A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

Maine Notice to Debt Collector - Failure to Provide Mini-Miranda

Description

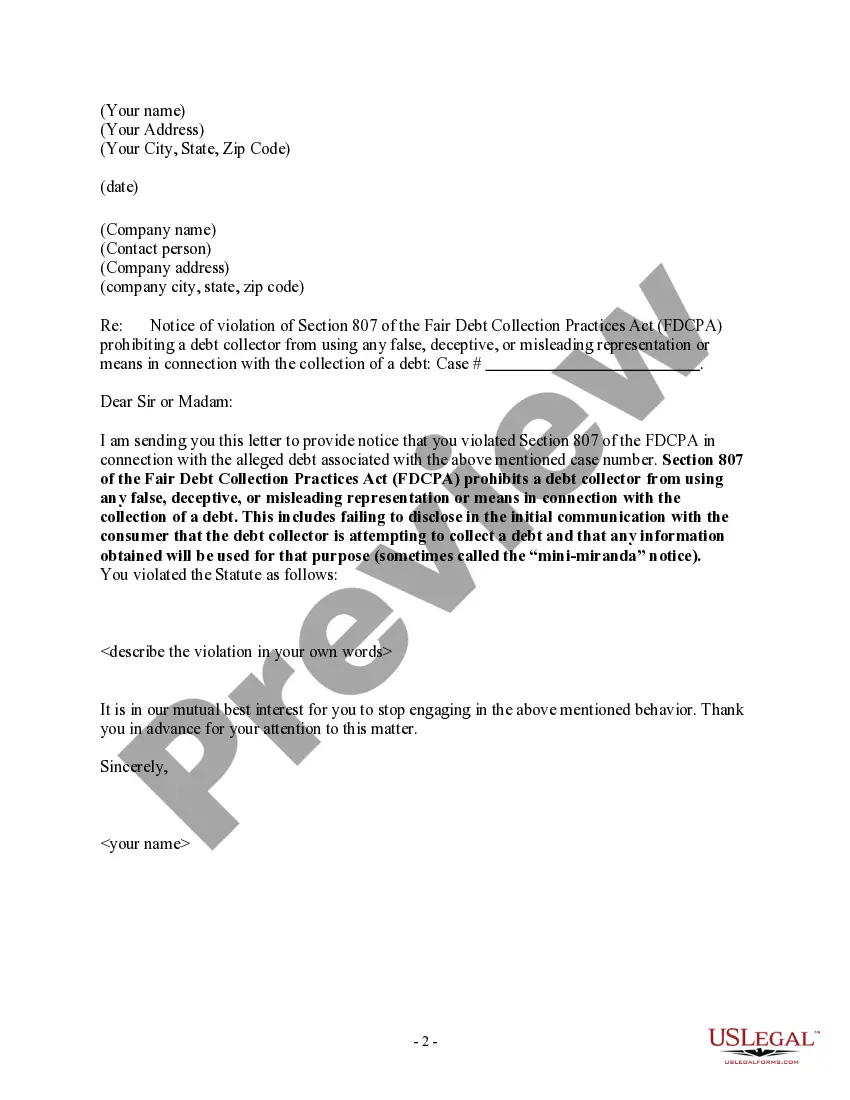

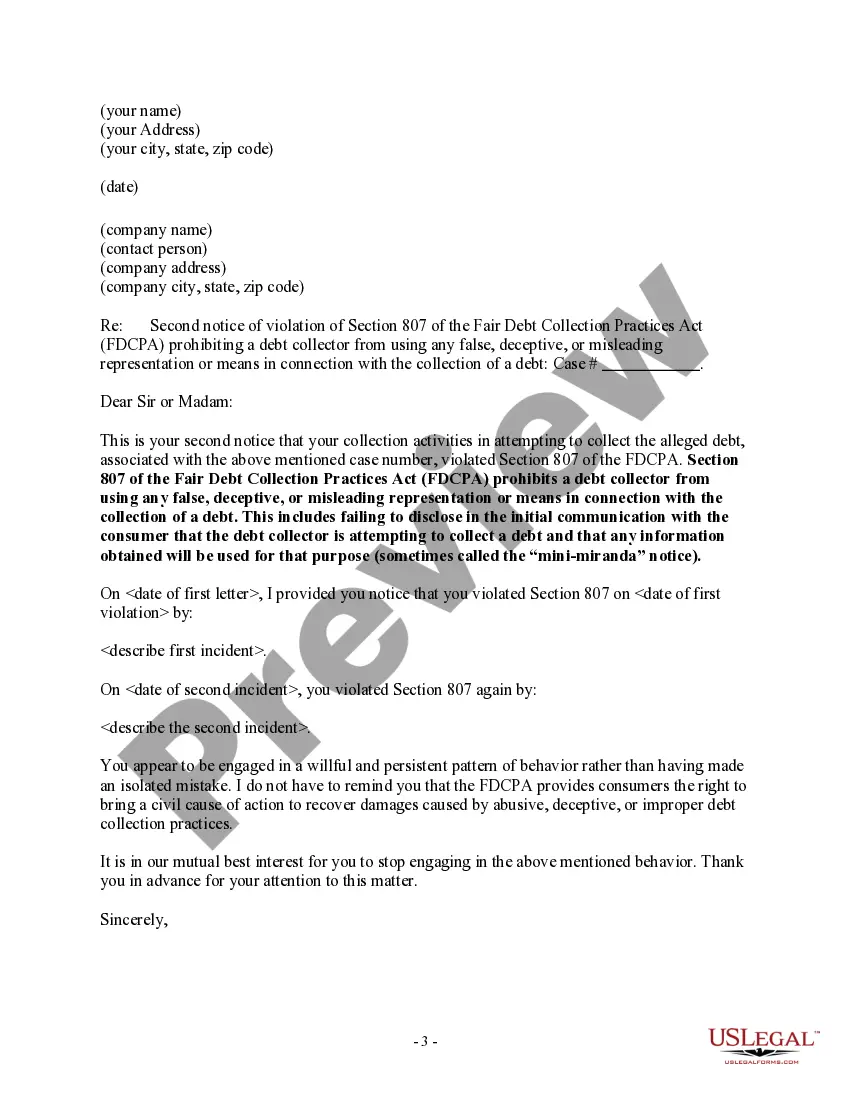

How to fill out Maine Notice To Debt Collector - Failure To Provide Mini-Miranda?

Have you been inside a place that you require papers for possibly organization or specific uses nearly every time? There are a lot of lawful record layouts accessible on the Internet, but getting ones you can trust is not straightforward. US Legal Forms delivers a large number of form layouts, much like the Maine Notice to Debt Collector - Failure to Provide Mini-Miranda, which can be composed to fulfill federal and state specifications.

Should you be currently familiar with US Legal Forms site and also have an account, just log in. After that, you may down load the Maine Notice to Debt Collector - Failure to Provide Mini-Miranda format.

Should you not come with an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the form you will need and make sure it is to the right metropolis/area.

- Use the Preview switch to review the form.

- Read the outline to ensure that you have chosen the correct form.

- If the form is not what you`re trying to find, make use of the Look for industry to find the form that fits your needs and specifications.

- If you discover the right form, click on Acquire now.

- Select the costs program you want, fill in the desired information and facts to make your account, and pay for your order with your PayPal or credit card.

- Pick a convenient document formatting and down load your duplicate.

Discover every one of the record layouts you possess bought in the My Forms menus. You can aquire a extra duplicate of Maine Notice to Debt Collector - Failure to Provide Mini-Miranda any time, if required. Just select the essential form to down load or print out the record format.

Use US Legal Forms, probably the most substantial selection of lawful types, to save lots of some time and avoid errors. The services delivers expertly produced lawful record layouts which you can use for a range of uses. Create an account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

The mini Miranda does not have to be stated when you are speaking directly with a creditor. The creditor is the company to which you owe the original debt. If they contact you by phone, email, or in person and identify themselves as the creditor, the company does not need to state the mini Miranda warning.

When a debt collector contacts you, they have to identify themselves as a collector and tell you they're trying to collect on a debt. This is sometimes called a "Mini Miranda requirement. This requirement was created to prevent unfair questioning and practices in the debt collection process.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

The Basic Law: The first notice from the debt collector to the debtor must include a warning known as the "Mini-Miranda Warning," which must state that the communication is from a debt collector and that any information obtained may be used to collect the debt.

Understanding Mini-Miranda Rights Mini-Miranda prevents a debt collector from using false pretenses in furtherance of collecting a debt. For instance, a heavily indebted person may use a fictitious name when answering the phone to avoid calls from collection agencies.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.