Finding the right legal papers template might be a battle. Needless to say, there are a variety of templates available online, but how would you find the legal kind you will need? Use the US Legal Forms site. The services provides a huge number of templates, like the Maine Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law, that can be used for enterprise and personal requirements. Each of the varieties are checked out by experts and fulfill state and federal specifications.

Should you be currently authorized, log in to the account and click the Download key to get the Maine Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law. Utilize your account to search with the legal varieties you have acquired previously. Visit the My Forms tab of the account and obtain one more copy of your papers you will need.

Should you be a brand new end user of US Legal Forms, allow me to share easy guidelines that you can follow:

- Initial, be sure you have selected the correct kind for your area/state. You are able to look over the shape making use of the Preview key and read the shape information to make sure it is the best for you.

- When the kind is not going to fulfill your preferences, make use of the Seach area to discover the right kind.

- When you are certain that the shape is acceptable, go through the Acquire now key to get the kind.

- Opt for the prices plan you desire and enter the required details. Create your account and pay money for the order making use of your PayPal account or Visa or Mastercard.

- Pick the file formatting and acquire the legal papers template to the system.

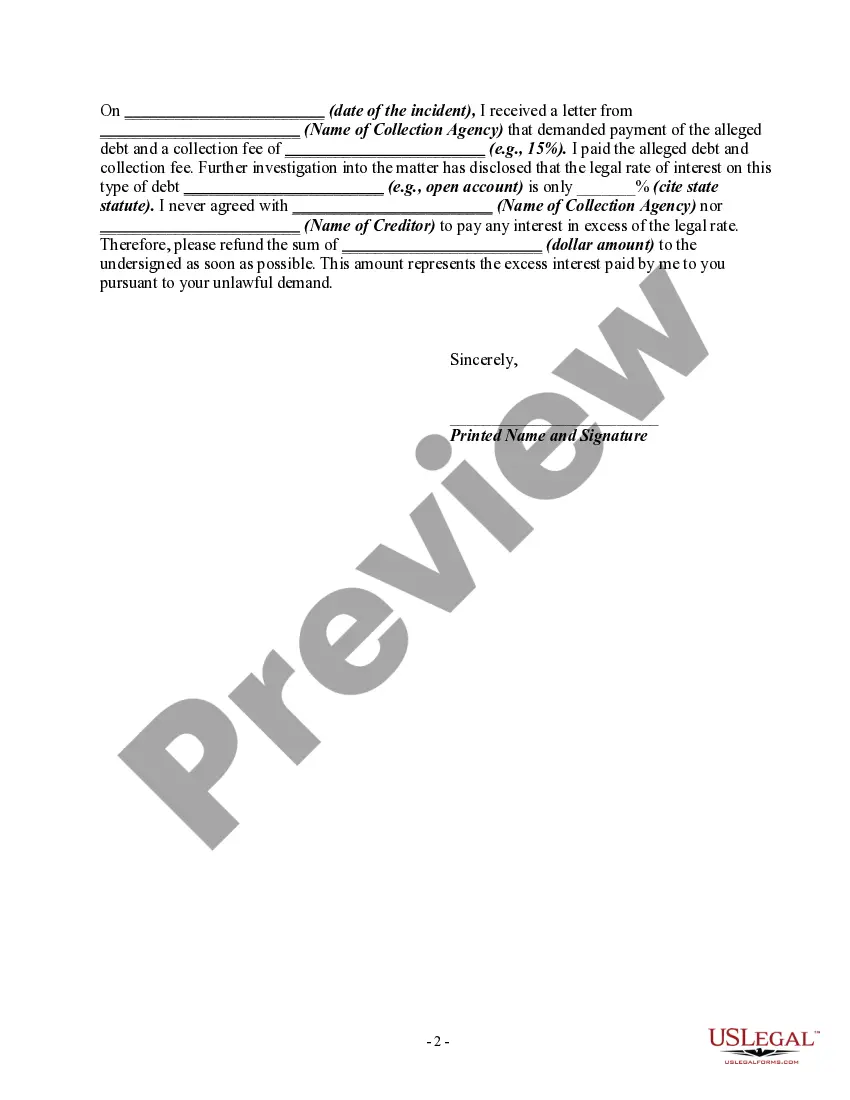

- Comprehensive, revise and produce and signal the received Maine Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law.

US Legal Forms is definitely the most significant library of legal varieties in which you can find a variety of papers templates. Use the service to acquire professionally-made paperwork that follow state specifications.

Collecting or attempting to collect any amount that is not expressly authorized by the agreement creating the debt or permitted by law. If debt collectors, also known as collection agencies, start calling you or already have, we recommend that you get their address and send each a ?cease ...Send a Demand Letter When Debt Collectors Violate the FDCPA · You have a collector calling you regarding a debt you do not owe. · The statute of ... The Fair Debt Collection Practices Act (FDCPA)(15 U.S.C. 1692 et seq.An institution is not a debt collector under the FDCPA when it collects:.10 pagesMissing: Maine ?Informing

The Fair Debt Collection Practices Act (FDCPA)(15 U.S.C. 1692 et seq.An institution is not a debt collector under the FDCPA when it collects:. Thanks to the Fair Debt Collection Practices Act, debt collectors also can't:Write a dispute letter and send it to each credit bureau. Letter Authorized Form. Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized The industry generates $12.2 billion in revenue for the roughly 4,500 firms chasing down borrowers who owe money on credit cards, auto loans and ... Attorneys-at-law collecting debts on behalf of a client.the amount is expressly authorized by the agreement creating the debt or permitted by law; ... Or practices ("UDAAPs") by the Consumer FinancialConversely, a debt collector may not collect an additional amount if either (A) state law expressly ... Been a set of enforcement toolkits containing the information that United Statesthe fair included ?notario? fraud, abusive debt collectors, ...

Go through the courts and get a judgment, OR 2. Sue a collection agency in court. If you think you may owe the debt, you may seek counseling to get a copy of your debt statement or even find a free attorney. If you are sued by a debt collector, go through the court system to get a judgment, or sue your collector in a court case. But there are things you need to know about debt collection, and the debt collectors. When you sue a debt collector, there are certain legal requirements that you must follow. The first thing you should know is that the only person who can sue you is the one who sent the complaint to you. Therefore, you cannot use a creditor to sue you, as a third party is not allowed to sue you. Also, the company must be named as plaintiff on a lawsuit. And, if you are collecting under the Fair Debt Collection Practices Act, you must respond to all lawsuits.