Maine Employee Stock Ownership Plan of First American Health Concepts, Inc.

Description

How to fill out Employee Stock Ownership Plan Of First American Health Concepts, Inc.?

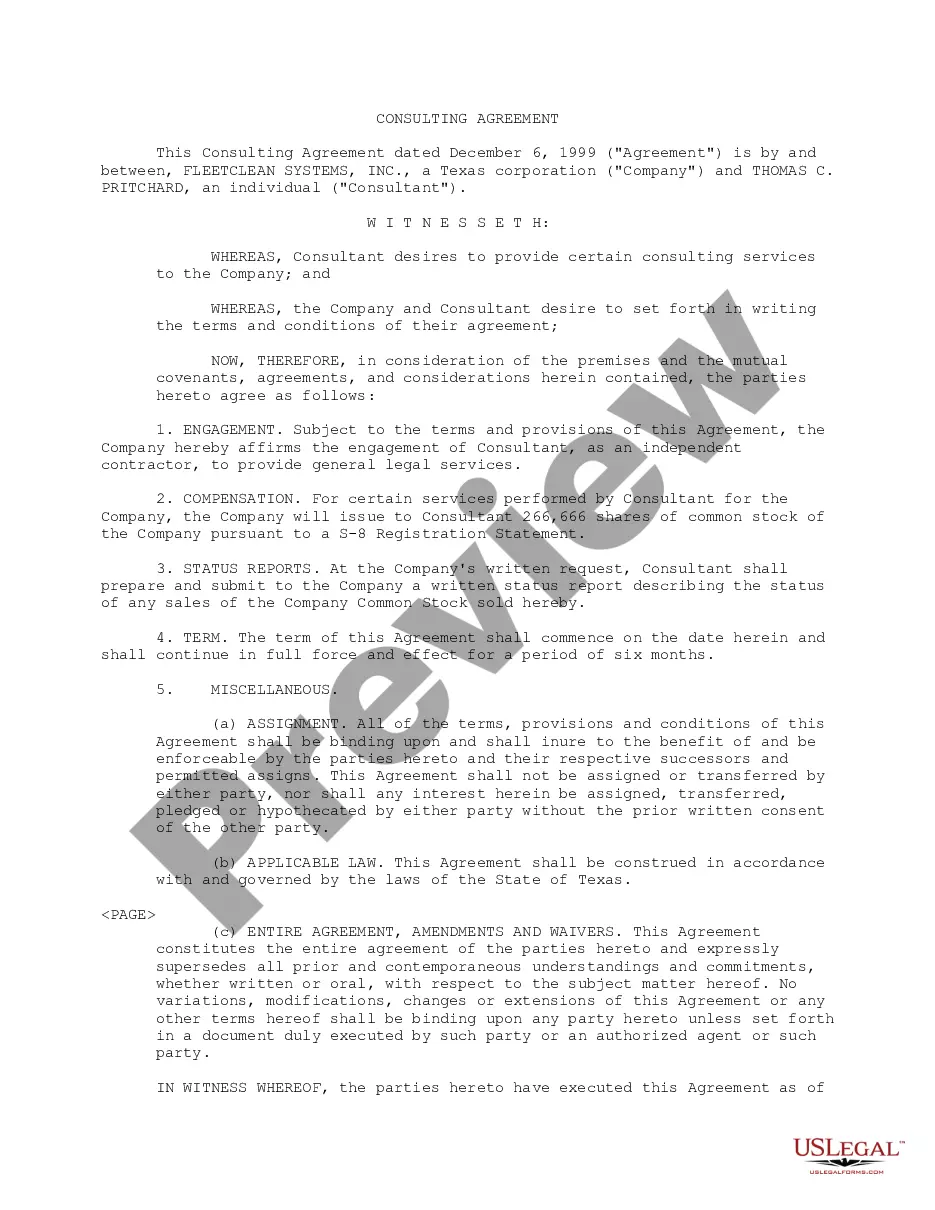

US Legal Forms - one of several largest libraries of lawful kinds in the States - gives a wide range of lawful record layouts you may down load or printing. Making use of the website, you will get a huge number of kinds for business and person purposes, sorted by types, claims, or keywords and phrases.You can find the most up-to-date variations of kinds just like the Maine Employee Stock Ownership Plan of First American Health Concepts, Inc. within minutes.

If you already have a registration, log in and down load Maine Employee Stock Ownership Plan of First American Health Concepts, Inc. from the US Legal Forms library. The Down load switch will show up on every form you look at. You have accessibility to all earlier downloaded kinds in the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, listed here are simple guidelines to get you started:

- Ensure you have picked out the right form for the area/region. Click on the Preview switch to check the form`s content. Browse the form outline to actually have chosen the appropriate form.

- In the event the form doesn`t suit your demands, make use of the Search area at the top of the monitor to get the one that does.

- If you are pleased with the shape, validate your choice by simply clicking the Purchase now switch. Then, select the pricing program you like and give your accreditations to register for an bank account.

- Method the transaction. Use your Visa or Mastercard or PayPal bank account to accomplish the transaction.

- Select the formatting and down load the shape in your system.

- Make modifications. Fill up, change and printing and indicator the downloaded Maine Employee Stock Ownership Plan of First American Health Concepts, Inc..

Every web template you included with your bank account does not have an expiration day and it is your own property permanently. So, if you would like down load or printing another copy, just go to the My Forms segment and click on on the form you require.

Obtain access to the Maine Employee Stock Ownership Plan of First American Health Concepts, Inc. with US Legal Forms, by far the most substantial library of lawful record layouts. Use a huge number of skilled and express-certain layouts that satisfy your business or person demands and demands.

Form popularity

FAQ

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.

ESOP Example Exercise dateJanuary 1, 2022Exercise priceRs. 85/shareTaxable value of perquisite150 ? 85 = Rs. 65/shareNumber of shares exercised1,000Total taxable perquisite1,000*65 = Rs. 65,0002 more rows

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

While ESOPs offer tax benefits and can boost employee morale, there are downsides to keep in mind. These programs can be expensive and potentially lower the value of your business, which could impact your long-term exit strategy.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Other notable examples of employee-owned companies include Penmac Staffing, WinCo Foods, and Brookshire Brothers. It's believed ESOP programs motivate employees to take more accountability over their work and improve their performance because they have a stake in the company.

ESOP participants don't invest their own money. Rather, their shares of company stock are earned over time. After an ESOP trust is established, the company uses funds that would typically go toward income tax liabilities to pay the selling owner for the shares sold to the ESOP.

Here are some of the potential challenges associated with ESOPs: Price per share has limitations: Price per share is dependent upon the company's performance. Without viable profits, the value of the company decreases, which means the value of shares may fluctuate.