Have you been within a situation where you require documents for possibly business or personal uses almost every day? There are a variety of authorized file templates available on the Internet, but discovering ones you can trust isn`t easy. US Legal Forms provides a huge number of kind templates, just like the Maine Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Nonpayment of any Debt Will Result in the Arrest or Imprisonment of any Person, that are published in order to meet federal and state requirements.

If you are currently knowledgeable about US Legal Forms internet site and also have an account, just log in. Afterward, it is possible to obtain the Maine Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Nonpayment of any Debt Will Result in the Arrest or Imprisonment of any Person web template.

Should you not have an bank account and would like to begin to use US Legal Forms, adopt these measures:

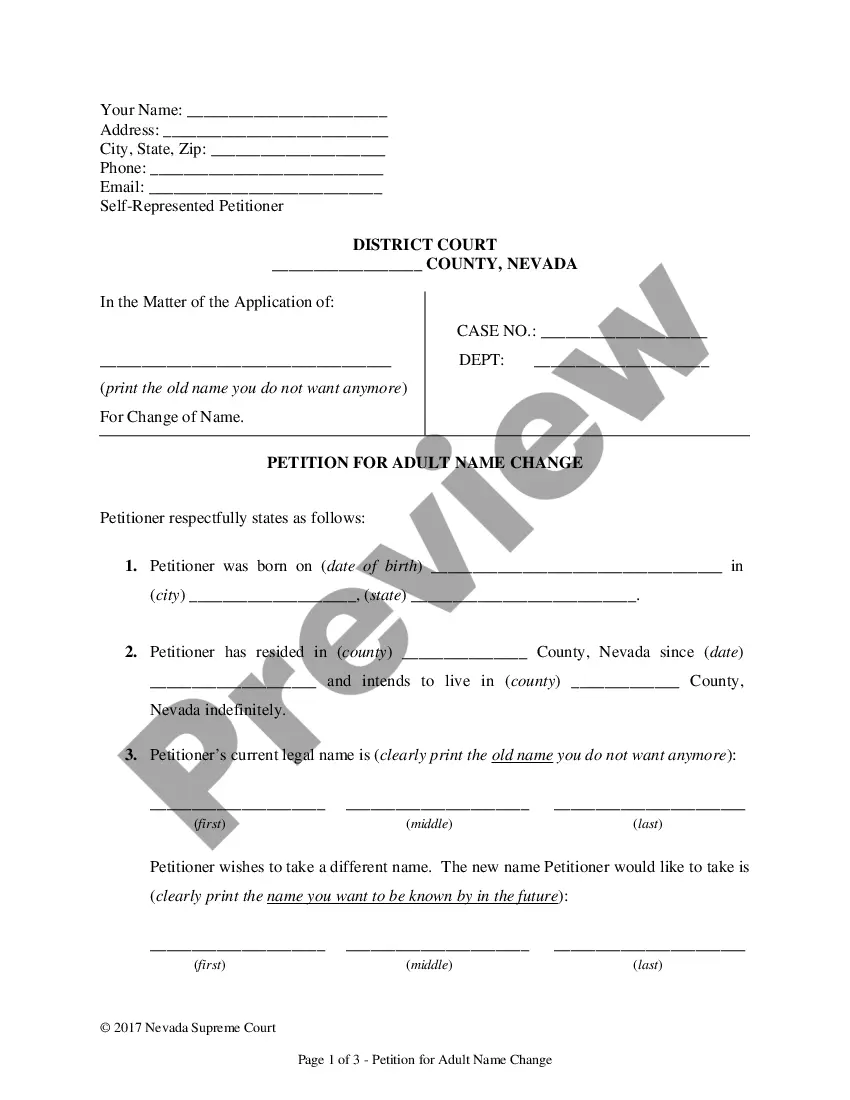

- Discover the kind you will need and make sure it is for that proper city/county.

- Take advantage of the Review switch to check the shape.

- See the explanation to actually have chosen the correct kind.

- If the kind isn`t what you are looking for, take advantage of the Look for field to find the kind that suits you and requirements.

- Whenever you get the proper kind, click on Purchase now.

- Pick the rates plan you would like, complete the specified information and facts to produce your account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free paper format and obtain your duplicate.

Get all the file templates you may have purchased in the My Forms menus. You can get a additional duplicate of Maine Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Nonpayment of any Debt Will Result in the Arrest or Imprisonment of any Person whenever, if required. Just click the required kind to obtain or print the file web template.

Use US Legal Forms, by far the most comprehensive selection of authorized forms, to save some time and avoid blunders. The service provides skillfully manufactured authorized file templates that can be used for a selection of uses. Generate an account on US Legal Forms and commence making your lifestyle easier.

... in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any DebtCollections - Fair Debt Practices Act - Letters. Debts.5 Debtor tells Employer that he will do his best to pay the debt. Meanwhile, the calls and letters to Debtor continue. He receives a letter every day ...A debt collector is prohibited from continuing to write or call a consumer-debtor once informed that the consumer is represented by an attorney or other ... Out? for attorneys engaged in debt collection activity, including the filing of suit.A debt collector may not use any false, deceptive, or misleading. Experience representing clients in consumer class actions involving the Fair Credit Reporting. Act (FCRA), Fair Debt Collection Practices Act. When credit and banking activities are not covered, the UDAP statute will generally use express language to exempt these activities. 2. Debt collection. a). 250 jobs ? ''(9) The representation to any covered mem- ber (as defined under section 805(e)(1)) that fail- ure to cooperate with a debt collector will result. States (debt collection), and the payment of judgments and relatedClaims against the government can arise out of virtually any aspect of. A wider audience, printed copies of the Course Handbook are available at the Debt Collection Industry: Selected Examples . The Consumer Financial Protection Bureau settled with a debt collection enterprise that allegedly misrepresented consumers' debts and failed to conduct ...