Maine Ratification of stock bonus plan of First West Chester Corp.

Description

How to fill out Ratification Of Stock Bonus Plan Of First West Chester Corp.?

Are you inside a situation the place you need to have documents for either enterprise or specific purposes almost every day time? There are plenty of legal document web templates accessible on the Internet, but finding kinds you can depend on is not simple. US Legal Forms delivers 1000s of kind web templates, much like the Maine Ratification of stock bonus plan of First West Chester Corp., that happen to be written to meet state and federal requirements.

Should you be already familiar with US Legal Forms website and also have an account, merely log in. Following that, it is possible to acquire the Maine Ratification of stock bonus plan of First West Chester Corp. format.

Unless you offer an bank account and would like to start using US Legal Forms, adopt these measures:

- Find the kind you need and ensure it is to the correct metropolis/state.

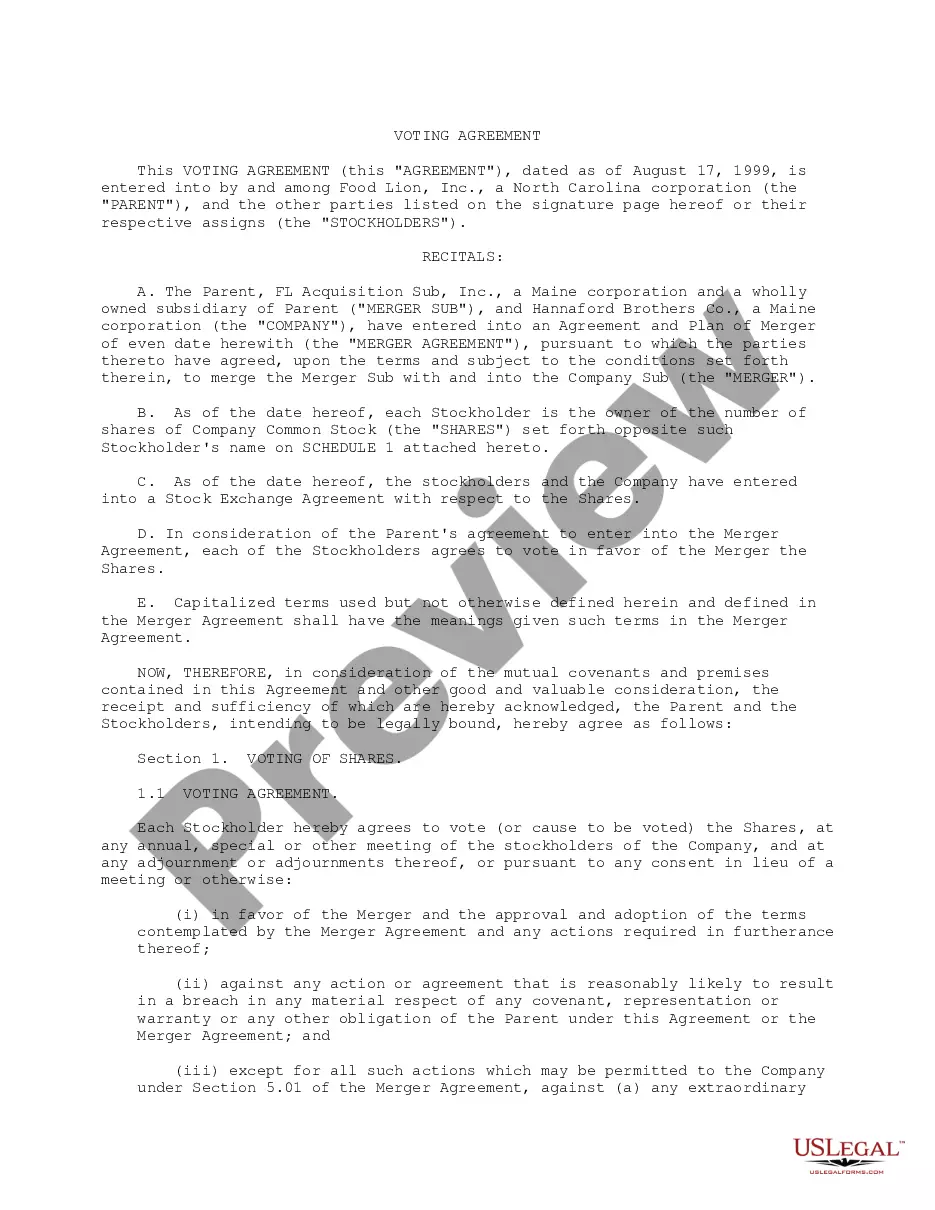

- Use the Preview key to examine the form.

- Read the information to ensure that you have selected the right kind.

- If the kind is not what you are seeking, take advantage of the Look for discipline to get the kind that meets your needs and requirements.

- Once you get the correct kind, click Purchase now.

- Select the rates strategy you desire, complete the desired information to make your account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Decide on a convenient file formatting and acquire your backup.

Discover each of the document web templates you possess bought in the My Forms menu. You can aquire a more backup of Maine Ratification of stock bonus plan of First West Chester Corp. whenever, if necessary. Just select the necessary kind to acquire or produce the document format.

Use US Legal Forms, one of the most extensive variety of legal varieties, in order to save some time and steer clear of faults. The assistance delivers expertly manufactured legal document web templates that you can use for a selection of purposes. Produce an account on US Legal Forms and initiate creating your daily life a little easier.