Maine Split-Dollar Life Insurance

Description

How to fill out Split-Dollar Life Insurance?

If you need to full, down load, or print authorized document themes, use US Legal Forms, the largest collection of authorized varieties, which can be found on the web. Use the site`s basic and convenient lookup to get the papers you will need. Numerous themes for company and person reasons are sorted by groups and states, or keywords. Use US Legal Forms to get the Maine Split-Dollar Life Insurance with a number of clicks.

In case you are already a US Legal Forms consumer, log in for your profile and click the Acquire option to obtain the Maine Split-Dollar Life Insurance. You can also accessibility varieties you formerly downloaded in the My Forms tab of your own profile.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have selected the form for your appropriate metropolis/country.

- Step 2. Use the Review solution to look through the form`s content. Never overlook to see the outline.

- Step 3. In case you are unsatisfied with all the develop, take advantage of the Search industry at the top of the monitor to locate other versions in the authorized develop template.

- Step 4. When you have located the form you will need, go through the Buy now option. Pick the costs strategy you favor and add your credentials to sign up for an profile.

- Step 5. Approach the transaction. You can utilize your credit card or PayPal profile to complete the transaction.

- Step 6. Find the formatting in the authorized develop and down load it on your own product.

- Step 7. Comprehensive, change and print or sign the Maine Split-Dollar Life Insurance.

Each and every authorized document template you acquire is your own eternally. You might have acces to every single develop you downloaded within your acccount. Click the My Forms segment and choose a develop to print or down load yet again.

Be competitive and down load, and print the Maine Split-Dollar Life Insurance with US Legal Forms. There are thousands of expert and status-distinct varieties you can use to your company or person demands.

Form popularity

FAQ

While split-dollar life insurance arrangements offer numerous advantages, they also come with potential drawbacks, such as complexity, tax considerations, and limited availability. Both employers and employees must carefully weigh the benefits and disadvantages of this type of arrangement before deciding to pursue it.

Employers are responsible for making split-dollar life insurance premiums, regardless of the plan's type. However, it is important to note that under loan arrangements, employees must repay the premiums via collateral assignments made to their employer.

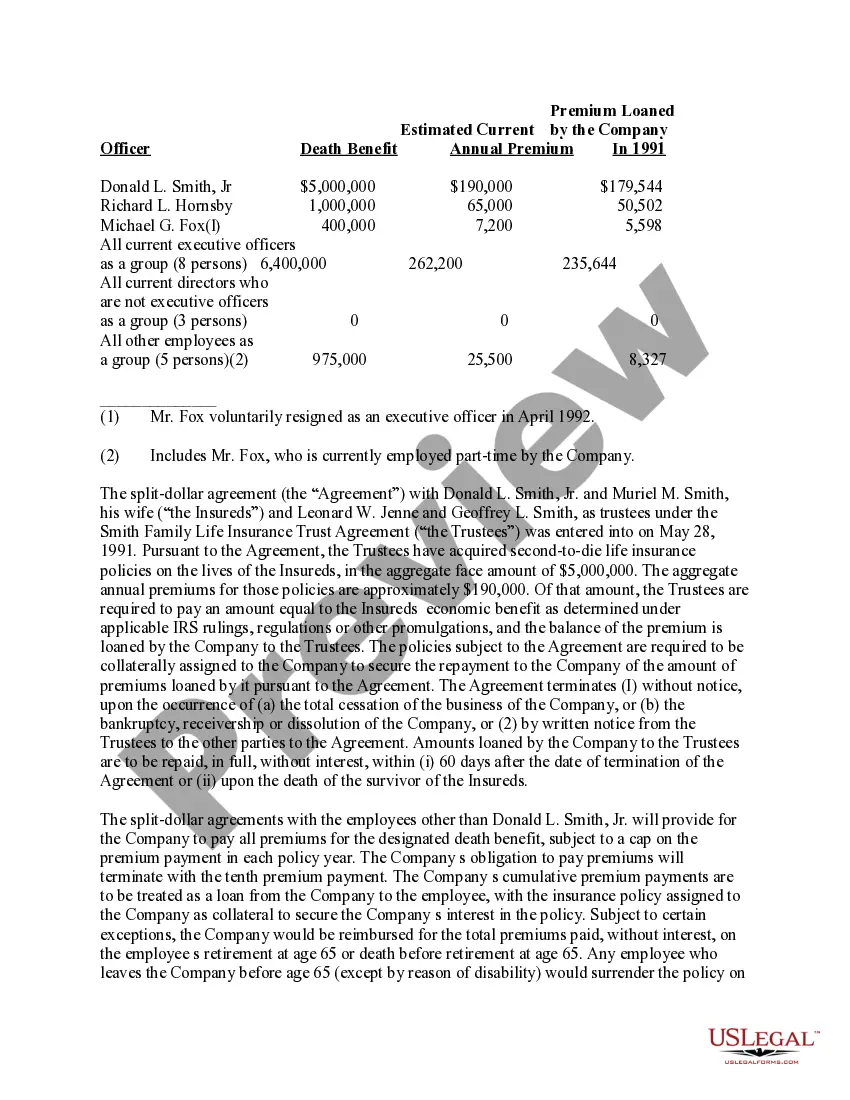

Split Dollar Loan Regime Agreement & Contract Generally, at the employee's death, the employer receives a portion of the death benefit (usually equal to the total premiums plus interest from the loan) and the employee's beneficiary receives the balance.

Split-dollar plans are usually used to help businesses address the financial risk of losing a high value employee unexpectedly. Most often, the premiums are paid by the employer, and the benefits are split between the employer and the family of the deceased.

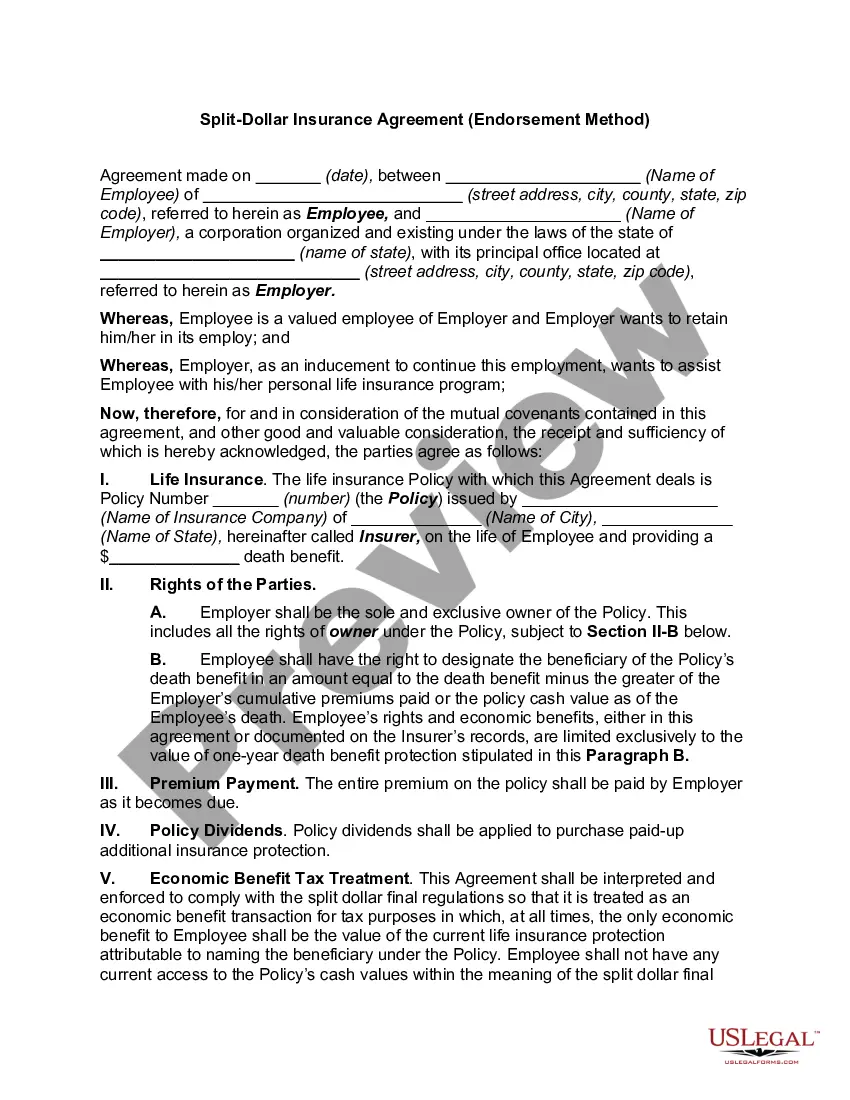

In a split-dollar plan, an employer and employee execute a written agreement that outlines how they will share the premium cost, cash value, and death benefit of a life insurance policy. Split-dollar plans are frequently used by employers to provide supplemental benefits for executives and to help retain key employees.

?Economic benefit? refers to how the IRS treats this type of split-dollar insurance agreement. It means your employer is giving you some benefit but not a loan. That means you'll be taxed on the value of the life insurance provided, and that value is determined by the IRS or the insurance company.

Split-dollar payment arrangements generally take one of two forms: The employer pays the premiums and owns the contract. The employer receives reimbursement of the premiums upon the employee's death, and the employee's beneficiary then receives the balance of the insurance proceeds.

Some potential disadvantages of split dollar life insurance include complex tax implications, potential disputes over policy ownership, limitations on the employee's ability to access cash value, and the need for careful planning to ensure compliance with applicable regulations.