Maine Approval of Option Grant: A Detailed Description of its Types and Process In the corporate landscape, option grants serve as a significant means of incentivizing executives and employees by granting them the opportunity to purchase company stock at a predetermined price. These option grants are subject to various regulations, including the approval process mandated by the state where the company is incorporated. In the case of Maine, the process known as "Maine Approval of Option Grant" outlines the necessary steps to obtain permission for granting stock options. This description will explore the different types of Maine Approval of Option Grant as well as the key requirements and considerations involved in the process. Types of Maine Approval of Option Grant: 1. General Option Grant: This type of option grant applies to most instances where stock options are issued to employees or executives in the State of Maine. It encompasses companies of all sizes, including both privately-held and publicly-traded organizations operating within the state's jurisdiction. 2. Incentive Stock Option (ISO) Grant: ISO grants are a specific type of option grant designated for qualified employees under the Internal Revenue Code. To obtain Maine Approval of an ISO Grant, the company must comply with additional regulations governing SOS, including meeting specific employee eligibility criteria and adhering to the tax implications associated with such grants. Key Requirements and Considerations: 1. Board Approval: The first step in obtaining Maine Approval of Option Grant involves gaining authorization from the company's board of directors. The board must review and approve the terms and conditions of the option grant, including the number of shares offered, the exercise price, and any vesting or performance requirements. 2. Written Option Plan: For a Maine Approval of Option Grant, it is necessary to have a written stock option plan in place. This plan should outline the details of the option grant program, including eligibility criteria, exercise schedules, and any restrictions or limitations associated with the grants. 3. Compliance with Securities Laws: Maine Approval of Option Grant requires compliance with applicable state and federal securities laws. It is imperative to ensure that the necessary filings are completed, such as Form D under Regulation D of the Securities Act of 1933, to ensure compliance with exemption requirements. 4. Employee Notifications: Once an option grant receives Maine Approval, the company is responsible for providing timely and comprehensive notifications to the eligible employees. These notifications must include details about the option grant, its terms, and any associated tax implications or vesting schedules. 5. Tax Considerations: Maine Approval of Option Grant also necessitates careful consideration of tax implications for both the company and the grant recipients. It is crucial to consult with legal and tax professionals to ensure compliance with state and federal tax regulations relating to option grants. In conclusion, Maine Approval of Option Grant plays a vital role in facilitating the issuance of stock options within the state boundaries. It is important for companies to understand the different types of option grants available and the associated requirements for compliance. By adhering to the necessary processes and regulations, companies can effectively leverage stock options as a valuable incentive tool while ensuring legal and regulatory compliance within Maine.

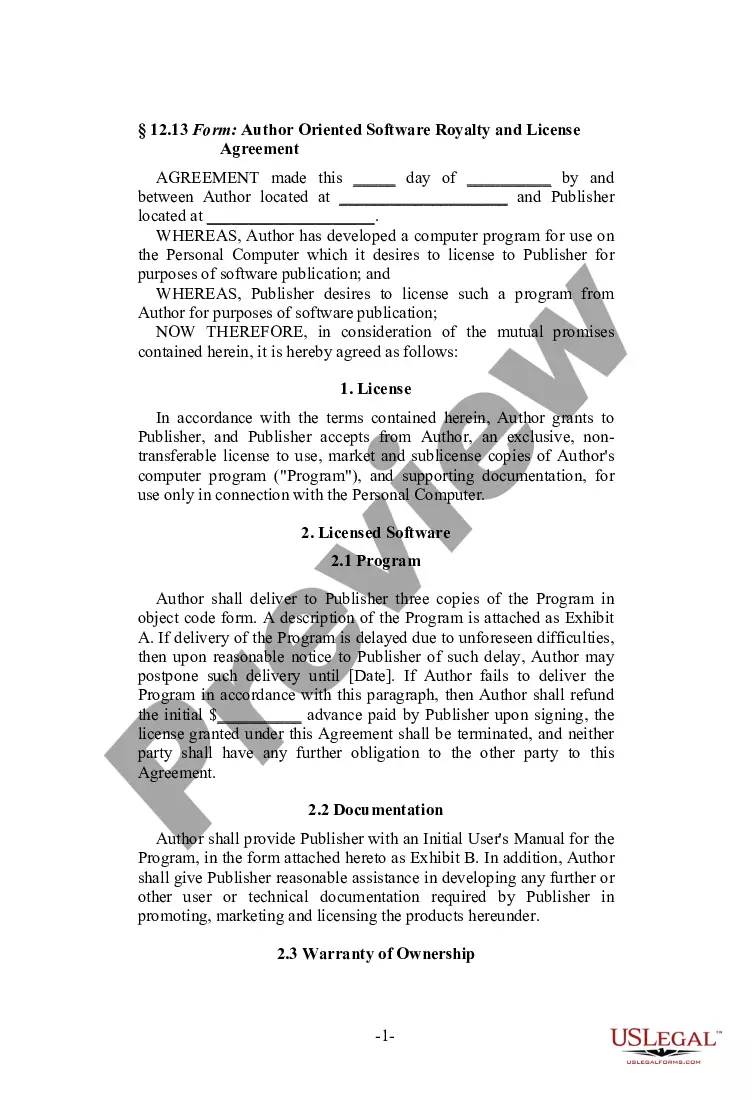

Maine Approval of option grant

Description

How to fill out Maine Approval Of Option Grant?

It is possible to commit hrs on the web searching for the authorized file design that meets the federal and state requirements you will need. US Legal Forms supplies 1000s of authorized kinds which can be analyzed by experts. You can easily obtain or produce the Maine Approval of option grant from my service.

If you already have a US Legal Forms accounts, you are able to log in and click on the Down load switch. Next, you are able to total, change, produce, or signal the Maine Approval of option grant. Every single authorized file design you purchase is your own property forever. To acquire another backup of any purchased develop, check out the My Forms tab and click on the related switch.

If you work with the US Legal Forms web site the first time, stick to the easy directions below:

- Very first, be sure that you have chosen the right file design for your county/area of your liking. Read the develop description to make sure you have picked the appropriate develop. If readily available, make use of the Preview switch to search throughout the file design as well.

- If you wish to find another version from the develop, make use of the Research industry to get the design that fits your needs and requirements.

- After you have discovered the design you would like, just click Purchase now to proceed.

- Pick the rates program you would like, type in your credentials, and sign up for an account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal accounts to pay for the authorized develop.

- Pick the file format from the file and obtain it to your system.

- Make alterations to your file if required. It is possible to total, change and signal and produce Maine Approval of option grant.

Down load and produce 1000s of file web templates making use of the US Legal Forms web site, which offers the largest collection of authorized kinds. Use professional and status-distinct web templates to deal with your small business or personal demands.