Maine Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans

Description

How to fill out Proposals To Approve Employees' Stock Deferral Plan And Directors' Stock Deferral Plan With Copy Of Plans?

Have you been within a situation in which you require files for both company or specific functions virtually every working day? There are plenty of authorized record web templates available on the net, but getting kinds you can depend on isn`t effortless. US Legal Forms gives a huge number of develop web templates, such as the Maine Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans, that happen to be created to meet federal and state needs.

When you are currently acquainted with US Legal Forms internet site and possess your account, just log in. Following that, you may acquire the Maine Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans template.

Unless you come with an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Discover the develop you want and make sure it is to the correct city/state.

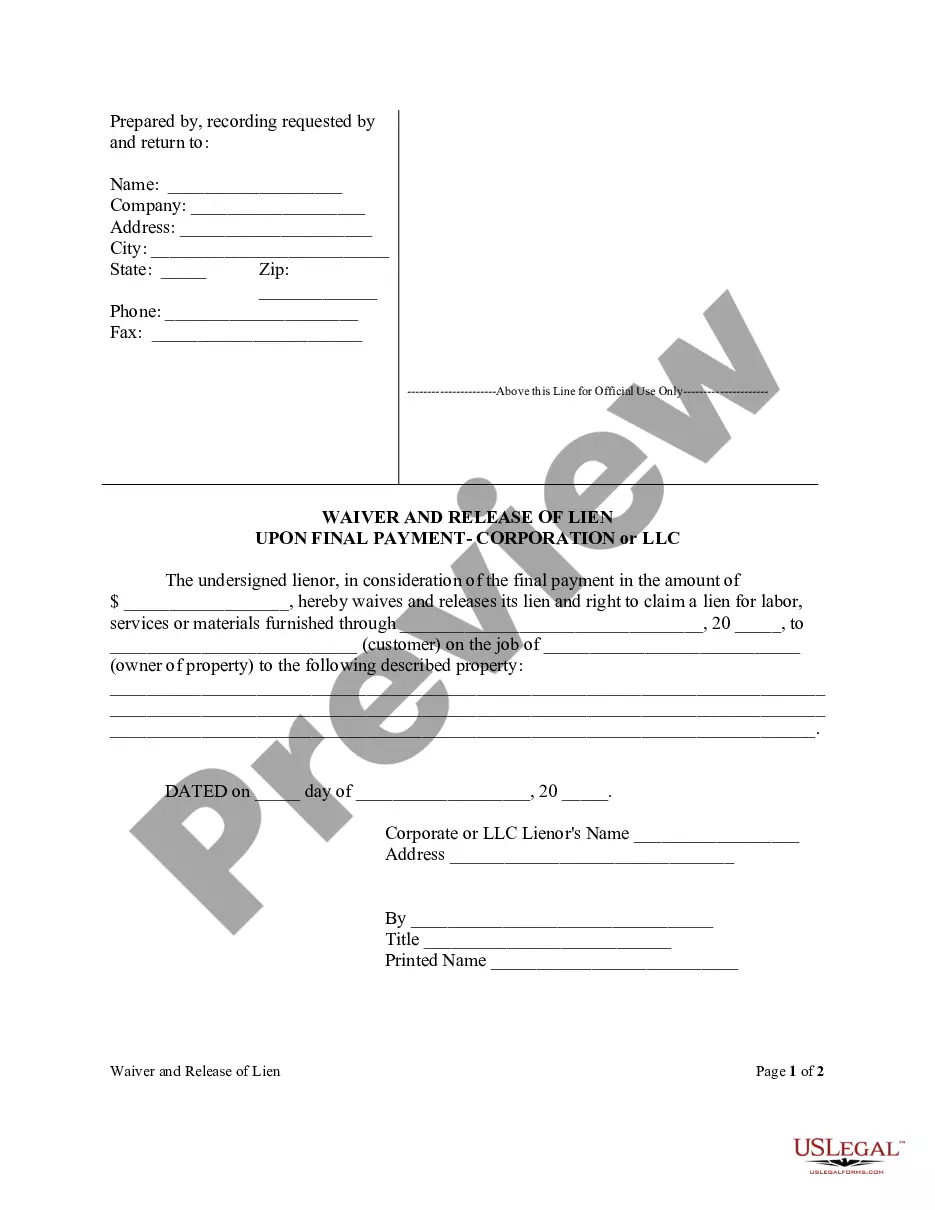

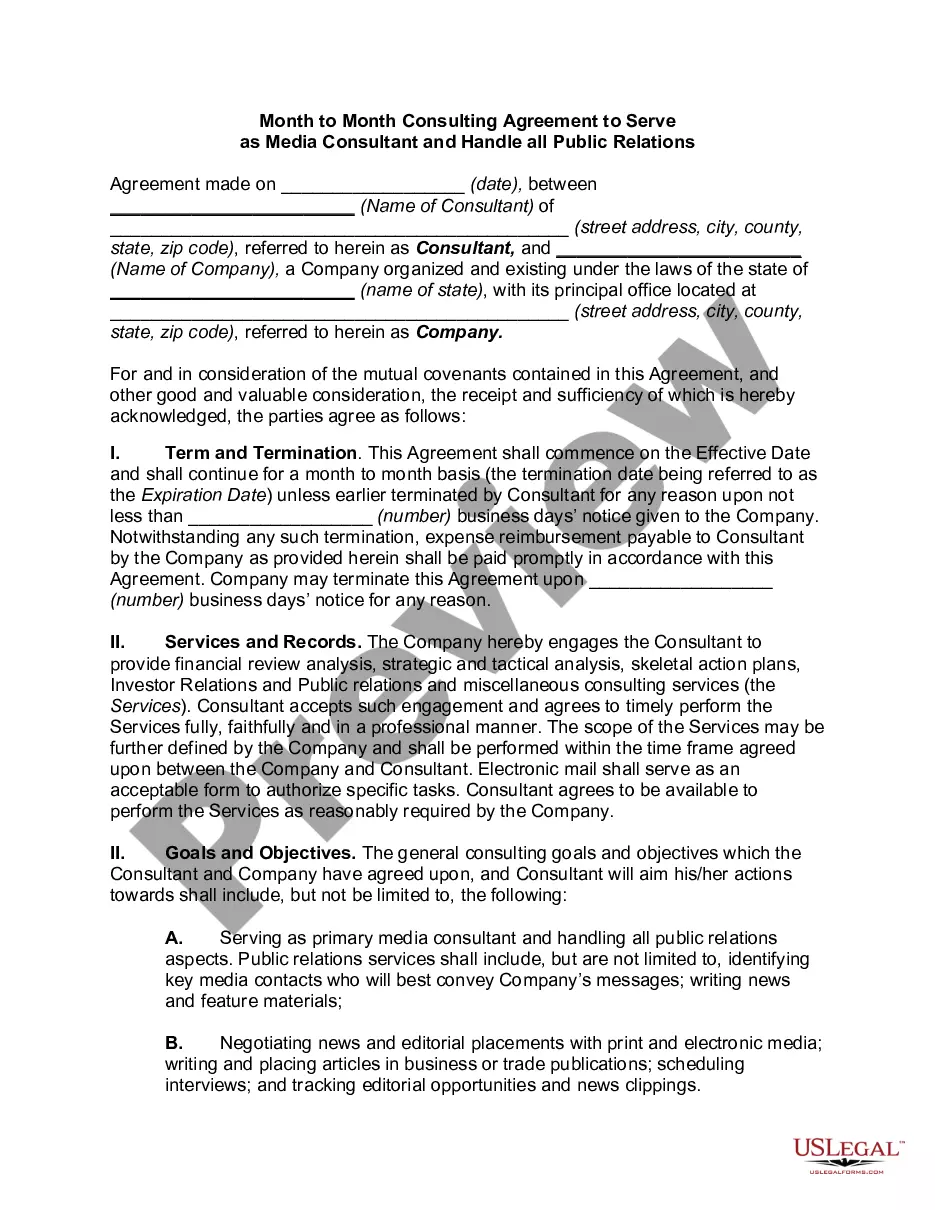

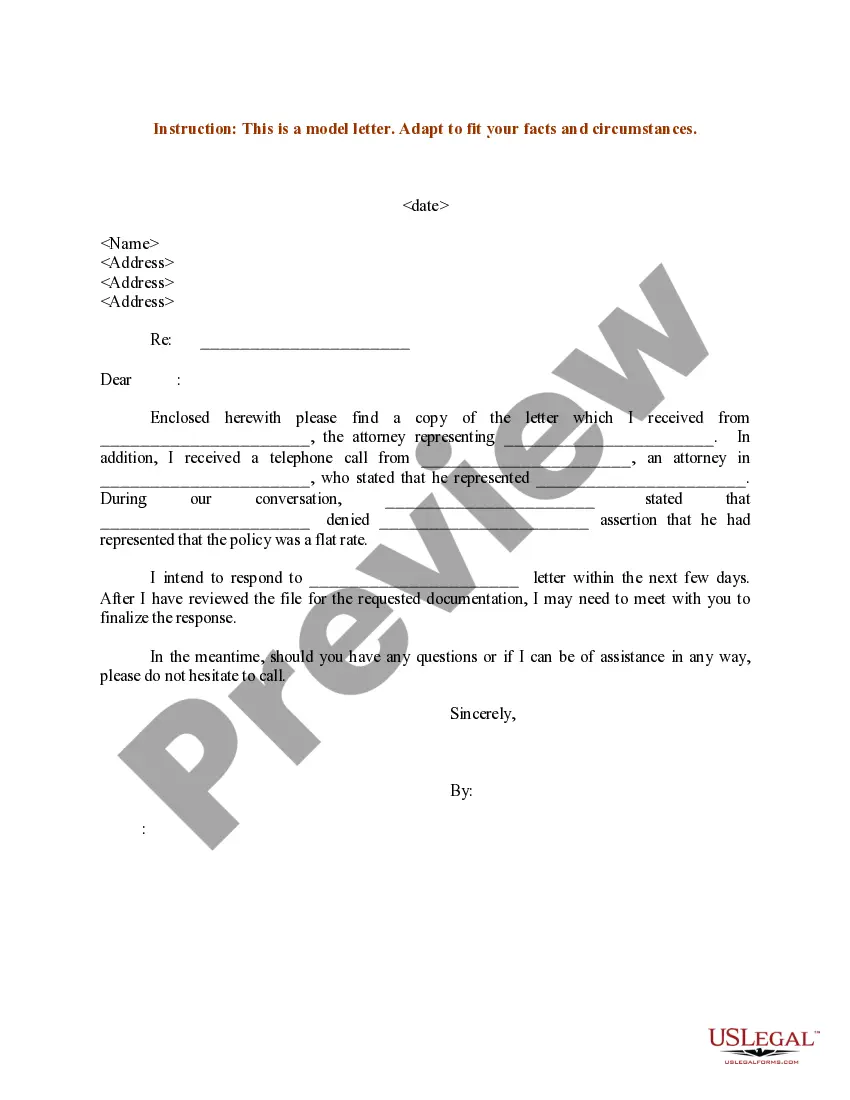

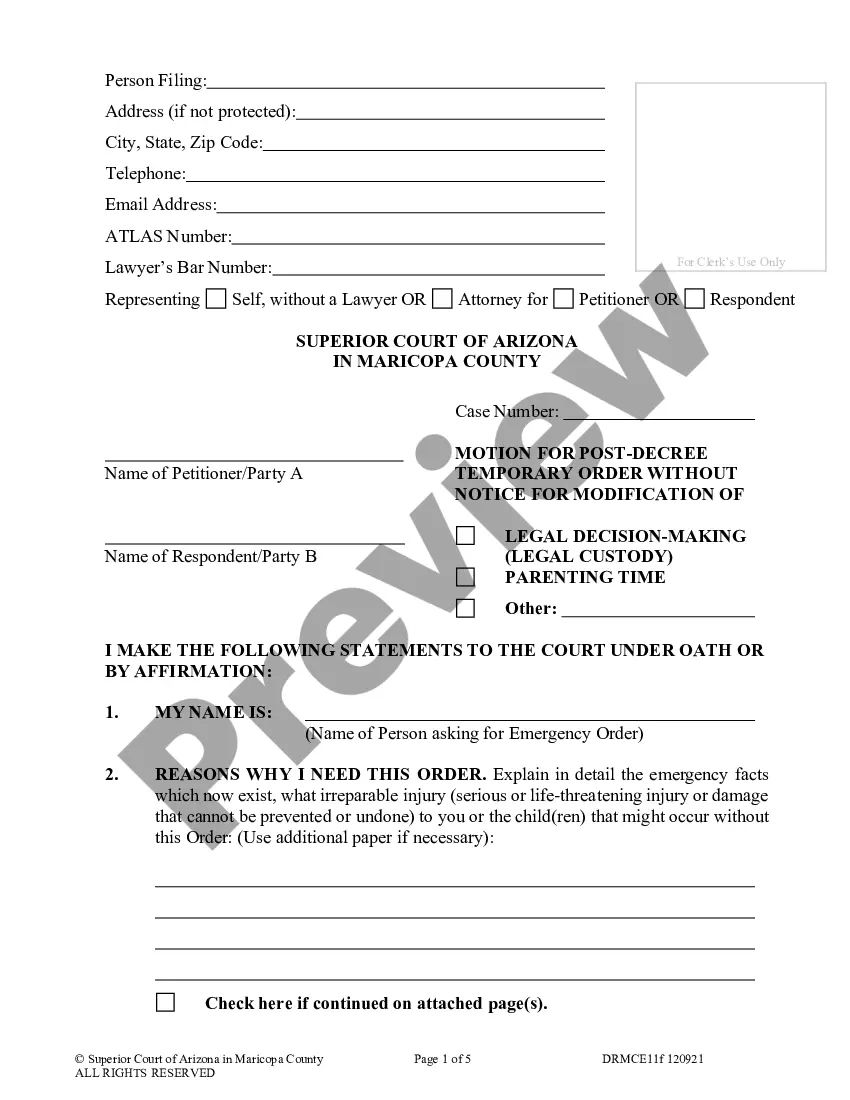

- Utilize the Review button to examine the form.

- Look at the explanation to ensure that you have selected the appropriate develop.

- When the develop isn`t what you`re searching for, utilize the Research area to get the develop that fits your needs and needs.

- When you obtain the correct develop, simply click Get now.

- Opt for the prices plan you want, fill in the specified details to produce your bank account, and pay for an order using your PayPal or credit card.

- Pick a hassle-free paper structure and acquire your duplicate.

Find each of the record web templates you have bought in the My Forms food list. You can aquire a extra duplicate of Maine Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans at any time, if needed. Just go through the needed develop to acquire or printing the record template.

Use US Legal Forms, the most extensive variety of authorized forms, to save some time and steer clear of blunders. The services gives appropriately produced authorized record web templates that you can use for a variety of functions. Produce your account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

There are two types of deferred compensation plans: non-qualified and qualified. Non-qualified deferred compensation plans are also referred to as Section 409A or NQDC plans. Deferred compensation plans are not required for all employees.

Deferred compensation plans can be a powerful tool for early retirement goals. Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state.

Key Differences Deferred compensation plans tend to offer better investment options than most 401(k) plans, but are at a disadvantage regarding liquidity. Typically, deferred compensation funds cannot be accessed, for any reason, before the specified distribution date.

Deferred compensation plans are optional programs that allow employees (individuals who are officers or employees of a state agency) to defer income until retirement. A deferred compensation plan is offered in addition to a retirement, pension or benefit system established by law.

A 401k plan has certain limitations on the amount that an individual can contribute each year. A deferred compensation plan, on the other hand, has no maximum contribution limit in any given year.