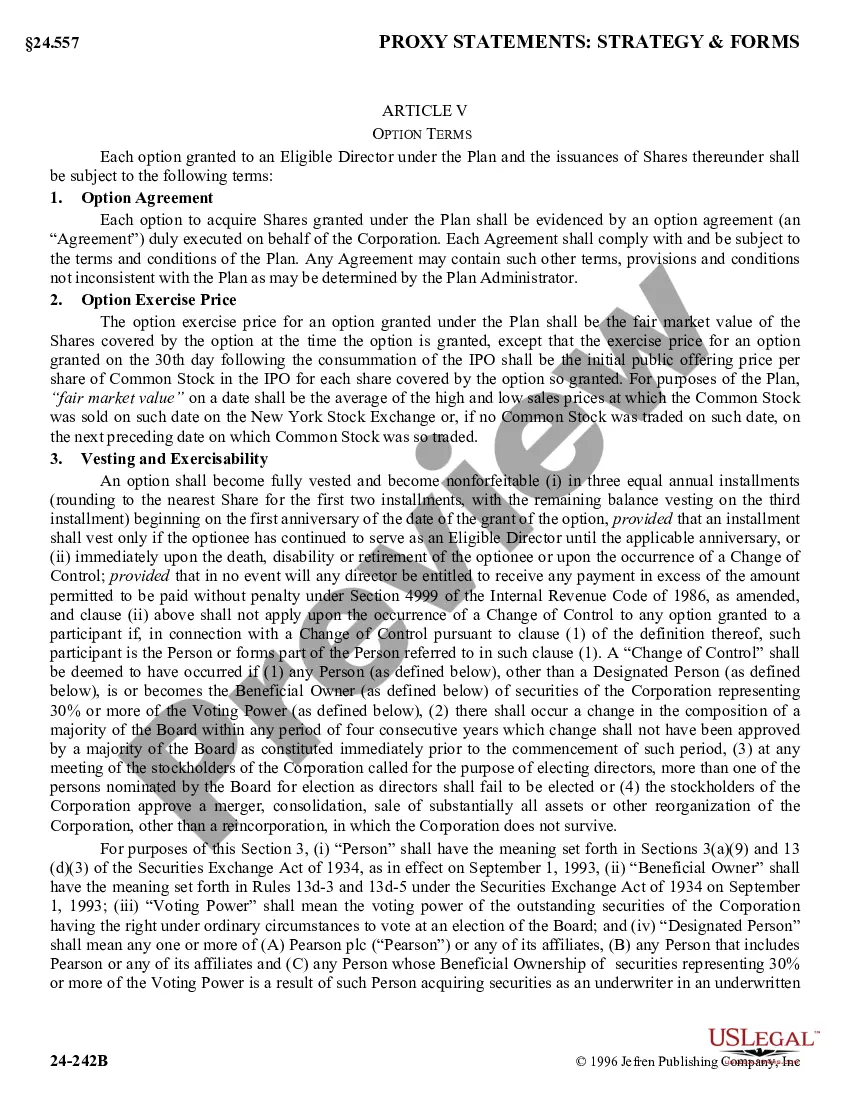

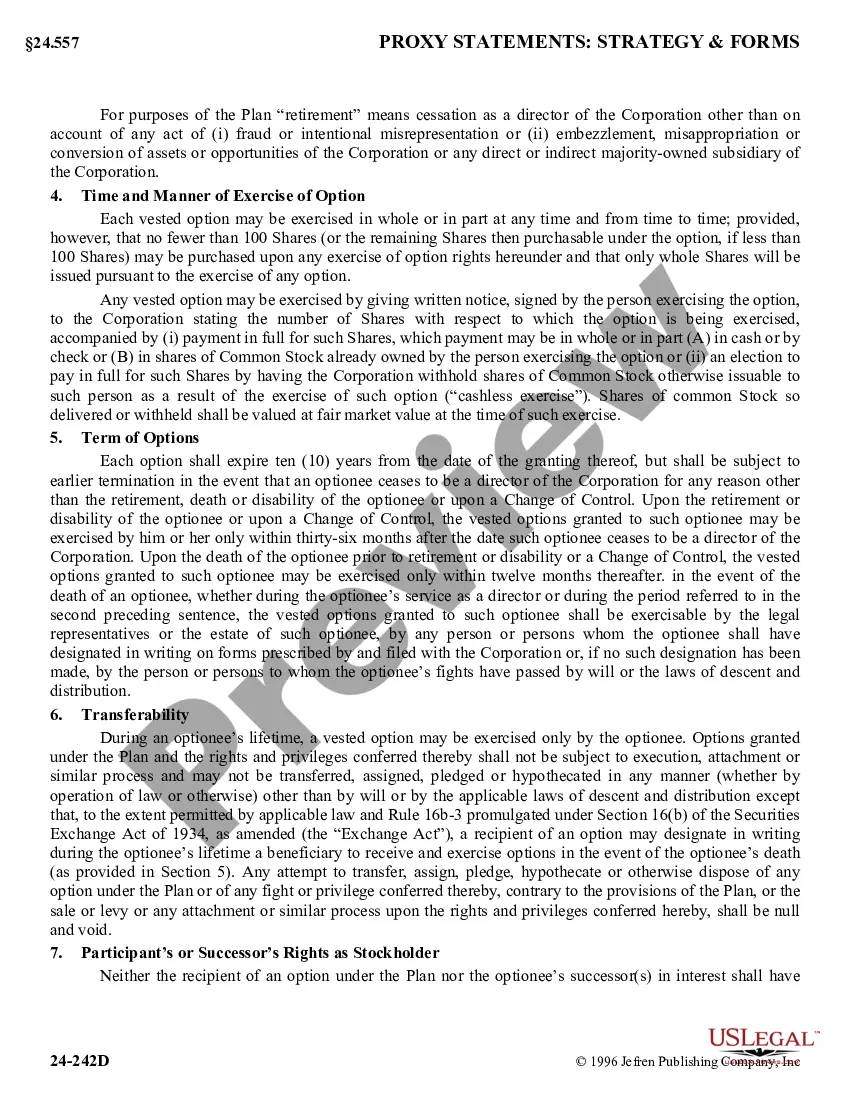

Maine Stock Option Plan for Nonemployee Directors of Camco International, Inc.

Description

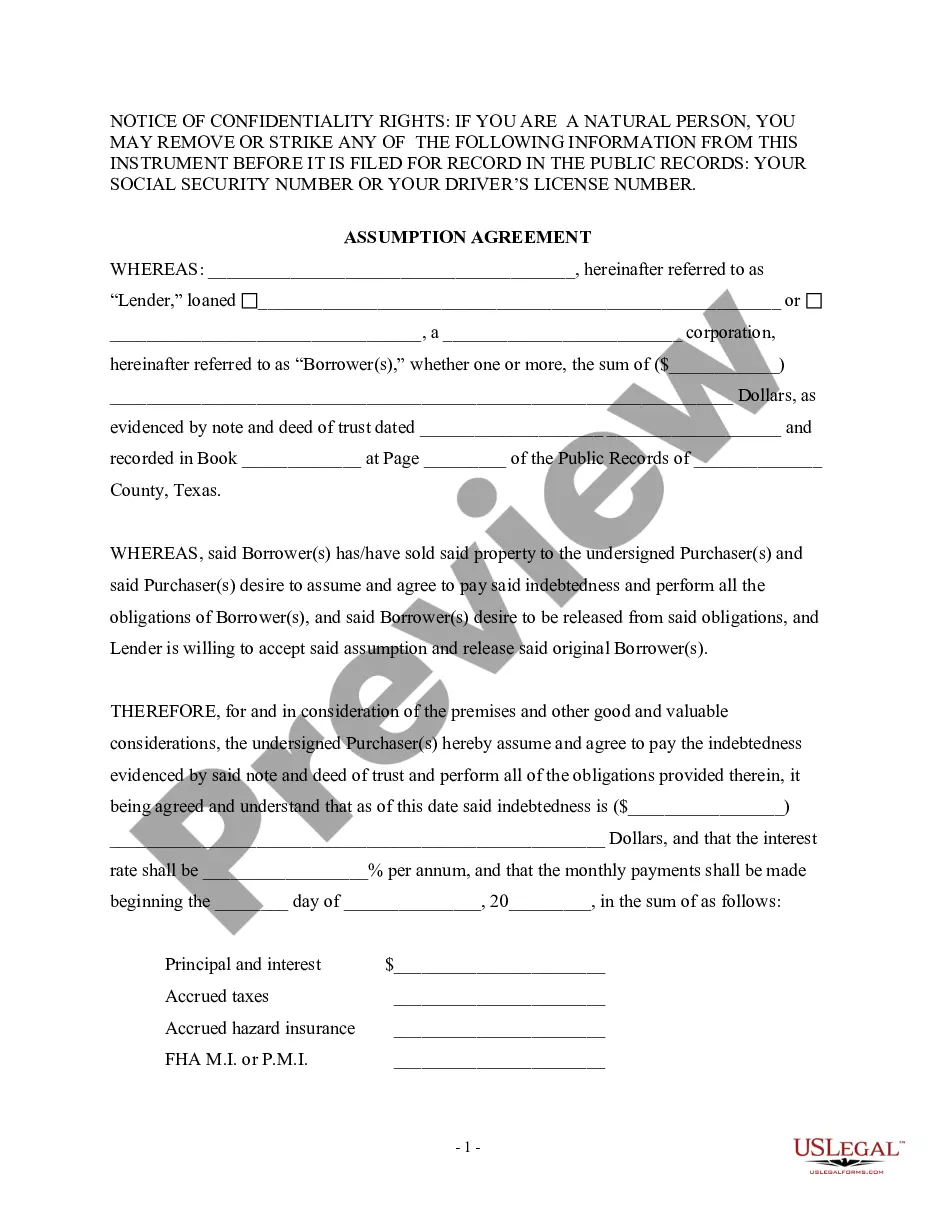

How to fill out Stock Option Plan For Nonemployee Directors Of Camco International, Inc.?

If you need to comprehensive, download, or produce authorized file themes, use US Legal Forms, the most important assortment of authorized varieties, that can be found online. Take advantage of the site`s simple and easy handy research to discover the paperwork you require. Various themes for business and specific reasons are sorted by groups and says, or key phrases. Use US Legal Forms to discover the Maine Stock Option Plan for Nonemployee Directors of Camco International, Inc. within a few clicks.

In case you are currently a US Legal Forms buyer, log in in your account and click the Download button to obtain the Maine Stock Option Plan for Nonemployee Directors of Camco International, Inc.. You can also accessibility varieties you earlier delivered electronically from the My Forms tab of the account.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the form to the correct town/country.

- Step 2. Take advantage of the Review solution to check out the form`s articles. Do not overlook to learn the information.

- Step 3. In case you are not satisfied with the kind, utilize the Lookup field near the top of the display screen to discover other versions in the authorized kind design.

- Step 4. Once you have found the form you require, select the Get now button. Select the prices program you prefer and put your credentials to register for the account.

- Step 5. Procedure the transaction. You should use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the structure in the authorized kind and download it on the gadget.

- Step 7. Full, revise and produce or indicator the Maine Stock Option Plan for Nonemployee Directors of Camco International, Inc..

Every authorized file design you buy is yours for a long time. You possess acces to each and every kind you delivered electronically inside your acccount. Click the My Forms section and choose a kind to produce or download once again.

Compete and download, and produce the Maine Stock Option Plan for Nonemployee Directors of Camco International, Inc. with US Legal Forms. There are many expert and express-distinct varieties you can use for your personal business or specific needs.