pick. See the form description to ensure you have selected the right form. If available, utilize the Review switch to look from the papers format too.

- In order to get yet another edition from the form, utilize the Search discipline to discover the format that meets your requirements and demands.

- Upon having located the format you need, simply click Get now to proceed.

- Find the pricing plan you need, type your credentials, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can utilize your credit card or PayPal accounts to fund the legitimate form.

- Find the formatting from the papers and acquire it to your gadget.

- Make alterations to your papers if needed. You are able to total, modify and indication and print out Maine Structured Settlement Factoring Transactions.

Download and print out a large number of papers layouts using the US Legal Forms site, that provides the biggest collection of legitimate kinds. Use skilled and status-distinct layouts to deal with your business or person needs.

Form popularity

FAQ

The Five Steps for Selling a Structured Settlement: Check with a lawyer and local laws to find out if your settlement can be sold. Decide if selling is a good idea, depending on your goals and financial situation. Research quotes and pick a trustworthy company. Attend your court date.

What is a Structured Settlement? A structured settlement annuity (?structured settlement?) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers' compensation settlement in a series of income tax-free periodic payments.

Structured Settlement calls people on old and expired debts, to get your Debit or Credit Card and make payments that are usually outside the statute of limitations.

The term ?structured settlement factoring transaction? means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration.

Structured settlements can provide long-term monthly payments in workers' compensation/medical malpractice cases. With a structured settlement annuity, there's no risk of outliving the money. Future payments can last for the claimant's lifetime.

Often, customers receive their funds from their structured settlement payment sale transaction within 60 to 90 days and funds from their annuity payment sale transaction within two to three weeks after their contract is finalized.

Cashing out a structured settlement can be a good way to access a significant amount of cash. But before making such a significant decision, review all of the costs carefully. If you decide to proceed with a sale, get offers from at least two to three different buyers to ensure you're getting the best deal possible.