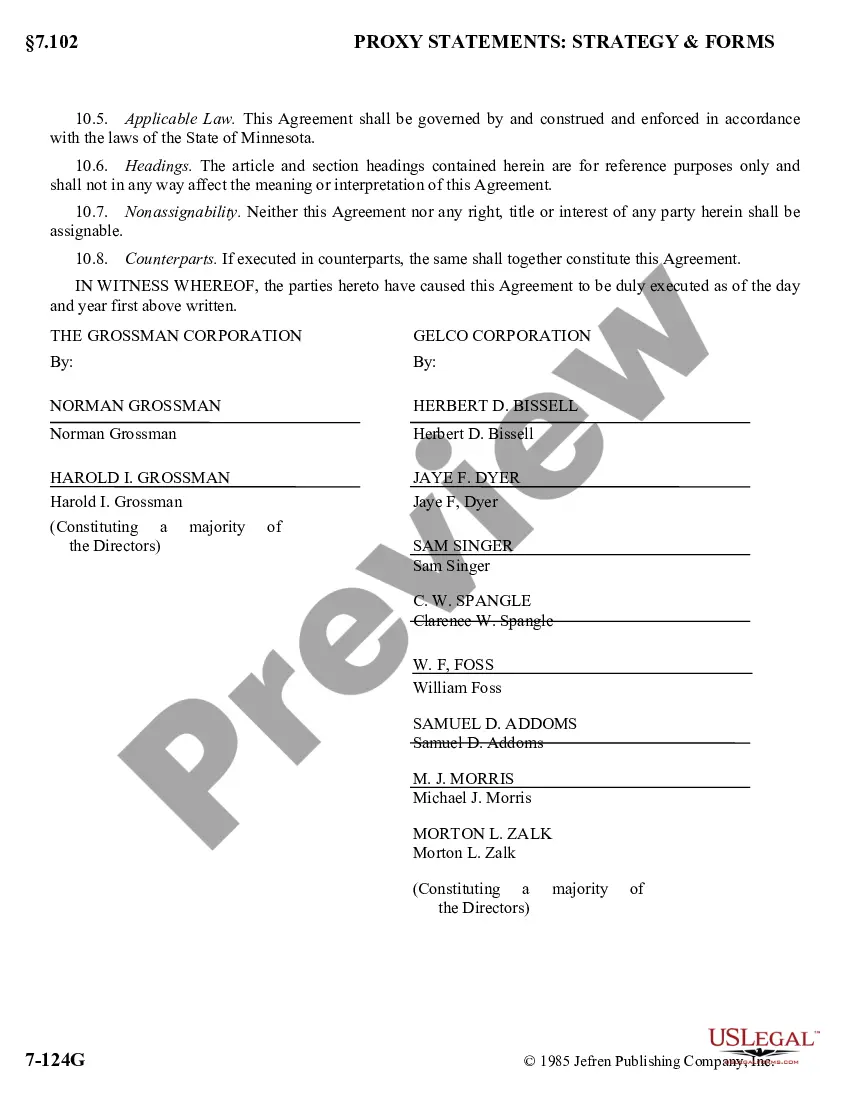

The Maine Agreement and Plan of Merger between Gel co Corp. and Grossman Corp. is a legally binding document that outlines the specific terms and conditions regarding the merger of these two companies. This comprehensive agreement includes various provisions, obligations, and rights that both parties must adhere to throughout the merger process. As Gel co Corp. and Grossman Corp. plan to merge their operations and resources, the Maine Agreement and Plan of Merger serves as the foundation for the consolidation. It covers essential aspects such as the purpose and structure of the merger, the exchange ratio of shares, proposed changes to corporate governance, and the treatment of employees, among other key elements. The agreement ensures that both Gel co Corp. and Grossman Corp. understand their roles and responsibilities during the merger process, and it establishes a framework for decision-making, integration of assets, and harmonization of operations. By agreeing to the terms outlined in the Maine Agreement and Plan of Merger, both companies commit to working together to achieve a successful and seamless integration. The Maine Agreement and Plan of Merger may also encompass specific types or variations, depending on the circumstances and objectives of the merger. These could include: 1. Stock-for-stock merger: This type of merger involves exchanging shares of one company for shares of the other. It specifies the exchange ratio, which determines the proportion of ownership each company will hold in the newly merged entity. 2. Cash-for-stock merger: In this type, one company acquires the other by offering cash to the shareholders of the target company in exchange for their shares. This type of merger is often used when the acquiring company has significant cash reserves and wants to gain control of the target company quickly. 3. Asset acquisition merger: Instead of combining the entire businesses, this type of merger involves one company acquiring specific assets of the other. It can include acquiring intellectual property, facilities, or specific business divisions, allowing both companies to focus on their core competencies. 4. Reverse merger: Sometimes, a smaller company may acquire a larger company to bypass the complexities and costs associated with an initial public offering (IPO). This reverse merger allows the smaller company to become a publicly-traded entity by merging with the larger company, which is already listed on a stock exchange. In conclusion, the Maine Agreement and Plan of Merger between Gel co Corp. and Grossman Corp. serves as a crucial legal document that outlines the terms and conditions of their merger. It acts as a roadmap for the integration of their businesses, assets, and operations, ensuring a smooth and successful consolidation. The agreement may take different forms depending on the specific objectives and circumstances of the merger, such as stock-for-stock, cash-for-stock, asset acquisition, or reverse merger.

Maine Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

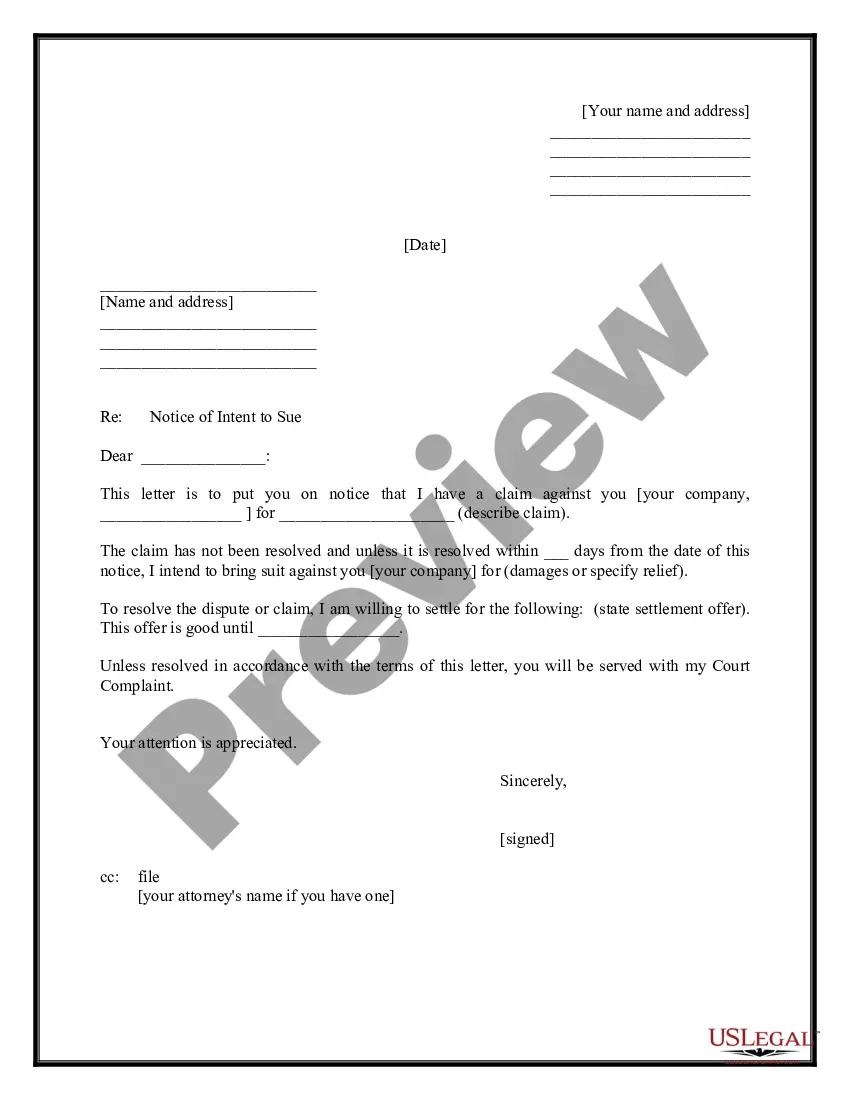

How to fill out Maine Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

Choosing the best legitimate record format can be quite a struggle. Needless to say, there are plenty of layouts available on the net, but how do you get the legitimate form you require? Use the US Legal Forms internet site. The assistance provides thousands of layouts, like the Maine Agreement and plan of merger by Gelco Corp. and Grossman Corp., which can be used for organization and private needs. All the kinds are examined by specialists and satisfy state and federal demands.

Should you be already listed, log in for your profile and click on the Acquire button to get the Maine Agreement and plan of merger by Gelco Corp. and Grossman Corp.. Utilize your profile to search with the legitimate kinds you might have ordered earlier. Check out the My Forms tab of your respective profile and acquire yet another copy of the record you require.

Should you be a fresh end user of US Legal Forms, listed below are easy guidelines that you should comply with:

- First, be sure you have selected the appropriate form for the town/region. You may look through the shape making use of the Preview button and look at the shape description to make certain this is basically the best for you.

- In case the form is not going to satisfy your expectations, take advantage of the Seach industry to find the correct form.

- When you are positive that the shape is proper, click the Purchase now button to get the form.

- Choose the prices strategy you need and type in the essential information and facts. Create your profile and purchase the order making use of your PayPal profile or charge card.

- Pick the file format and download the legitimate record format for your system.

- Total, edit and produce and indicator the attained Maine Agreement and plan of merger by Gelco Corp. and Grossman Corp..

US Legal Forms may be the biggest catalogue of legitimate kinds for which you can find a variety of record layouts. Use the service to download professionally-made paperwork that comply with status demands.

Form popularity

FAQ

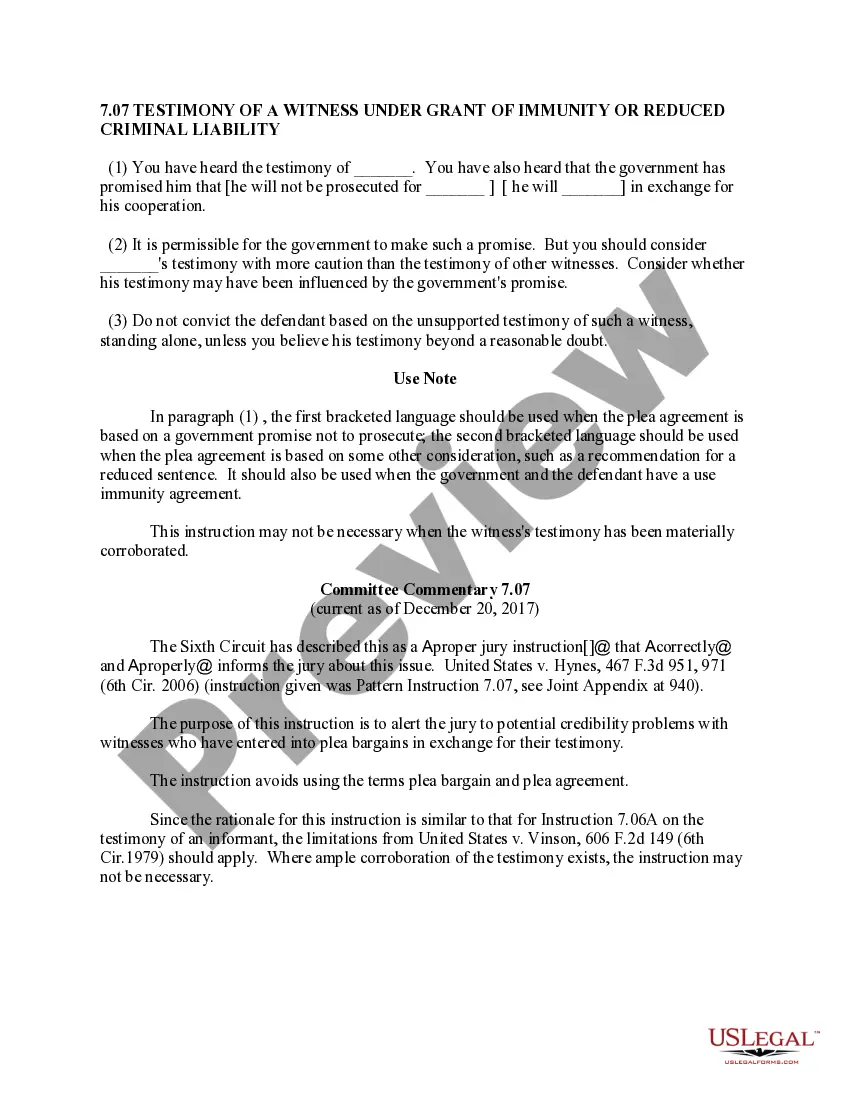

Public company mergers require filing a variety of public disclosure documents. In the United States, the companies make public filings of these materials with the Securities and Exchange Commission (SEC).

A public seller will file the merger proxy with the SEC usually several weeks after a deal announcement. You'll first see something called a PREM14A, followed by a DEFM14A several days later. The first is the preliminary proxy, the second is the definitive proxy (or final proxy).

Business Source Complete, ABI/INFORM, Mergent Online, and Nexis Uni (formerly LexisNexis) will provide news articles on recent mergers and acquisitions, as well as industry reports. These industry reports may indicate whether an industry is consolidating or growing industry.

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

Use SEC filings to find details about a company's merger or acquisition. Both the target and acquirer will file reports.

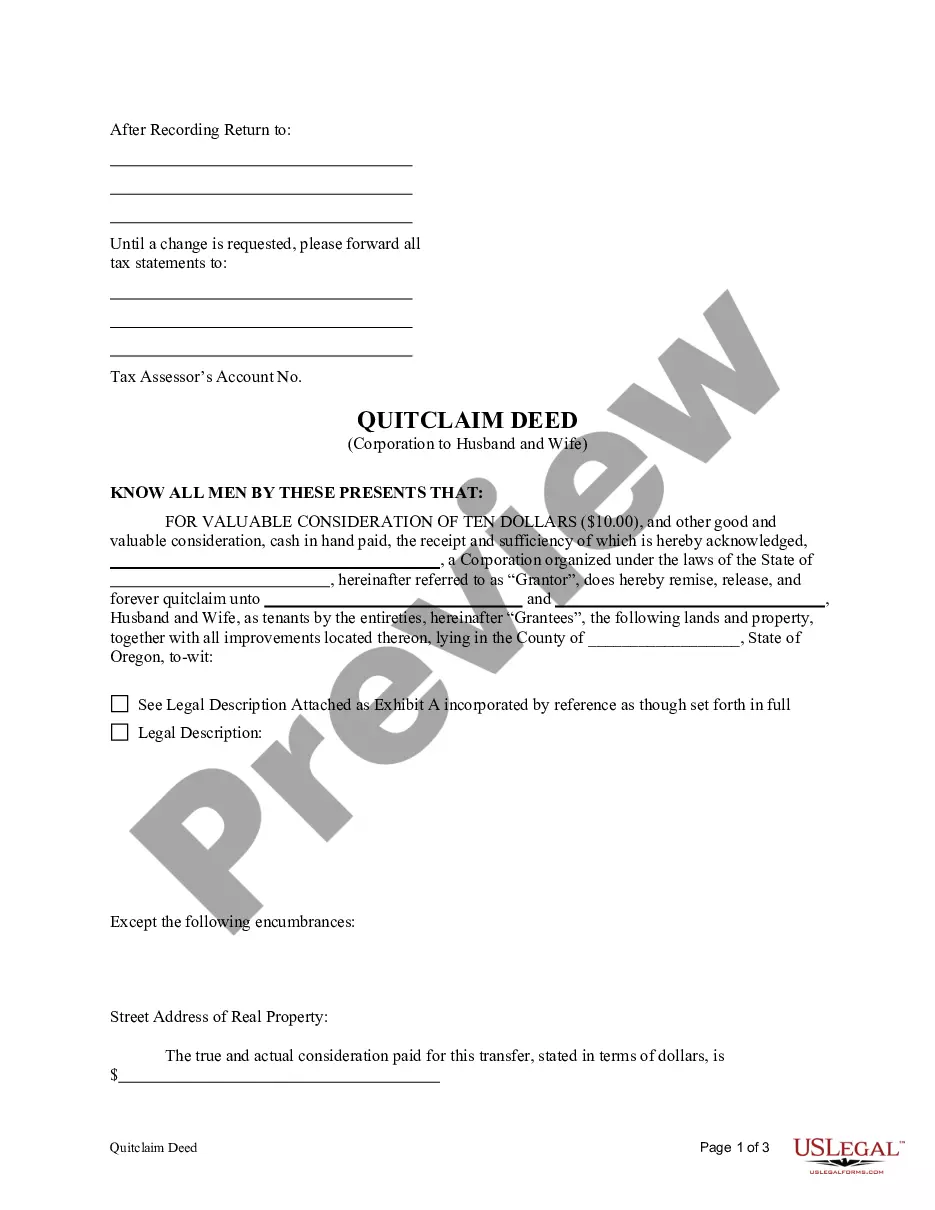

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).