Maine Reorganization of corporation as a Massachusetts business trust with plan of reorganization

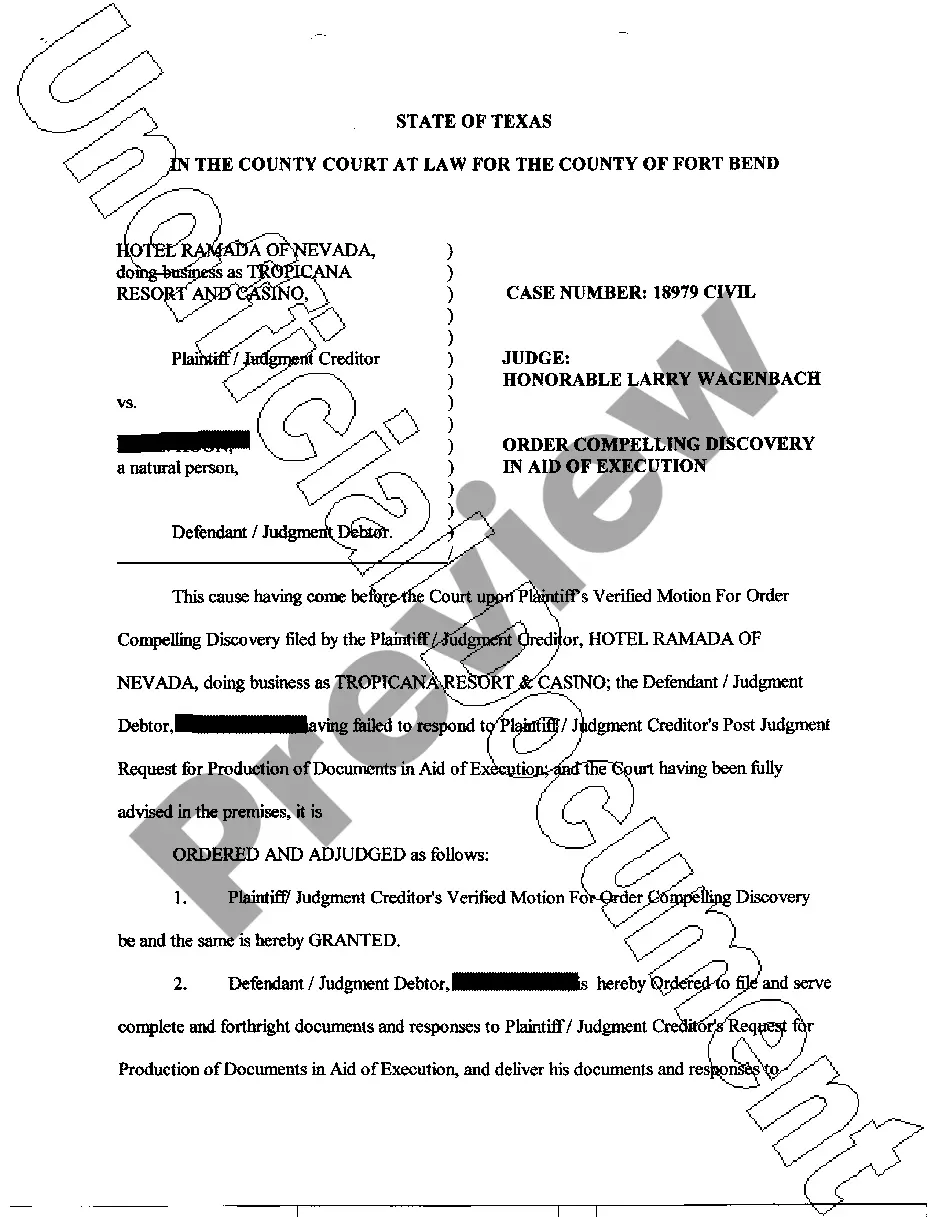

Description

How to fill out Reorganization Of Corporation As A Massachusetts Business Trust With Plan Of Reorganization?

US Legal Forms - one of the most significant libraries of authorized types in the States - gives a wide array of authorized document templates you can obtain or produce. Utilizing the internet site, you can find a huge number of types for organization and individual functions, sorted by groups, claims, or keywords.You can get the latest types of types just like the Maine Reorganization of corporation as a Massachusetts business trust with plan of reorganization in seconds.

If you currently have a membership, log in and obtain Maine Reorganization of corporation as a Massachusetts business trust with plan of reorganization through the US Legal Forms local library. The Download button can look on every develop you see. You gain access to all formerly downloaded types in the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, listed here are basic directions to help you started off:

- Be sure to have picked out the best develop for the city/state. Click on the Review button to review the form`s content material. See the develop information to actually have selected the correct develop.

- In case the develop does not satisfy your specifications, make use of the Lookup discipline at the top of the monitor to get the one that does.

- In case you are happy with the shape, verify your option by clicking on the Get now button. Then, choose the rates strategy you prefer and supply your references to sign up for the account.

- Approach the purchase. Use your credit card or PayPal account to accomplish the purchase.

- Pick the structure and obtain the shape on your gadget.

- Make changes. Load, edit and produce and sign the downloaded Maine Reorganization of corporation as a Massachusetts business trust with plan of reorganization.

Every single format you included in your money lacks an expiration time and it is your own permanently. So, in order to obtain or produce one more copy, just go to the My Forms section and click on the develop you will need.

Gain access to the Maine Reorganization of corporation as a Massachusetts business trust with plan of reorganization with US Legal Forms, by far the most considerable local library of authorized document templates. Use a huge number of professional and express-certain templates that fulfill your small business or individual needs and specifications.

Form popularity

FAQ

A business trust is one vital arm to the entire body of a running business. Also known as common law trusts, business trusts, such as grantor, simple, and complex trusts, give a trustee the authority to manage a beneficiary's interest in the business.

A Massachusetts corporate trust (business trust) is generally subject to personal income tax rather than corporate excise tax. Certain corporate trusts are exempt from taxation altogether.

Massachusetts trusts (also known as common-law trusts, business trusts, or unincorporated business organizations) are a unique type of trust used by individuals to run a business outside the normal legal entities such as a corporation or partnership.

A Massachusetts Business Trust (MBT) is a legal trust set up for the purposes of business, but not necessarily one that is operated in the Commonwealth of Massachusetts. They may also be referred to as an unincorporated business organization or UBO.

It's typically one individual serving as a trustee of a business trust. At the end of the trust's length, the business interests transfer to its beneficiaries. Business trusts are treated as corporations and may conduct business transactions just like individuals.