The Maine Amendment to the articles of incorporation to eliminate par value is an important legal process that allows a corporation to remove the stated par value of its shares. This amendment modifies the original articles of incorporation, which typically specify the par value of the company's stock. By eliminating par value, a corporation gains more flexibility in determining the price of its shares. Par value represents the minimum price at which a share can be issued, and it sets a base level of liability for shareholders. However, par value often becomes irrelevant over time, as the market value of shares may far exceed the designated par value. The Maine Amendment enables companies to adapt to changing market conditions and adjust their capital structure without the limitations imposed by par value. Without a par value, corporations have the option to issue shares at prices determined by market demand, supply, and the financial condition of the company. Maine's law offers different types of amendments to the articles of incorporation to eliminate par value. Some of these variations include: 1. Standard Amendment to Eliminate Par Value: This amendment allows corporations to remove the par value designation from their shares, granting them greater flexibility in pricing their stocks. It requires submitting the necessary paperwork to the Maine Secretary of State, such as the amendment form and the required filing fee. 2. Reverse Stock Split Amendment: This amendment is applicable when a corporation wants to reduce the number of its outstanding shares while maintaining the same total capitalization. By increasing the par value per share proportionally, the reverse stock split amendment eliminates excess shares and adjusts the par value accordingly. 3. Conversion to No-Par Value Stock Amendment: In some cases, a corporation might opt to convert its shares from having a par value to no-par value stock. This amendment entails altering the articles of incorporation to remove the par value specification entirely, providing the corporation with more flexibility in determining share prices. Regardless of the specific Maine Amendment chosen, the process typically involves drafting the necessary amendment documents, obtaining approval from the board of directors and shareholders, and filing the amendment with the Maine Secretary of State. It is advisable to consult with legal professionals or corporate attorneys who specialize in Maine corporate law to ensure compliance with all legal requirements and procedures. In summary, the Maine Amendment to the articles of incorporation to eliminate par value allows corporations to remove the fixed minimum price of their shares, granting them greater flexibility in determining share prices. This amendment helps businesses streamline their capital structure and adapt to market dynamics while complying with Maine corporate laws.

Maine Amendment to the articles of incorporation to eliminate par value

Description

How to fill out Maine Amendment To The Articles Of Incorporation To Eliminate Par Value?

US Legal Forms - among the greatest libraries of legitimate types in the States - provides an array of legitimate record web templates you can obtain or produce. Using the internet site, you will get a large number of types for business and individual functions, sorted by groups, says, or key phrases.You can find the most recent types of types much like the Maine Amendment to the articles of incorporation to eliminate par value in seconds.

If you already have a monthly subscription, log in and obtain Maine Amendment to the articles of incorporation to eliminate par value through the US Legal Forms library. The Acquire key will appear on every single kind you perspective. You have accessibility to all in the past delivered electronically types within the My Forms tab of your own accounts.

If you want to use US Legal Forms the very first time, here are simple directions to help you started off:

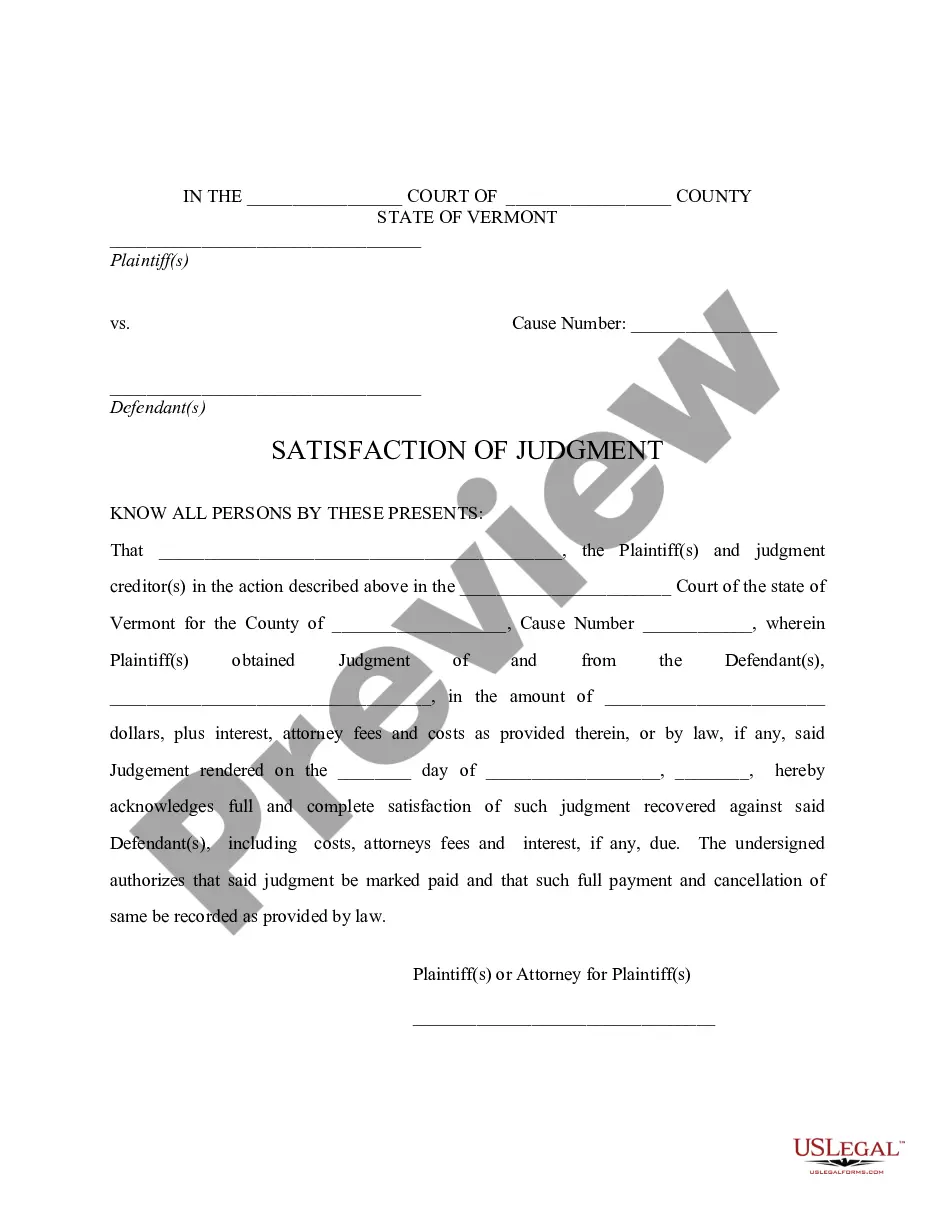

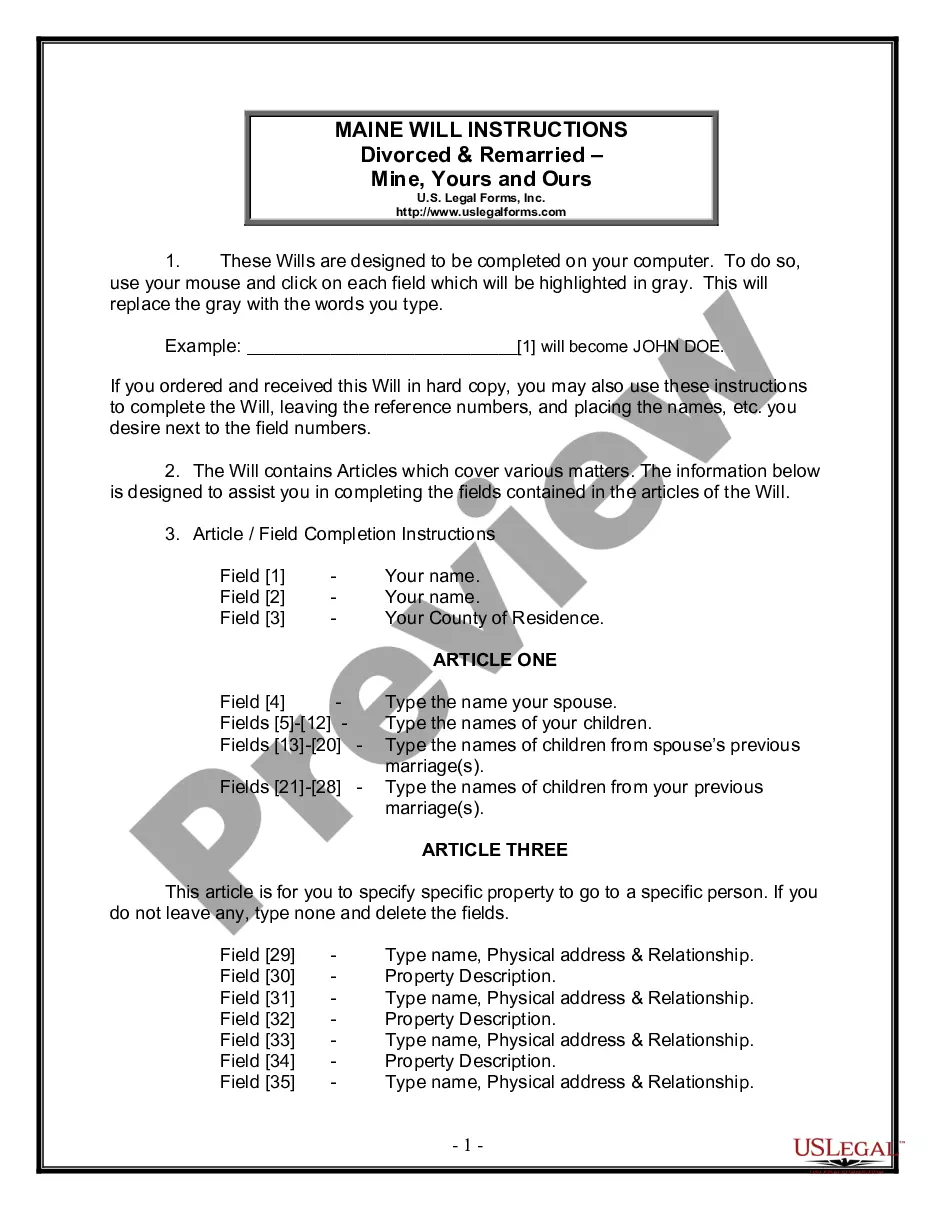

- Ensure you have selected the best kind for your personal metropolis/region. Go through the Review key to review the form`s information. Look at the kind outline to ensure that you have chosen the proper kind.

- If the kind doesn`t match your specifications, use the Research area near the top of the display screen to find the the one that does.

- In case you are happy with the form, confirm your choice by clicking the Get now key. Then, choose the rates program you favor and provide your accreditations to sign up for an accounts.

- Process the financial transaction. Make use of your bank card or PayPal accounts to complete the financial transaction.

- Pick the file format and obtain the form on the device.

- Make changes. Complete, change and produce and indicator the delivered electronically Maine Amendment to the articles of incorporation to eliminate par value.

Every template you put into your bank account does not have an expiry time and is your own property for a long time. So, if you want to obtain or produce yet another duplicate, just go to the My Forms area and then click on the kind you require.

Gain access to the Maine Amendment to the articles of incorporation to eliminate par value with US Legal Forms, the most comprehensive library of legitimate record web templates. Use a large number of skilled and condition-certain web templates that meet up with your business or individual requires and specifications.

Form popularity

FAQ

A California corporation generally is a legal entity which exists separately from its owners. While normally limiting the owners from personal liability, taxes are levied on the corporation as well as on the shareholders.

A corporation, sometimes called a C corp, is a legal entity that's separate from its owners. Corporations can make a profit, be taxed, and can be held legally liable. Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures. Choose a business structure | U.S. Small Business Administration sba.gov ? business-guide ? choose-business-... sba.gov ? business-guide ? choose-business-...