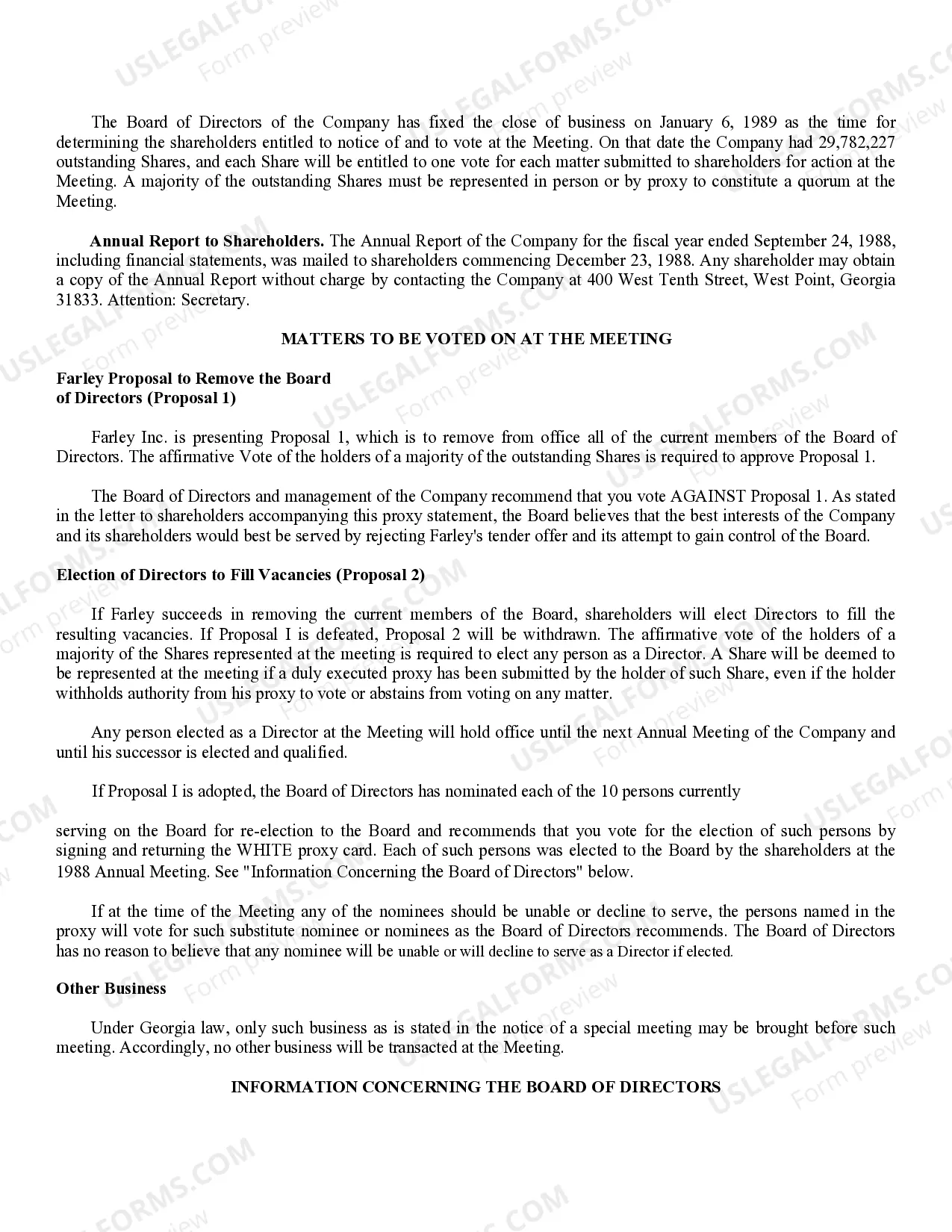

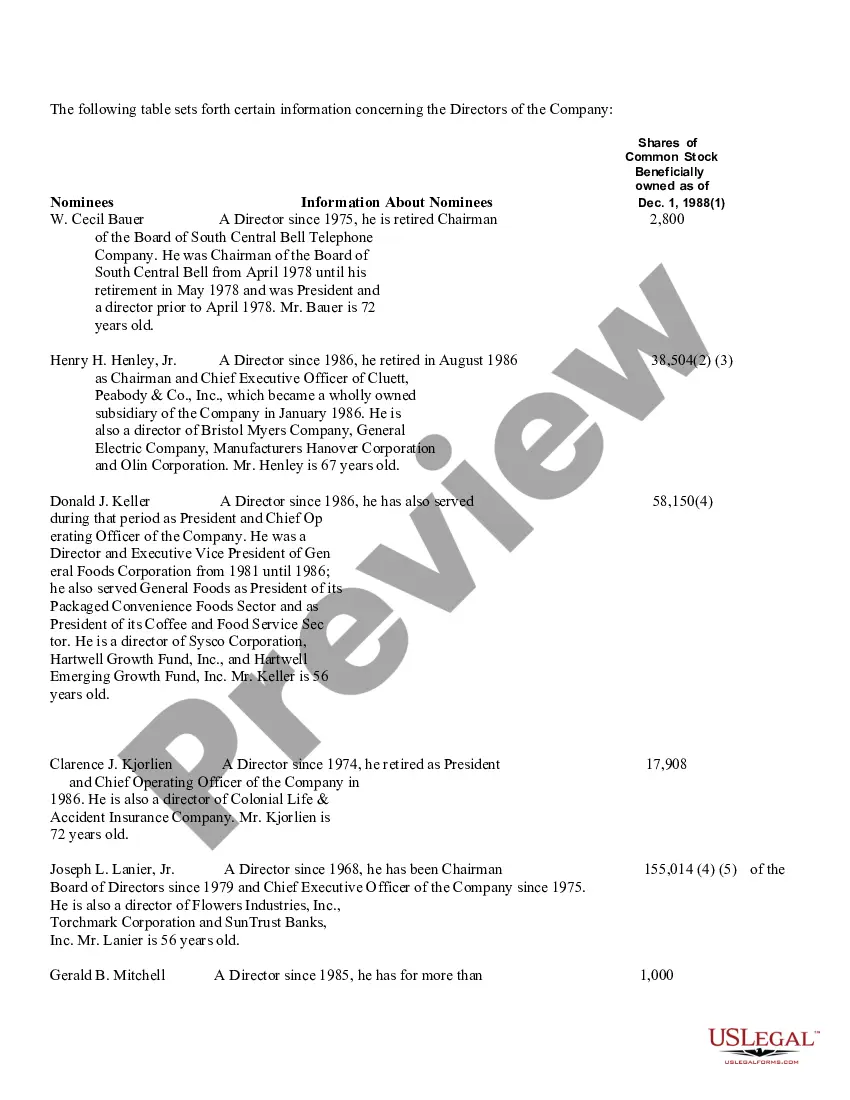

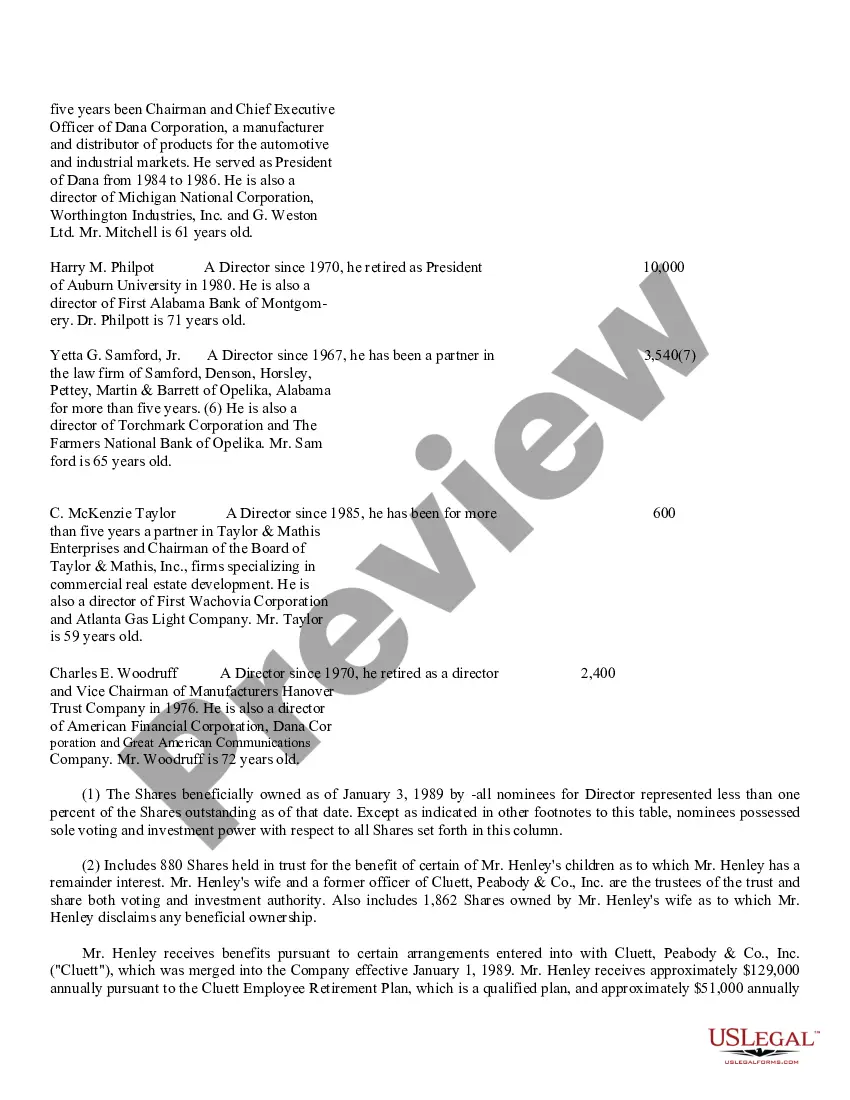

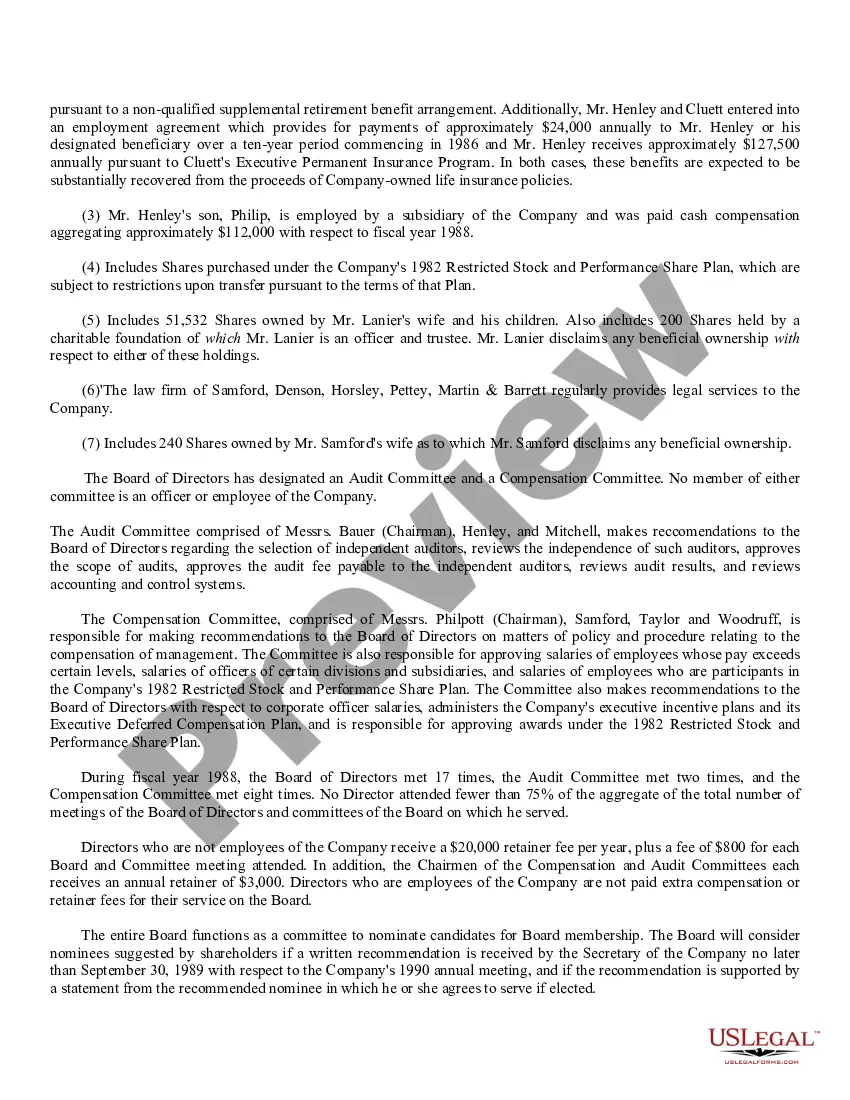

Maine Proxy Statement with appendices of West Point-Pepperell, Inc.

Description

How to fill out Proxy Statement With Appendices Of West Point-Pepperell, Inc.?

You are able to devote time on the Internet looking for the authorized record design that fits the state and federal needs you want. US Legal Forms supplies a large number of authorized kinds that happen to be evaluated by professionals. You can easily acquire or print the Maine Proxy Statement with appendices of West Point-Pepperell, Inc. from my support.

If you currently have a US Legal Forms profile, you can log in and click the Download option. Afterward, you can comprehensive, edit, print, or signal the Maine Proxy Statement with appendices of West Point-Pepperell, Inc.. Each authorized record design you acquire is the one you have permanently. To acquire an additional copy associated with a bought form, visit the My Forms tab and click the related option.

Should you use the US Legal Forms website the first time, keep to the straightforward directions under:

- Very first, ensure that you have selected the proper record design for that state/area of your choosing. Read the form outline to make sure you have picked the appropriate form. If offered, make use of the Preview option to appear with the record design also.

- In order to locate an additional edition from the form, make use of the Search area to get the design that meets your requirements and needs.

- After you have located the design you desire, just click Purchase now to continue.

- Find the prices prepare you desire, type in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can use your credit card or PayPal profile to cover the authorized form.

- Find the structure from the record and acquire it for your product.

- Make adjustments for your record if required. You are able to comprehensive, edit and signal and print Maine Proxy Statement with appendices of West Point-Pepperell, Inc..

Download and print a large number of record layouts using the US Legal Forms web site, that provides the most important collection of authorized kinds. Use specialist and condition-particular layouts to handle your organization or person requirements.