Maine Stock Option Plan (SOP) is a comprehensive program that allows companies to grant employees various types of stock options and stock appreciation rights (SARS). Under the SOP, companies can provide their employees with Incentive Stock Options (SOS), Nonqualified Stock Options (Nests), and SARS as part of their compensation packages. 1. Incentive Stock Options (SOS): Maine Stock Option Plan offers SOS as a type of stock option that provides certain tax advantages to employees. These options are typically granted to key employees and must meet specific IRS requirements to qualify for favorable tax treatment. SOS allow employees to purchase company stock at a predetermined price, known as the strike or exercise price, within a specified timeframe. 2. Nonqualified Stock Options (Nests): Another type of stock option available under the SOP is the Nonqualified Stock Option. Nests do not meet the qualifying criteria for SOS and thus do not receive the same tax benefits. However, they offer flexibility in granting options to a broader range of employees, including executives, consultants, and directors. Like SOS, Nests also have an exercise price and an expiration date. 3. Stock Appreciation Rights (SARS): Maine Stock Option Plan also includes Stock Appreciation Rights, which provide employees with a different type of equity-based compensation. SARS do not grant actual stock, but instead, they provide employees with the right to receive the appreciation in the stock's value between the grant date and the exercise date. SARS can be settled in cash or company stock, depending on the plan's terms. It's important to note that the specific terms, terms of exercise, vesting schedules, and eligibility requirements for each of these options may vary depending on the company's SOP. Companies can customize their Maine Stock Option Plan to meet their specific needs, taking into consideration factors such as company size, industry, and employee requirements. By offering a combination of Incentive Stock Options, Nonqualified Stock Options, and Stock Appreciation Rights through the Maine Stock Option Plan, companies can attract and retain talented employees, align their interests with those of shareholders, and provide a valuable long-term incentive for employee loyalty and performance.

Maine Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Maine Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

Finding the right lawful document template can be quite a struggle. Obviously, there are a variety of web templates available online, but how would you discover the lawful develop you need? Utilize the US Legal Forms web site. The assistance delivers a large number of web templates, for example the Maine Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights, which can be used for enterprise and private demands. Each of the types are checked out by pros and meet up with state and federal demands.

In case you are already registered, log in for your profile and click on the Acquire option to have the Maine Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights. Utilize your profile to look throughout the lawful types you have bought previously. Go to the My Forms tab of your profile and acquire an additional duplicate of the document you need.

In case you are a brand new consumer of US Legal Forms, here are basic directions that you can stick to:

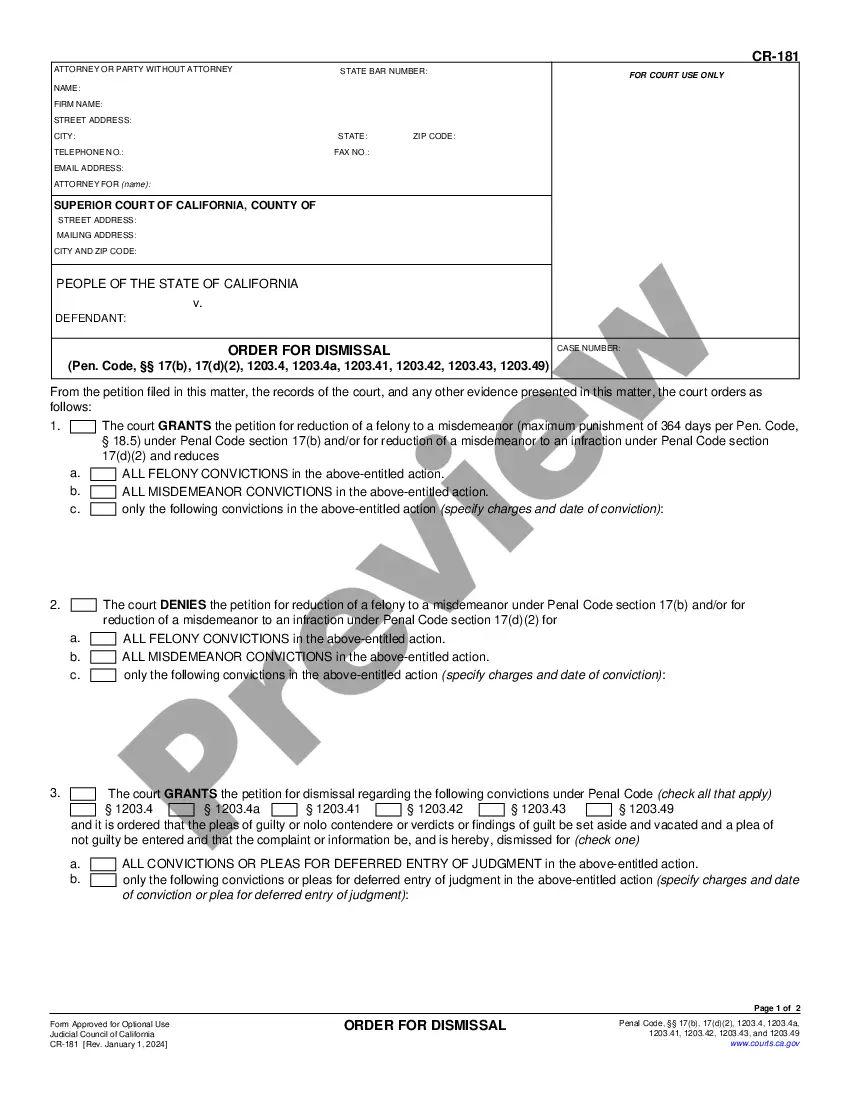

- Initially, ensure you have selected the appropriate develop for your personal town/state. You can check out the form making use of the Review option and look at the form description to make certain it is the right one for you.

- In the event the develop does not meet up with your expectations, take advantage of the Seach field to obtain the correct develop.

- When you are positive that the form is proper, select the Get now option to have the develop.

- Choose the pricing strategy you desire and type in the needed info. Design your profile and pay money for your order utilizing your PayPal profile or Visa or Mastercard.

- Opt for the data file structure and acquire the lawful document template for your product.

- Complete, modify and print out and sign the received Maine Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

US Legal Forms is definitely the largest collection of lawful types in which you will find a variety of document web templates. Utilize the company to acquire skillfully-made papers that stick to condition demands.