Maine Stock Repurchase Plan of Croft Oil Company, Inc., is a program designed by the company to repurchase its own stock from the stockholders. This plan provides an opportunity for the company to invest in its own shares, which can have several benefits, including increasing shareholder value and supporting stock price stability. By repurchasing its own stock, Croft Oil Company, Inc., aims to demonstrate confidence in its future growth and financial prospects. The Maine Stock Repurchase Plan of Croft Oil Company, Inc., operates through various mechanisms to execute the repurchase. One of the main types of stock repurchase plans is an open market repurchase plan. Through this approach, the company buys back its shares from the open market, allowing stockholders willing to sell their shares to participate. This method often provides flexibility in terms of quantity and timing, depending on market conditions. Another type of stock repurchase plan is a tender offer. In this scenario, Croft Oil Company, Inc., invites its stockholders to sell a specified number of their shares at a predetermined price and within a defined time frame. This approach can be advantageous if the company aims to repurchase a significant portion of its outstanding shares efficiently. Furthermore, a third type of stock repurchase plan is the accelerated stock repurchase (ASR) program. This plan involves entering into an agreement with an investment bank, which then repurchases a predetermined number of shares from the market on behalf of Croft Oil Company, Inc. This method enables the company to repurchase a substantial amount of shares promptly, usually within a short period. The Maine Stock Repurchase Plan implemented by Croft Oil Company, Inc., ensures compliance with applicable securities laws and regulations. The plan's specifics, such as the maximum number of shares to be repurchased, the duration of the program, and any limitations or restrictions, are disclosed in public filings with relevant authorities. By implementing the Maine Stock Repurchase Plan, Croft Oil Company, Inc., provides an opportunity for its shareholders to participate in the company's growth by selling their shares at a fair price. This plan signifies the company's commitment to enhancing shareholder value and aligning the interests of management with those of the stockholders.

Maine Stock Repurchase Plan of Croff Oil Company, Inc.

Description

How to fill out Maine Stock Repurchase Plan Of Croff Oil Company, Inc.?

Have you been in the placement in which you require documents for either organization or personal functions just about every day time? There are plenty of legal papers layouts available on the net, but locating types you can depend on is not straightforward. US Legal Forms provides a huge number of form layouts, much like the Maine Stock Repurchase Plan of Croff Oil Company, Inc., which can be published to satisfy state and federal demands.

In case you are previously knowledgeable about US Legal Forms website and get your account, just log in. Following that, you may down load the Maine Stock Repurchase Plan of Croff Oil Company, Inc. format.

If you do not provide an account and wish to start using US Legal Forms, adopt these measures:

- Obtain the form you need and ensure it is for that proper city/region.

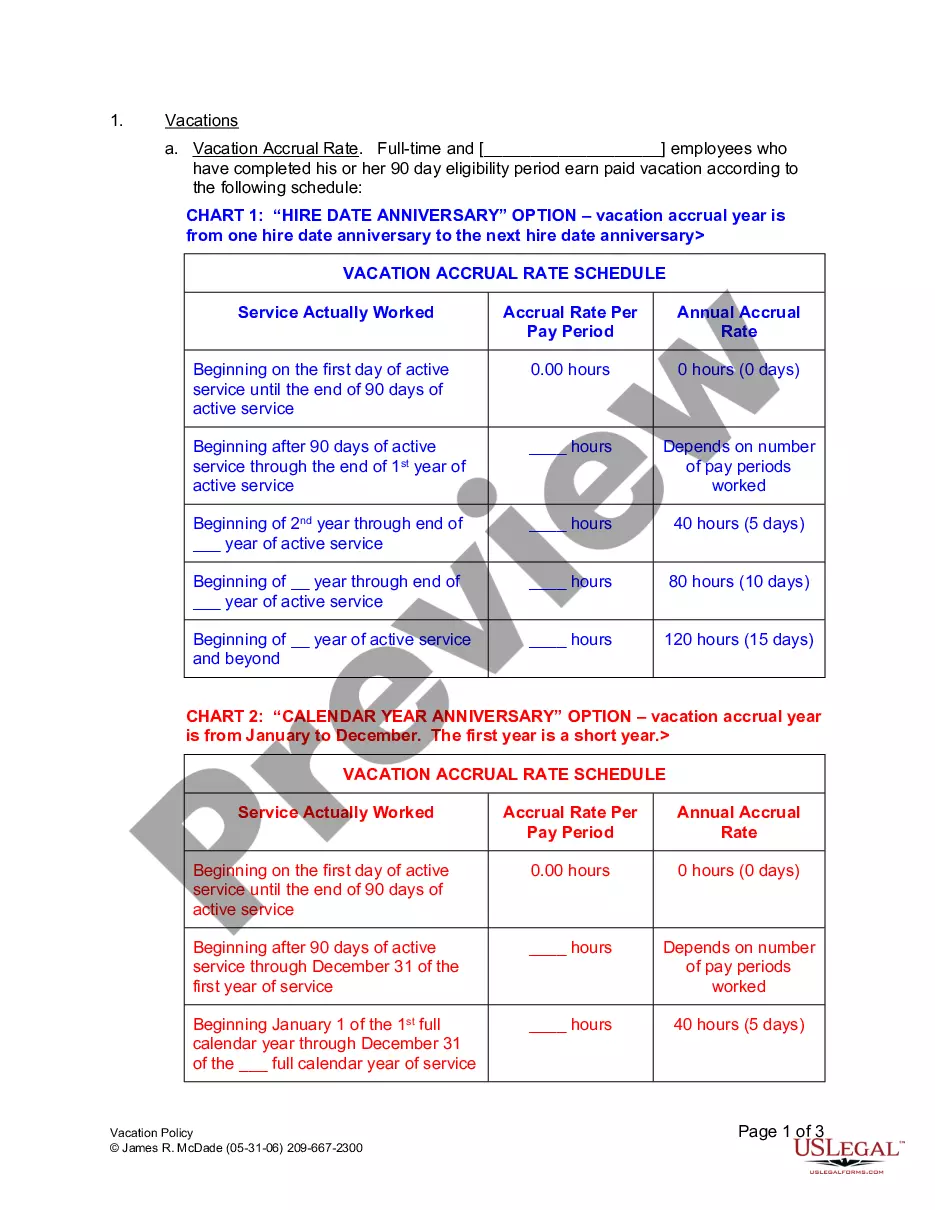

- Utilize the Preview key to check the form.

- Read the description to ensure that you have chosen the right form.

- In the event the form is not what you`re trying to find, take advantage of the Look for industry to discover the form that suits you and demands.

- When you find the proper form, click Purchase now.

- Opt for the rates plan you want, complete the desired info to generate your bank account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Pick a practical paper format and down load your copy.

Locate all the papers layouts you possess bought in the My Forms food selection. You can aquire a extra copy of Maine Stock Repurchase Plan of Croff Oil Company, Inc. whenever, if possible. Just select the required form to down load or print the papers format.

Use US Legal Forms, by far the most comprehensive collection of legal types, in order to save time as well as prevent mistakes. The service provides appropriately produced legal papers layouts which can be used for a selection of functions. Produce your account on US Legal Forms and begin producing your life easier.