Maine Retirement Plan for Outside Directors

Description

How to fill out Retirement Plan For Outside Directors?

If you want to comprehensive, acquire, or print legitimate record templates, use US Legal Forms, the largest assortment of legitimate kinds, which can be found online. Utilize the site`s simple and hassle-free look for to get the documents you require. Various templates for enterprise and personal reasons are sorted by groups and suggests, or keywords. Use US Legal Forms to get the Maine Retirement Plan for Outside Directors with a handful of click throughs.

In case you are already a US Legal Forms consumer, log in in your bank account and click the Download button to get the Maine Retirement Plan for Outside Directors. You can also gain access to kinds you earlier acquired from the My Forms tab of your bank account.

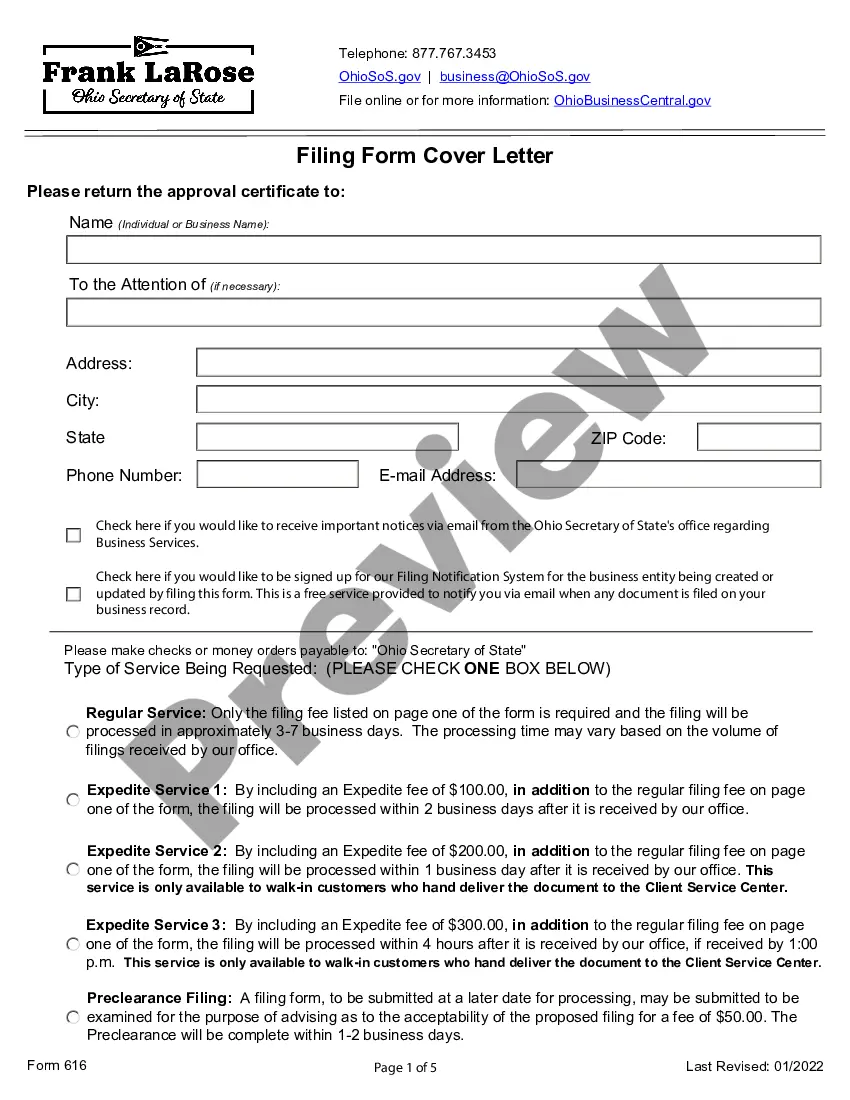

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that appropriate area/nation.

- Step 2. Take advantage of the Preview solution to look through the form`s content. Don`t forget about to read the description.

- Step 3. In case you are not satisfied with all the kind, use the Research industry towards the top of the display screen to locate other versions in the legitimate kind format.

- Step 4. Upon having identified the form you require, click the Acquire now button. Choose the pricing program you favor and include your qualifications to sign up for the bank account.

- Step 5. Process the deal. You can use your Мisa or Ьastercard or PayPal bank account to perform the deal.

- Step 6. Find the structure in the legitimate kind and acquire it on your own system.

- Step 7. Total, revise and print or indication the Maine Retirement Plan for Outside Directors.

Every single legitimate record format you acquire is your own property for a long time. You have acces to each kind you acquired with your acccount. Click on the My Forms area and select a kind to print or acquire once more.

Be competitive and acquire, and print the Maine Retirement Plan for Outside Directors with US Legal Forms. There are thousands of skilled and status-specific kinds you can use for the enterprise or personal demands.

Form popularity

FAQ

You qualify to receive a benefit upon reaching your normal retirement age of 60, 62 or 65, whether or not you are in service, provided that you have earned creditable service of 5 or 10 years, whichever amount is applicable to you.

In June 2021, Maine signed a bill into law to create the Maine Retirement Savings Program. Under the program, private-sector employers that don't offer a retirement plan must provide their employees the option to contribute to a Roth IRA from their paychecks.

The two plans are also different in that 401(k) plans do not offer a three-year Pre-Retirement Catch-Up; and 457(b) plans do. Another difference is that a 401(k) distribution prior to age 59½ may be subject to a 10% early withdrawal penalty and 457(b) plans generally do not have the same early withdrawal penalty.

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

457(b) plans are generally available for state and local government employees, as well as certain tax-exempt nonprofits. These plans are very similar to other types of employer-offered retirement accounts. Employees can make contributions up to the annual limit, invest these funds, and grow their retirement nest egg.

ERISA does not require any employer to establish a retirement plan. It only requires that those who establish plans must meet certain minimum standards. The law generally does not specify how much money a participant must be paid as a benefit.

If you invest in a 457(b) plan, you'll have access to certain advantages like tax-deferred growth and the opportunity to choose how to invest funds. There are also potential disadvantages to keep in mind, including fees that may be higher than other types of investments and no employer match.

The MaineSaves plan is a voluntary retirement savings program. You choose how much you'd like to save and where you'd like your money invested. This is an easy, pre-tax way to save additional funds towards retirement conveniently through payroll deduction.