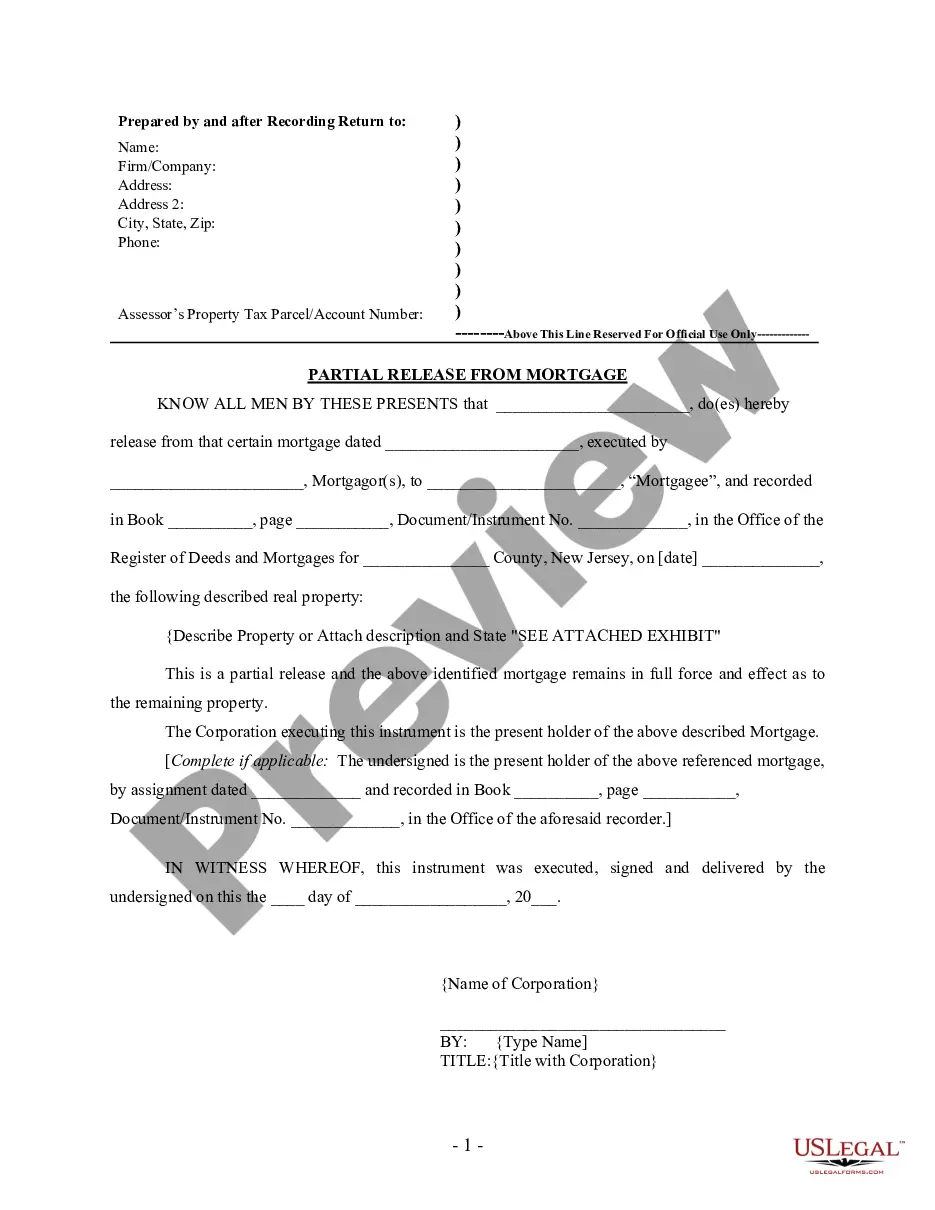

Maine Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 is a legal document used in bankruptcy proceedings to disclose the debtor's intentions regarding certain types of property they possess. This form provides detailed information about the debtor's intentions with various assets and debts during a Chapter 7 bankruptcy process in Maine, following the changes made to the bankruptcy law in 2005. There are different variations of Maine Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005, each catering to different types of property and debts. These variations include: 1. Real Property: This section of the form focuses on the debtor's intentions regarding real estate property, such as their primary residence, rental properties, or land. The debtor must specify whether they plan to retain or surrender the property, reaffirm or redeem certain obligations attached to the property, or take any other action. 2. Personal Property: This section encompasses the debtor's intentions concerning various personal belongings, including vehicles, furniture, electronics, jewelry, and other valuable possessions. The debtor must indicate whether they intend to retain the property or surrender it to the bankruptcy estate. 3. Secured Debts: Here, the debtor outlines their intentions towards secured debts, which are debts tied to collateral (such as a mortgage or car loan). The debtor can choose to reaffirm the debt, redeem the collateral, or surrender the collateral in this section. 4. Unexpired Leases and Executory Contracts: This section requires the debtor to disclose their intentions for any active leases or contracts they have entered into before filing for bankruptcy. They can either assume (continue) or reject these agreements. 5. Other Intangible and Non-Exempt Property: This part covers any other intangible assets, non-exempt property, or accounts held by the debtor. Examples may include stocks, bonds, patents, copyrights, and investment accounts. The debtor must state their intentions regarding these assets as well. It is crucial for debtors to provide accurate and detailed information in their Maine Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 to ensure compliance with bankruptcy laws and to assist the bankruptcy trustee in effectively managing the bankruptcy estate. This form plays a significant role in determining the outcome of a Chapter 7 bankruptcy case, helping debtors navigate the process and make informed decisions about their assets and debts.

Maine Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Maine Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

Discovering the right authorized file format can be quite a have difficulties. Naturally, there are a lot of layouts available online, but how can you obtain the authorized form you need? Make use of the US Legal Forms web site. The assistance provides a large number of layouts, including the Maine Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, that can be used for enterprise and private requires. Every one of the kinds are examined by pros and meet up with state and federal needs.

When you are presently authorized, log in in your account and click the Obtain option to have the Maine Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005. Use your account to look from the authorized kinds you may have purchased formerly. Go to the My Forms tab of the account and get one more backup of your file you need.

When you are a new customer of US Legal Forms, allow me to share simple guidelines so that you can follow:

- Very first, be sure you have chosen the proper form to your metropolis/area. You may look through the form utilizing the Review option and read the form description to guarantee this is basically the best for you.

- If the form is not going to meet up with your preferences, use the Seach discipline to obtain the right form.

- Once you are sure that the form is acceptable, select the Buy now option to have the form.

- Select the pricing prepare you desire and type in the essential details. Make your account and pay for an order making use of your PayPal account or credit card.

- Choose the submit formatting and download the authorized file format in your device.

- Comprehensive, modify and produce and sign the acquired Maine Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005.

US Legal Forms will be the biggest local library of authorized kinds that you can see numerous file layouts. Make use of the company to download expertly-produced papers that follow condition needs.