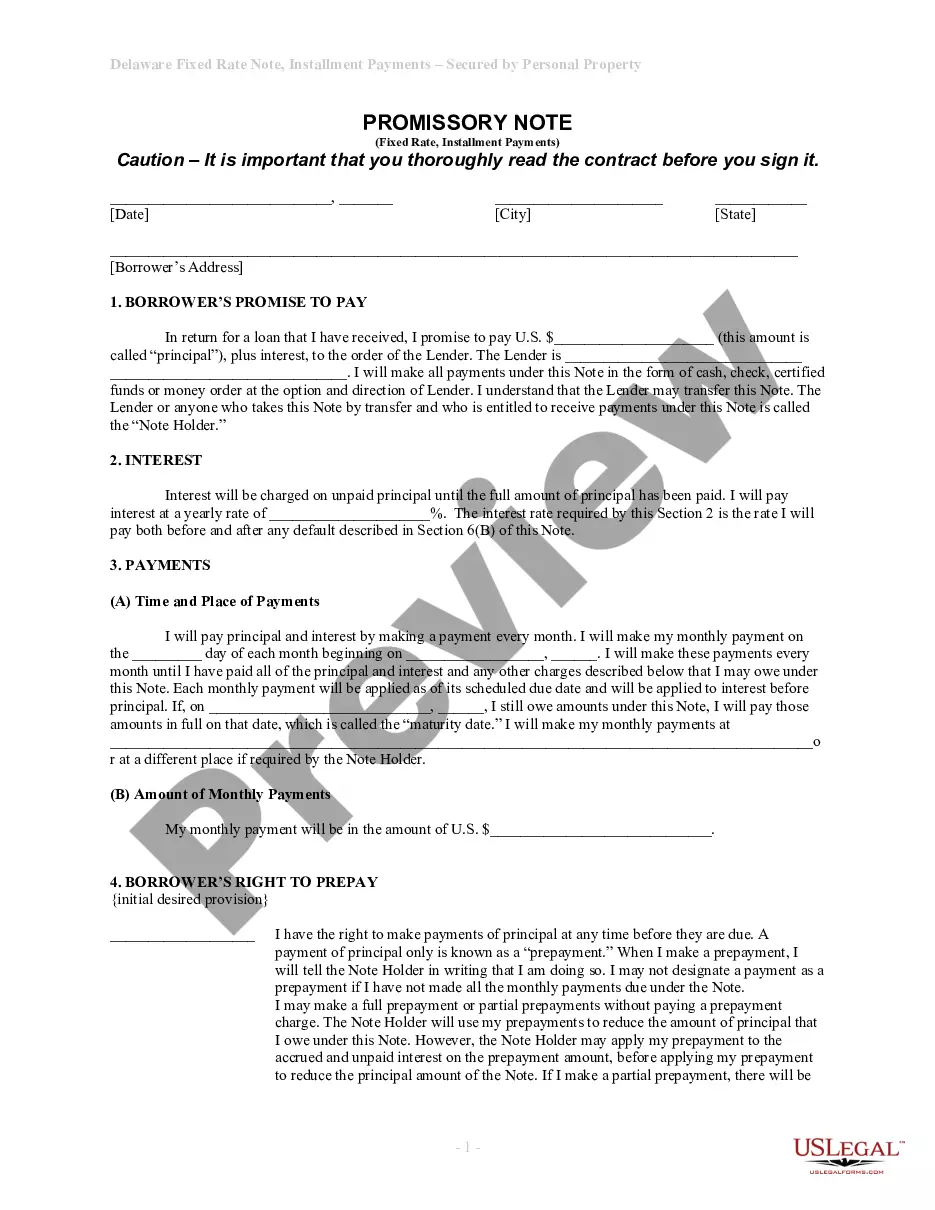

Maine Form of Revolving Promissory Note is a legal document that outlines the terms and conditions of a revolving credit agreement between a lender and a borrower in the state of Maine. This note serves as evidence of the borrower's promise to repay the borrowed amount, along with any applicable interest and fees, in a revolving manner. The Maine Form of Revolving Promissory Note typically includes crucial elements such as the principal amount, interest rate, payment terms, maturity date, and any applicable late fees or penalties. It also identifies the parties involved, namely the lender and borrower, with their respective names, addresses, and contact information. One type of Maine Form of Revolving Promissory Note is the Secured Revolving Promissory Note. It includes additional provisions that outline the collateral offered by the borrower to secure the loan. This collateral could be in the form of real estate, vehicles, equipment, or any valuable asset. The security interest provides the lender with an assurance that they can recover their funds in case of default. Another variation is the Unsecured Revolving Promissory Note, which doesn't require any collateral. This type of note commonly involves higher interest rates to compensate for the increased risk undertaken by the lender. The Maine Form of Revolving Promissory Note may also include provisions regarding prepayment penalties, default conditions, and the lender's rights and remedies in case of non-payment. It is crucial for all parties involved to fully understand and agree upon these provisions before signing the document. Overall, the Maine Form of Revolving Promissory Note serves as a legally binding agreement that offers flexibility to borrowers by providing them with a line of credit that can be accessed and repaid on an ongoing basis. It is advisable to consult with legal professionals or financial advisors to ensure compliance with applicable laws and regulations and to draft a comprehensive and enforceable agreement tailored to the specific needs of the lender and borrower.

Maine Form of Revolving Promissory Note

Description

How to fill out Maine Form Of Revolving Promissory Note?

US Legal Forms - one of the largest libraries of legal varieties in the USA - delivers a variety of legal papers themes you may acquire or print out. While using website, you will get 1000s of varieties for company and specific reasons, categorized by categories, states, or key phrases.You can find the newest variations of varieties just like the Maine Form of Revolving Promissory Note within minutes.

If you currently have a monthly subscription, log in and acquire Maine Form of Revolving Promissory Note through the US Legal Forms catalogue. The Down load button will show up on each type you view. You gain access to all earlier downloaded varieties inside the My Forms tab of your own accounts.

If you wish to use US Legal Forms for the first time, here are straightforward directions to get you began:

- Make sure you have picked out the best type for your personal area/state. Select the Preview button to review the form`s content. Look at the type information to actually have chosen the appropriate type.

- In case the type doesn`t match your specifications, utilize the Lookup discipline towards the top of the display screen to get the one that does.

- In case you are happy with the shape, verify your choice by clicking on the Get now button. Then, choose the costs strategy you want and give your references to register for an accounts.

- Approach the financial transaction. Make use of Visa or Mastercard or PayPal accounts to accomplish the financial transaction.

- Find the format and acquire the shape on your device.

- Make changes. Complete, change and print out and indication the downloaded Maine Form of Revolving Promissory Note.

Each and every design you added to your account does not have an expiry day and it is the one you have permanently. So, if you want to acquire or print out an additional copy, just visit the My Forms segment and then click around the type you will need.

Get access to the Maine Form of Revolving Promissory Note with US Legal Forms, one of the most comprehensive catalogue of legal papers themes. Use 1000s of expert and status-distinct themes that fulfill your business or specific requires and specifications.

Form popularity

FAQ

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.

However, using a lawyer is not necessary for the loan to be valid. Once you draft the promissory note, it's time for everyone to sign it: the lender, the borrower and the co-signer (if there is one). Again, seeking professional help such as notarizing the signatures is a good idea but not required.

A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.