Maine Eligible Director Nonqualified Stock Option Agreement of Kyle Electronics is a legal document that outlines the terms and conditions associated with granting nonqualified stock options to eligible directors of Kyle Electronics in the state of Maine. This agreement sets forth the specific rights, obligations, and restrictions that govern the exercise and sale of these stock options. The agreement is designed to comply with relevant laws and regulations in Maine, ensuring that all parties involved are operating within the legal framework provided by the state. The Maine Eligible Director Nonqualified Stock Option Agreement of Kyle Electronics may include several variations or types, depending on the specific circumstances and requirements of the company. Each variation may have its own unique provisions and conditions. Some potential types of Maine Eligible Director Nonqualified Stock Option Agreements of Kyle Electronics could include: 1. Standard Nonqualified Stock Option Agreement: This type of agreement outlines the basic terms and conditions governing the granting and exercise of nonqualified stock options to eligible directors of Kyle Electronics in Maine. It covers aspects such as the number of options granted, the exercise price, vesting schedule, and expiration date. 2. Performance-Based Stock Option Agreement: In certain cases, Kyle Electronics may offer nonqualified stock options that are tied to the performance of the company or specific targets. This agreement would specify the performance metrics and goals that the eligible directors must achieve to exercise their stock options. 3. Change of Control Stock Option Agreement: In the event of a change in control of Kyle Electronics, this type of agreement outlines the terms under which eligible directors may exercise their nonqualified stock options. It may include provisions for acceleration of vesting or special considerations in the event of a merger, acquisition, or other significant corporate transaction. 4. Restricted Stock Option Agreement: Instead of granting fully vested stock options, Kyle Electronics may choose to provide restricted stock options that are subject to certain conditions or restrictions, such as a specific performance period or continued service requirement. This agreement would outline these restrictions and the eventual release of the stock options. Overall, the Maine Eligible Director Nonqualified Stock Option Agreement of Kyle Electronics is a critical legal document that protects the rights of both the company and the eligible directors. By clearly defining the terms and conditions associated with the granting and exercise of nonqualified stock options, this agreement ensures transparency, fairness, and compliance with the laws of Maine.

Maine Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics

Description

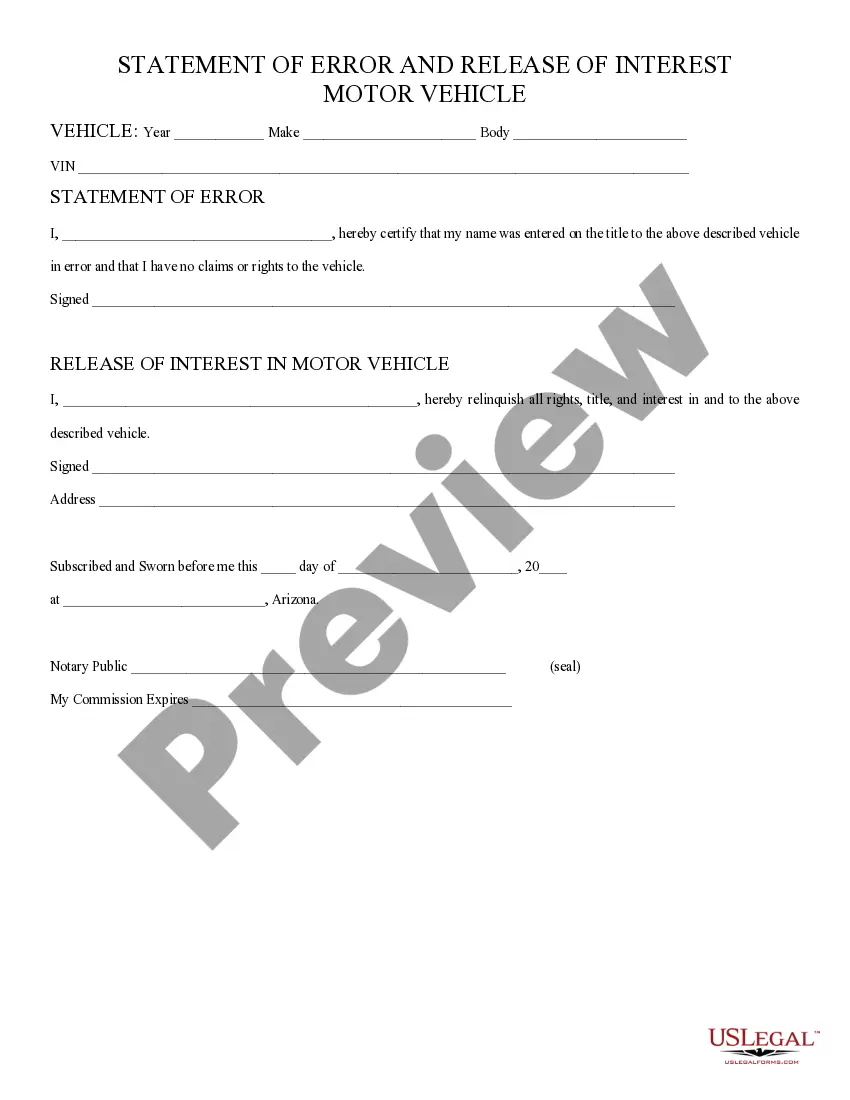

How to fill out Maine Eligible Director Nonqualified Stock Option Agreement Of Wyle Electronics?

Are you presently in the place in which you will need papers for sometimes company or person reasons just about every time? There are a lot of lawful papers templates available on the Internet, but locating versions you can trust isn`t simple. US Legal Forms offers a large number of develop templates, much like the Maine Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics, that happen to be composed to meet federal and state demands.

If you are previously informed about US Legal Forms internet site and get a merchant account, basically log in. After that, you may obtain the Maine Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics design.

If you do not have an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Discover the develop you require and ensure it is to the correct metropolis/county.

- Take advantage of the Review switch to analyze the form.

- See the outline to ensure that you have chosen the correct develop.

- In the event the develop isn`t what you are seeking, utilize the Look for field to discover the develop that meets your needs and demands.

- Once you find the correct develop, click on Buy now.

- Opt for the rates plan you need, submit the desired details to create your account, and buy an order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free document structure and obtain your version.

Find all the papers templates you might have bought in the My Forms food list. You can obtain a extra version of Maine Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics any time, if required. Just click the needed develop to obtain or print the papers design.

Use US Legal Forms, probably the most considerable selection of lawful varieties, to conserve efforts and steer clear of blunders. The assistance offers skillfully made lawful papers templates which you can use for a range of reasons. Generate a merchant account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

What is a Stock Option Agreement? A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.

An employee stock option (ESO) is a form of financial equity compensation that is offered to employees and executives by their organization. The stock options offered come in the form of regular call options and allow the employee or executive to purchase their organization's stocks at a specified price and time.

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

Weighing your options Ultimately, it's best to remember that stock options are just that: Options. They don't compel anyone to do anything, but they can, in some cases, prove extremely valuable and help significantly increase an employee's wealth. If they're fortunate enough to be at a strong, growing company, that is.