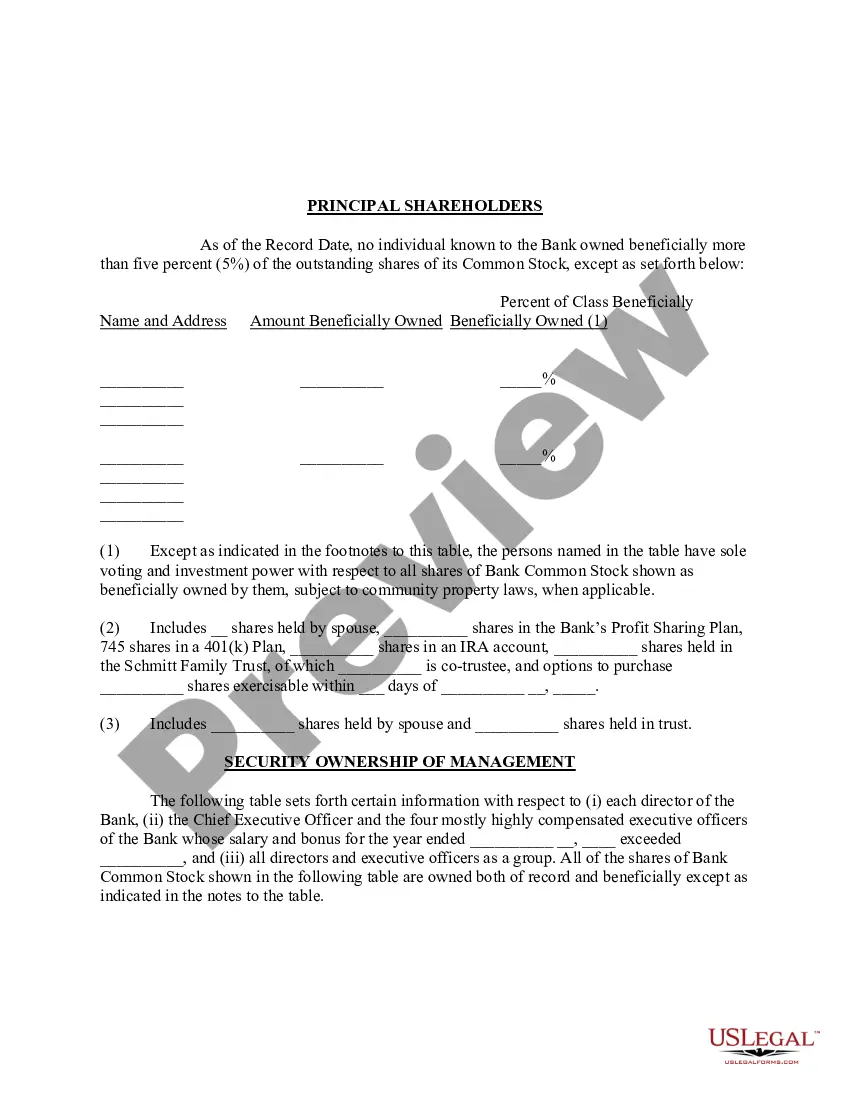

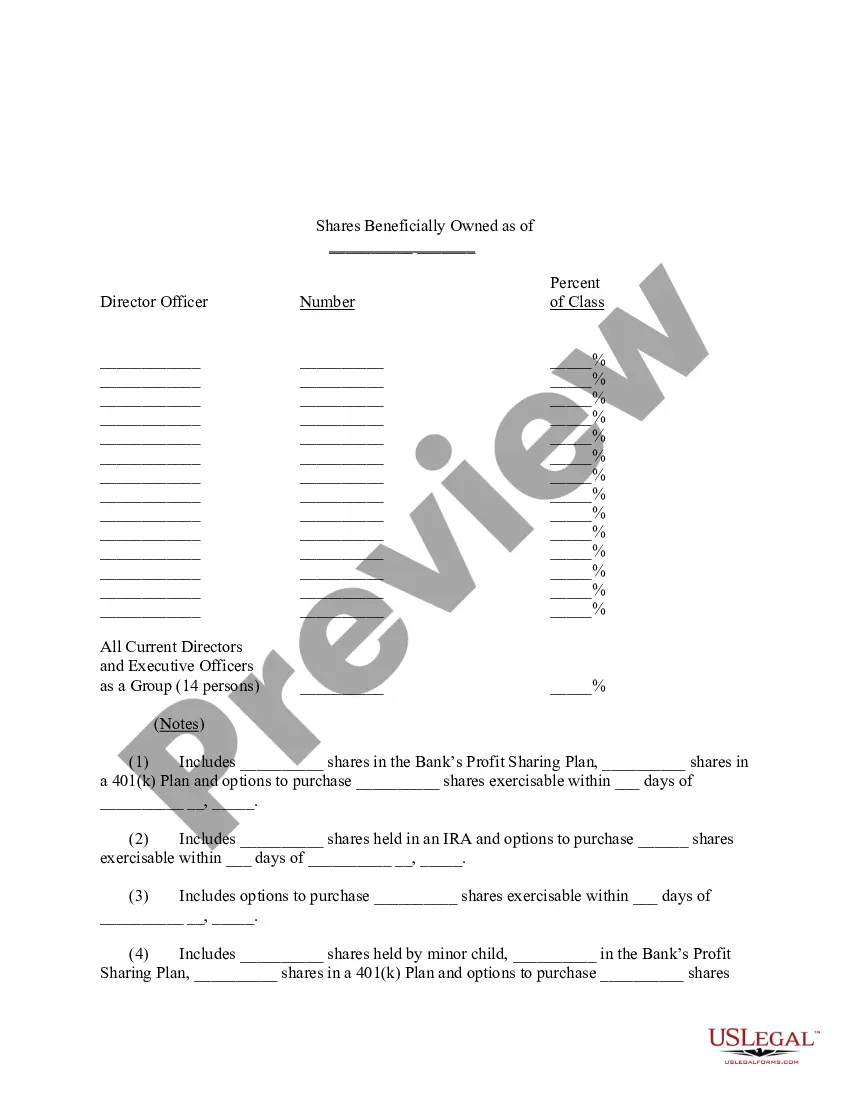

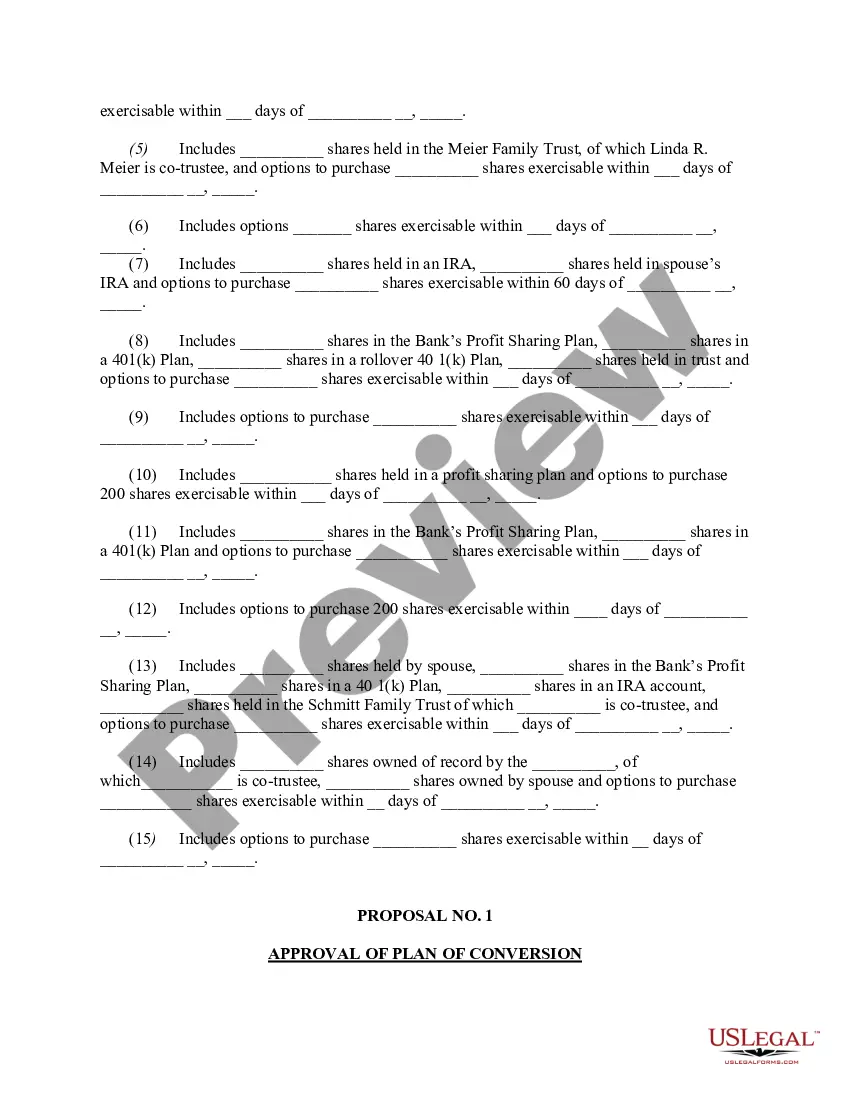

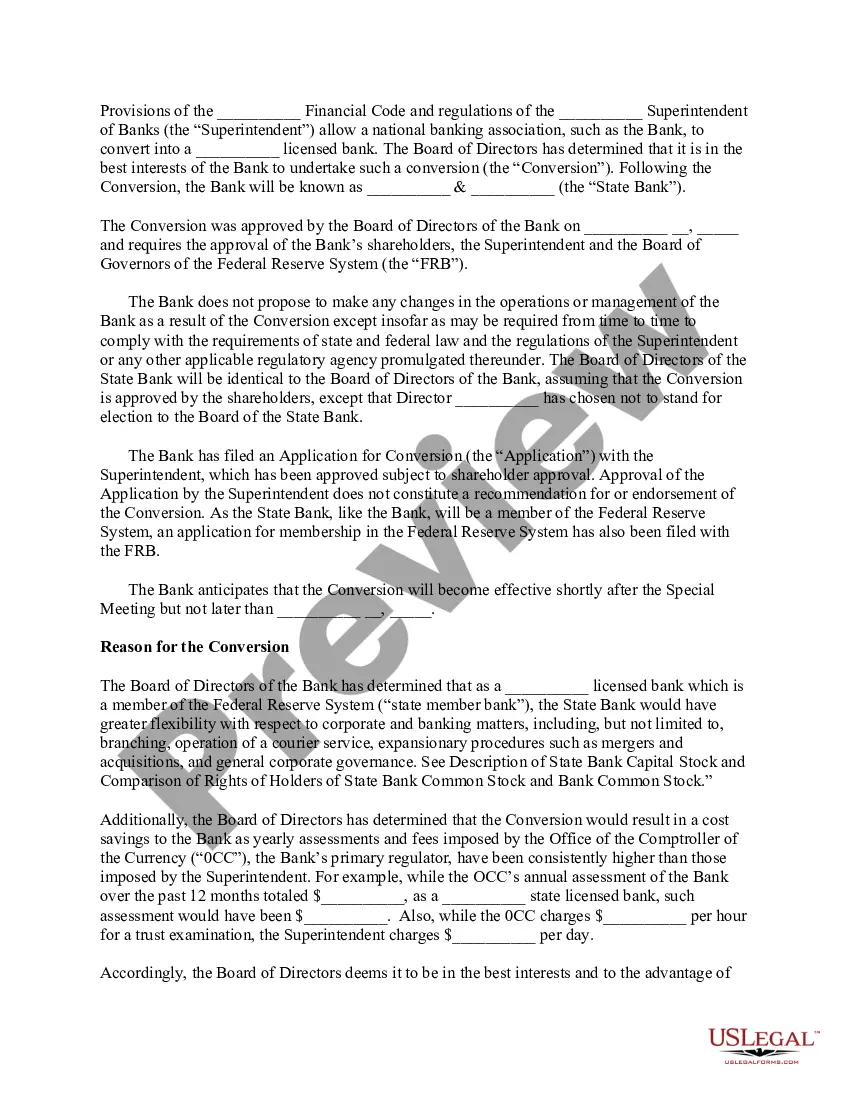

A Maine Proxy Statement is a legal document filed by University National Bank and Trust Co., providing shareholders with important information and details about matters being voted upon during the annual shareholder meeting. It serves as a communication tool between the bank and its shareholders, ensuring transparency and allowing shareholders to make informed decisions. The Maine Proxy Statement includes various sections that cover key aspects of the bank's operations and governance. These sections typically include: 1. Meeting Information: This section includes details regarding the date, time, and location of the annual meeting, as well as instructions on how shareholders can attend and participate. 2. Voting Information: Shareholders can find information about the items they are being asked to vote on, such as election of directors, executive compensation, and any other significant matters related to the bank's operations. It outlines the mechanisms and procedures for voting, including through proxy voting. 3. Board of Directors: This section provides details about the bank's board members, their qualifications, backgrounds, and key responsibilities. It may include information about any potential conflicts of interest and the bank's governance practices. 4. Management Compensation: Shareholders can find information about the compensation structure of the bank's senior executives and directors. This typically includes details on salaries, bonuses, stock options, and other benefits. The Proxy Statement may also disclose performance metrics used to determine compensation. 5. Ownership Structure: This section outlines the bank's ownership structure, including significant shareholders and any controlling interests. It may include information about institutional investors, beneficial owners, and any related-party transactions. 6. Financial Performance: Shareholders can find a summary or highlights of the bank's financial results, including revenue, profitability, and key ratios. This information can help shareholders assess the bank's financial health and performance over time. 7. Risk Factors: The Proxy Statement usually includes a section discussing potential risks that the bank may face in its operations. These risks may include market volatility, regulatory changes, cybersecurity threats, and other factors that could impact the bank's financial stability. It is worth noting that while the specific content and structure may vary slightly between different Maine Proxy Statements of University National Bank and Trust Co., the general purpose of these documents is to provide detailed information to shareholders and secure their voting rights.

Maine Proxy Statement - University National Bank and Trust Co.

Description

How to fill out Maine Proxy Statement - University National Bank And Trust Co.?

Choosing the best legitimate record web template might be a have difficulties. Obviously, there are a lot of web templates accessible on the Internet, but how would you obtain the legitimate develop you want? Take advantage of the US Legal Forms web site. The service offers a huge number of web templates, including the Maine Proxy Statement - University National Bank and Trust Co., that you can use for business and personal needs. All the varieties are examined by experts and meet federal and state demands.

When you are previously registered, log in in your profile and then click the Obtain button to find the Maine Proxy Statement - University National Bank and Trust Co.. Make use of profile to look through the legitimate varieties you might have purchased in the past. Visit the My Forms tab of the profile and acquire another duplicate of your record you want.

When you are a whole new end user of US Legal Forms, listed here are straightforward guidelines so that you can stick to:

- Initially, make certain you have chosen the proper develop for your metropolis/county. You can check out the shape while using Review button and look at the shape explanation to guarantee this is the right one for you.

- In the event the develop does not meet your needs, take advantage of the Seach area to discover the right develop.

- When you are certain that the shape is acceptable, click the Purchase now button to find the develop.

- Choose the prices plan you need and enter in the essential information and facts. Create your profile and buy the order with your PayPal profile or bank card.

- Select the submit file format and acquire the legitimate record web template in your system.

- Complete, edit and print out and sign the obtained Maine Proxy Statement - University National Bank and Trust Co..

US Legal Forms may be the largest collection of legitimate varieties that you can find a variety of record web templates. Take advantage of the service to acquire expertly-created paperwork that stick to condition demands.

Form popularity

FAQ

Proxies make payments simpler by doing away with the need to know beneficiary bank details ? all you need is their mobile number or email address. QR codes for paying businesses are another example of proxies - you don't need to know bank details, just scan the code and the payment will reach its destination.

Proxy Statements The proxy documents provide shareholders with the information necessary to make informed votes on issues important to the company's performance. A Proxy statement offers shareholders and prospective investors insight into a company's governance and management operations.

Filling out a voting proxy form is necessary in order to be able to have someone vote on your behalf in an election or referendum. Proxy voting, the act of having some else vote on your behalf, is often allowed in specific circumstances.

Proxies allow users to use an account (it can be in cold storage or a hot wallet) less frequently but actively participate in the network with the weight of the s in that account. Proxies are allowed to perform a limited amount of actions related to specific substrate pallets on behalf of another account.

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make. What is a proxy statement? Definition, rules, & examples diligent.com ? resources ? blog ? what-is-a-... diligent.com ? resources ? blog ? what-is-a-...

Companies use mailed notices to direct shareholders to publicly accessible websites where they can find proxy statements. The SEC also makes proxy statements available through its EDGAR database. Most retail investors, however, learn about the availability of proxy statements through an email from their brokerage firm. A Primer on Proxy Statements and Shareholders' Meetings | FINRA.org finra.org ? investors ? insights ? proxy-seas... finra.org ? investors ? insights ? proxy-seas...